|

Economist on 'oil shock'

|

|

August 18, 2000: 6:25 p.m. ET

Economist predicts oil prices may soar, complicating the Fed's rate policy

|

NEW YORK (CNNfn) - Oil prices have been on the rise and could spike sharply higher as the U.S. appetite for foreign crude oil increases moving into the winter months, an economist at Goldman Sachs said Friday.

In a weekly update for clients, William Dudley, Goldman's director of U.S. economic research, warned there is a 10 percent probability that crude prices will exceed $50 per barrel within the next year.

He cited faster global economic growth, a seasonal increase in demand, very low oil inventories, and a sharp fall in unused capacity among the Organization of Petroleum Exporting Countries (OPEC) as reasons for the potential "oil shock."

What's more, he said, such a sharp rise in oil prices could throw a wrench into the Federal Reserve's efforts to guide the soaring U.S. economy to a soft landing rather than a hard one.

"If such an oil shock occurred, the risk of a hard landing would increase," Dudley said. "Fed officials would be faced with conflicting objectives -- on one hand offsetting the restraint exerted by higher oil prices on economic activity, and on the other hand keeping inflationary expectations in check."

Dudley pointed out that the last three U.S. economic downturns were precipitated, in part, by higher oil prices. However, he also noted that certain macroeconomic factors have changed since then, including an economy that is less energy intensive and has a more moderate inflationary environment.

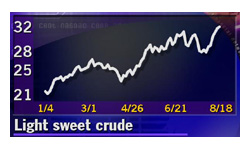

U.S. oil prices have been rising steadily all year, spiking sharply this summer. According to a government report released Friday, rising crude oil prices drove the U.S. trade deficit to a record high of $30.62 billion in June. U.S. oil prices have been rising steadily all year, spiking sharply this summer. According to a government report released Friday, rising crude oil prices drove the U.S. trade deficit to a record high of $30.62 billion in June.

And light sweet crude futures traded on the New York Mercantile Exchange rose for the third straight day on Friday despite reaffirmation from the president of OPEC that the cartel would raise output if prices remain stubbornly high.

September crude oil futures rose 5 cents to $31.99 amid continuing concerns over tight U.S. crude inventories, currently near 24-year lows.

For the week ended Aug. 18, U.S. oil prices rose 97 cents per barrel, and since the beginning of August oil prices increased by nearly $5 a barrel.

Prices rose even though OPEC President Ali Rodriguez reiterated Friday that the cartel was committed to keeping prices within its $22-to-$28 per barrel price target mechanism.

"If prices in the market stay above $28 day after day, production will rise by 500,000 barrels per day," Rodriguez, who is also Venezuelan Energy and Mines Minister, told reporters in Caracas.

--Reuters contributed to this report

|

|

|

|

|

|

|