|

Biotech blooms in Europe

|

|

August 18, 2000: 11:40 a.m. ET

Amid DNA discoveries and deal making, Europe's biotech sector is flourishing

By Staff Writer Martha Slud

|

LONDON (CNNfn) - They've gotten a slower start than their U.S. counterparts, but European biotechnology companies are beginning to harvest the fruits of an industry-wide boom.

As scientists worldwide race to find practical applications for discoveries about the human genome and companies join forces on costly research and development efforts to bring new drugs to the market, more European biotech firms are spearheading the innovations and gaining prominence in their fields.

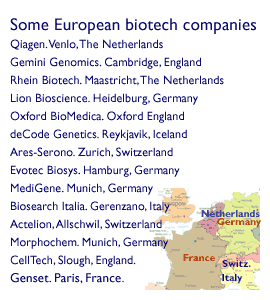

Traditionally, European biotech has been led by a handful of companies in a few regional hubs. But a slew of younger firms throughout Europe are braving the often-rough environment for initial public offerings and tapping into capital markets in their home countries and the United States. Britain and Germany have led the way, while France, Netherlands, Italy and Spain also are nurturing their budding biotech industries.

Biotechnology -- with its long road from scientific discovery to profitable product -- is one of the most turbulent sectors on the market. Biotechnology -- with its long road from scientific discovery to profitable product -- is one of the most turbulent sectors on the market.

Many European biotech stocks, like their U.S. counterparts, have had a turbulent year - cresting to unprecedented levels this past winter amid excitement about mapping of the human genome but then falling sharply this spring. The sector has staged a significant recovery over the past few months.

European investors soured on the sector two years ago amid the high-profile travails of one-time industry star British Biotech PLC, which saw its share price plummet and investor confidence erode after its clinical development director raised serious questions about the viability of its drug pipeline. The company's chief executive quit in the wake of the scandal and regulators launched a probe of the firm's operations.

Today, many investors are more cautious on the prospects of biotech start-ups that offer promises about potential breakthroughs but little in the way of tangible immediate profits. Experts say, however, that the number of companies with stronger business models and good prospects for clinical breakthroughs is steadily growing. Earlier this week, for example, shares of U.K.-based Oxford BioMedica PLC (OXB) surged 15 percent in one day after the company announced it had discovered 23 previously unknown genes that may play a role in a range of diseases.

As European biotech matures, more firms are finding welcoming homes for their stocks throughout Europe on technology-oriented exchanges such as Germany's Neuer Markt, France's Nouveau Marche or Milan's Nuovo Mercato, as well as on the technology-laden U.S. Nasdaq exchange.

"I think what you're seeing is a flood of companies that have reached a certain level of maturity coming to the market," said Paul Kelly, chief executive of Gemini Genomics, a Cambridge, England-based company that held an $84 million initial public offering in July and saw its stock jump more than 40 percent in its first day of Nasdaq trading. "These are companies that have good science, and are very well capitalized and structured."

Other recent IPOs include the debut earlier this month of Lion Bioscience (LEON: Research, Estimates), a Heidelberg, Germany-based company focused on developing software to rapidly analyze human genes. The company raised $188.5 million on its IPO on the Neuer Markt and the Nasdaq. That follows the June IPO by Reykjavik, Iceland-based deCode Genetics (DCGN: Research, Estimates), which is engaged in controversial research to comb through data about Iceland's native population to determine the relationship between genes and disease. DeCode raised $173 million in its Nasdaq IPO.

Also, Italy's Biosearch Italia, a drug developer focused on antibiotics, last month raised  161 million ($147 million) in Milan, while German biochip maker GeneScan Europe AG raised 161 million ($147 million) in Milan, while German biochip maker GeneScan Europe AG raised  107 million ($98 million) in Frankfurt. 107 million ($98 million) in Frankfurt.

Playing catch-up

For years, European biotech firms have played catch-up to the United States, which is credited with giving birth to the industry in the late 1970s and early 1980s through private efforts centered on research institutions such as the Massachusetts Institute of Technology and Stanford University in California.

Europe didn't develop a real business presence in biotech until about a decade later.

"The U.S. biotech industry started earlier, and it's just relatively more mature," said Andrew Baum, a biotech stock analyst at Morgan Stanley Dean Witter in London. "There are now some very grown-up U.S. companies with multibillion dollar market caps. Europe has started later."

While Europe had formidable scientific talent of its own, its scientists didn't have the same entrepreneurial spirit, strong corporate management or access to venture capital funds as their U.S. counterparts, says Mark Clement, a managing director at Merlin BioSciences, a London-based venture capital firm focused on biotech investments throughout Europe.

In fact, there was "a kind of brain drain going on," Clement said. "A lot of the technologies were actually European, but the people driving the business models were in the U.S."

There are still many concerns that European biotech will be swallowed by the United States, where private companies have spearheaded cutting-edge research into analyzing the structure of the human genome in hopes of creating potent drugs to treat cancer, Alzheimer's disease, depression and other illnesses based on genetic discoveries.

Some European scientists bemoaned a decision earlier this month by genomics equipment maker Amersham Pharmacia Biotech, which is partially owned by Anglo-Norwegian firm Nycomed Amersham PLC (NAM), to move its headquarters to Piscataway, N.J. Many scientists fear that successful European companies will transplant themselves to the United States to take advantage of greater market opportunities.

But Clement, of Merlin Biosciences, says that European biotechs have an important niche.

While U.S. companies, such as Rockville, Md.-based Celera Genomics Group (CRA: Research, Estimates), had the financial backing to pioneer costly efforts to map the human genome, many European firms are focused on providing the "picks and shovels" to mine the vast genetic landscape and unearth how to put gene research to use - research that ultimately may be much more lucrative than the raw genetic data that already has been culled.

"Now, when we get to the next stage, functionality -- how are they are going to be able to get to drugs? -- I think that Europe has a lot to offer," he said.

Equipment companies such as Netherlands-based Qiagen NV (QGENF: Research, Estimates) - one of a handful of money-making biotechs on Germany's Neuer Markt - has seen its stock climb at a time when many other biotech drug makers have had ups and downs. Its shares are trading near its 52-week highs at about $52 per share on the Nasdaq exchange, up from a year-ago level of about $9.

Deals in the sector

With an estimated 1,200 biotech firms in Europe and only about 10 percent of them publicly traded, the sector is seen as ripe for consolidation over the next few years.

In one of the biggest deals so far, Germany's Evotec Biosys AG, a company that screens chemicals for use in drug development, announced earlier this month it would buy Britain's chemistry specialist Oxford Assymetry PLC for roughly $474.7 million in stock.

The deal marked the first time a Germany biotech company bought an English rival. Oxford was a particularly attractive target - like Qiagen, it is among the select group of European companies in the sector making money.

As the sector continues to mature, European investors will become even more selective and demand to see more profits and successful product launches from biotech companies, industry experts say.

"Over the next two years we've got a number of compounds coming to market," Clement said. "I think the pharmaceutical industry and the capital markets are going to be watching quite carefully what's going on."

|

|

|

|

|

|

|