|

Visa, MC trial ends

|

|

August 22, 2000: 3:50 p.m. ET

Visa and MasterCard wrap up their 10-week defense in antitrust trial

|

NEW YORK (CNNfn) - The antitrust trial involving Visa and MasterCard ended Tuesday in New York after more than 10 weeks of testimony, and now awaits a decision by U.S. District Judge Barbara Jones.

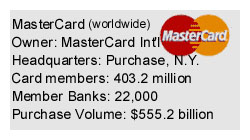

Both credit card firms were sued by the federal government for antitrust violations. The government alleges that the companies' policies prevent them from truly competing with each other, and that together they block other competitors' entry into the market.

The Justice Department opposes the policies of Visa and MasterCard, which together control about 75 percent of the credit card market, that discourage banks doing business with them from issuing credit cards from other companies, such as American Express (AXP: Research, Estimates) or Discover, a unit of Morgan Stanley Dean Witter.

"We believe we have presented strong evidence through witness deposition, testimony and documents to support the government's case that Visa and MasterCard engaged in conduct that stifled competition and harmed consumers," said Joel Klein, assistant attorney general at DOJ. "The litigation team led by Melvin Schwarz did an outstanding job."

Judge Jones gave no indication about when she would issue her ruling in the case, which began June 12. However, both sides are scheduled to present "findings of fact," before Jones on Oct. 16. That means lawyers for both sides will ask Jones for an immediate ruling in their favor based on trial evidence and testimony. Jones' decision could come weeks later. Judge Jones gave no indication about when she would issue her ruling in the case, which began June 12. However, both sides are scheduled to present "findings of fact," before Jones on Oct. 16. That means lawyers for both sides will ask Jones for an immediate ruling in their favor based on trial evidence and testimony. Jones' decision could come weeks later.

Both Visa and MasterCard officials claimed Tuesday that the government failed to prove its case.

"Testimony in court has echoed what all Americans who open their mailbox, turn on their TV or log onto their computer already know: Competition is alive and well in the credit card market," Kelly Presta, a spokesman for Visa U.S.A., said in a statement.

Noah Hanft, MasterCard's deputy general counsel said, that the government hasn't entered any evidence demonstrating that consumers have been harmed by their policies.

"After four years of investigation, hundreds of depositions and dozens of witnesses, all they've succeeded in doing is proving what we've been saying all along - that the payments card industry is highly competitive." "After four years of investigation, hundreds of depositions and dozens of witnesses, all they've succeeded in doing is proving what we've been saying all along - that the payments card industry is highly competitive."

Government wants an end to policies

The remedy Justice is seeking would end the credit card networks' policy of "dual governance," which permits both Visa and MasterCard to install board members who hold a significant interest in the other's card. Dual governance means a Visa board member may have a significant MasterCard portfolio and vice versa.

Justice wants banks to be 100 percent "dedicated" to either Visa or MasterCard; that is, issuing either all Visa cards or all MasterCards. Justice wants banks to be 100 percent "dedicated" to either Visa or MasterCard; that is, issuing either all Visa cards or all MasterCards.

The remedy also calls for an end of the networks' exclusionary rule, which prohibits member banks from issuing cards from competitors such as American Express or Discover by dropping them from the network if they do so.

The government says banks should be allowed to issue any card they want and to cancel agreements with Visa and MasterCard at any time.

During the trial, which lasted about two months and included testimony from more than 40 witnesses, Justice argued the networks' duality and exclusionary policies, which have been in place since the 1970s, hampered competition and innovation.

In particular, the government pointed to smart cards, credit cards equipped with a computer chip. Justice argued that such advanced cards could have hit the market a decade earlier had Visa and MasterCard had not been so cozy. Instead, rival American Express issued its Blue Card earlier this year, which comes with a computer chip.

Visa and MasterCard disagreed, saying their own studies showed the market was not yet there for smart cards sparked their decision not to produce the cards. Visa and MasterCard disagreed, saying their own studies showed the market was not yet there for smart cards sparked their decision not to produce the cards.

Additionally, MasterCard argued that eliminating duality could doom the network because most banks would likely turn to Visa because it is a much larger network.

"I think that the tendency would be (for issuers) to go toward the larger of the two systems," MasterCard's expert witness, Robert Pindyck, testified on Tuesday.

Pyndyck, an economics professor from the Massachusetts Institute of Technology in Cambridge, Mass., said the current industry structure has not harmed consumers and that the government's remedy could have a "devastating impact" by limiting competition between MasterCard and Visa, as well as between other card issuers and methods of payment, such as cash and checks.

And if MasterCard were driven out of business, consumers would suffer because of a lack of choice in the market. And if MasterCard were driven out of business, consumers would suffer because of a lack of choice in the market.

Earlier this month, Judge Jones rejected a motion by Discover to join the suit. Discover claims that as a relatively small card issuer, it would be squeezed out of the market as well if duality ended.

|

|

|

|

|

|

|