|

Fed holds rates steady

|

|

August 22, 2000: 5:11 p.m. ET

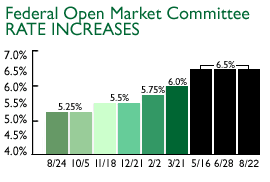

FOMC keeps influential fed funds rate at 6.5% for second straight meeting

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Federal Reserve policy makers voted to once again leave interest rates unchanged Tuesday, but kept the warning light on for Wall Street that they remain on high alert for signs of accelerating inflation -- something that could prompt them to raise rates again down the road.

The Federal Open Market Committee opted to hold the influential fed funds rate -- the target rate at which banks borrow from each other on a short-term basis -- steady at 6.5 percent. It also left the less-used discount rate -- the rate at which the Fed's 12 district banks lend directly to financial institutions -- unchanged at 6 percent.

It was the second straight meeting that the Fed has left rates alone after having raised rates by a half percentage point a little more than three months ago. It was the second straight meeting that the Fed has left rates alone after having raised rates by a half percentage point a little more than three months ago.

Wall Street largely cheered the decision, even though most analysts and investors had already expected the Fed to stand pat this time around. Both the Dow Jones industrial average and the Nasdaq composite index posted double-digit gains in the wake of the Fed's 2:15 pm ET announcement, though both indexes retraced some of the gains by the end of the day. Bonds also briefly posted gains before settling back to end the day little changed.

A dearth of evidence showing a slower economy and subdued inflation were seen influencing Fed Chairman Alan Greenspan, and the FOMC, to wait and see if their six rate increases since June 1999 have already been enough to stabilize economic growth and ensure that inflation remains under wraps.

Demand is moderating: Fed

In the briefly worded statement that accompanied the Fed's decision, the FOMC indicated that mounting economic evidence of a slowdown had at least partially managed to do that -- convince the Committee to step aside and admire its recent handiwork as the economy finishes up its third quarter and makes its way to the home stretch for the year.

By raising rates, Fed officials have been trying to slow economic growth and contain inflation by boosting the cost of borrowing -- on everything from car loans to mortgages to corporate lines of credit. In some parts of the country, growth has slowed significantly, hampered by consumers who are much less willing than before to part with their cash. By raising rates, Fed officials have been trying to slow economic growth and contain inflation by boosting the cost of borrowing -- on everything from car loans to mortgages to corporate lines of credit. In some parts of the country, growth has slowed significantly, hampered by consumers who are much less willing than before to part with their cash.

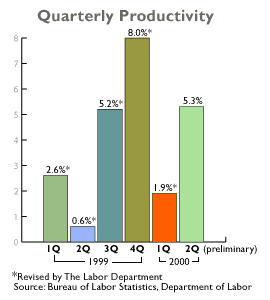

At the same time, more open global markets and rapid advances in technology both have helped quell inflation by boosting competition and forcing companies to keep prices low. They have also made workers much more productive, allowing them to get a lot more done in a lot less time and at a significantly lower cost to businesses.

Combined, that has created a recipe for a new kind of economy that analysts, investors and Fed officials are only beginning to understand and accept. It is an economy that can grow at a faster pace than it used to without triggering inflation and causing the boom-and-bust cycles that became a hallmark of economic growth throughout much of the 20th century, according to the experts.

The joy of semantics

That's exactly what the Fed said in its statement. Even though the economy is chugging along at what would normally be considered an above-potential pace, recent economic numbers indicate that "more rapid advances in productivity have been raising that potential growth rate as well as containing costs and holding down underlying price pressures," the Fed said.

The statement also noted "that demand is moderating toward a pace closer to the rate of growth of the economy's potential to produce."

That in of itself was a departure from wording previously used by the Fed. In its June 28 statement, the central bank referred to "tentative and preliminary" signs of a slowdown -- words that were much more cautious and reserved than those used Tuesday. Fed officials next meet in Washington on Oct. 6. That in of itself was a departure from wording previously used by the Fed. In its June 28 statement, the central bank referred to "tentative and preliminary" signs of a slowdown -- words that were much more cautious and reserved than those used Tuesday. Fed officials next meet in Washington on Oct. 6.

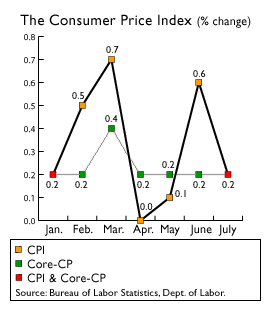

"The numbers do in fact suggest that there is no inflation problem in the U.S.," said Jeff Cheah, an economist with Standard & Poor's market research arm, MMS. "There might be some risk that inflation is crawling up, and I use the word 'crawling,' but there is more overwhelming evidence that U.S. growth is slowing to a more sustainable pace."

"What all this tells us and is certainly telling the Fed is that maybe we need to examine what the sustainable growth rate really is," Cheah added. "The risk is that we have an economy that is growing at a pace that historically suggests we should see inflation pressures, but we're not seeing that yet."

A more 'dovish' tone

The Fed's "on hold" decision comes amid a recent string of economic reports suggesting that the U.S. economy is slowing. Job creation posted its biggest monthly drop in a decade last month. Home sales retreated, manufacturing activity leveled off and retail sales posted only a moderate advance.

And predictions are that economic activity will slow even more in the months ahead as the rest of the Fed's rate increases implemented earlier this year begin to take effect. A rate increase from the Fed typically takes six-to-nine months to trickle its way down into the heart of the economy by raising borrowing costs for consumers and businesses and deterring consumers from spending.

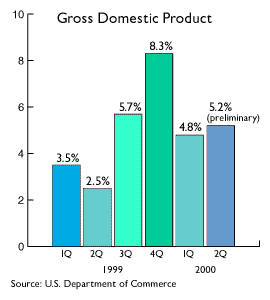

For some economists, that means rates could soon be going down, rather than up. If the Fed taps the proverbial brakes too hard, the theory goes, the record 10-year-long expansion could come to an end by sinking the economy into recession. The economy expanded at a 5.2 percent pace in the second quarter, up slightly from the 4.8 percent pace recorded in the first quarter but down from the torrid 8.3 percent pace of growth registered in the fourth. For some economists, that means rates could soon be going down, rather than up. If the Fed taps the proverbial brakes too hard, the theory goes, the record 10-year-long expansion could come to an end by sinking the economy into recession. The economy expanded at a 5.2 percent pace in the second quarter, up slightly from the 4.8 percent pace recorded in the first quarter but down from the torrid 8.3 percent pace of growth registered in the fourth.

Diane Swonk, a senior economist with Bank One Securities, told CNNfn that the tone of the Fed's statement was more "dovish" than normal -- a word used by economists to describe the Fed's view on the economy's progress. Hawkish is the other word used on Wall Street to describe Fed sentiment when they are trying to tone the pace of the economy down.

Even so, Swonk said the Fed could still raise rates later this year if it sees that inflation, which has appeared on some levels within the U.S. economy this past year, begins to creep higher. (178KB WAV) (178KB AIFF)

Rate cut on the horizon?

"It's not unreasonable to expect that the Fed could soon consider moving rates lower, and a few economists have talked about that," Cheah said. "But I think the Fed is very conscious of activity in the stock market, and I think if they did lower rates there might be some exuberance there that they don't want to see -- at least not yet.

Judging from trading in the futures market, most investors don't anticipate  another rate increase through the remainder of this year. The fed funds futures contract for December has an implied yield of 6.60 percent -- only 10 basis points above the current 6.5-percent rate. That's down from mid-July, when the implied yield was above 6.75 percent and investors were expecting another quarter-percentage point rate increase by year-end. another rate increase through the remainder of this year. The fed funds futures contract for December has an implied yield of 6.60 percent -- only 10 basis points above the current 6.5-percent rate. That's down from mid-July, when the implied yield was above 6.75 percent and investors were expecting another quarter-percentage point rate increase by year-end.

"If they were to cut rates, it might endorse the view that the Fed believes inflation is not a problem. And that can be a dangerous game," Cheah said.

"We are seeing a slowdown, but we're not necessarily seeing a slow economy," said Lara Rhame, an economist with Brown Brothers Harriman. "The Fed is still going to be on alert for inflation, and we're going to have to wait and see more evidence before we can conclude that it isn't a threat."

Indeed, Fed officials warned in their statement Tuesday about the risk of a continuing gap between growth of demand and the available supply of goods and services to feed it, "at a time when the utilization of the pool of available workers remains at an unusually high level." The U.S. jobless rate held steady at 4 percent last month, even as job creation declined.

Still on alert

"Against the background of its long-term goals of price stability and sustainable economic growth and of the information currently available, the Committee believes the risks continue to be weighted mainly toward conditions that may generate heightened inflation pressures in the foreseeable future," the Fed said.

And there are those out there on Wall Street who believe that the Fed is not finished its dirty work just yet -- even with the upcoming presidential election less than three months away. History suggests that the Fed, which is not officially associated with any political party, does not alter its monetary policy leading up to a presidential election; it can raise or lower interest rates during an election period, but it has never done so.

That's because there is still evidence of strong growth and accelerating inflation, depending on which rose-colored glasses you have on.

"Look at that Michigan Survey of consumer sentiment, the preliminary for early August, it is near record levels," said David Jones, an economist with Aubrey G. Lanston. "The wealth effect may serve to kick spending back up later in the year," he said. "We just don't know, but my bet is that the Fed is not finished."

|

|

|

|

|

|

U.S. Federal Reserve

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|