|

Unsexy stocks refind zip

|

|

August 23, 2000: 7:06 a.m. ET

Tech boom, tech boom, tech boom bang. Portfolio flat? Planners say 'I told you so'

By Staff Writer Alex Frew McMillan

|

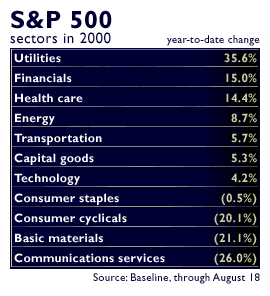

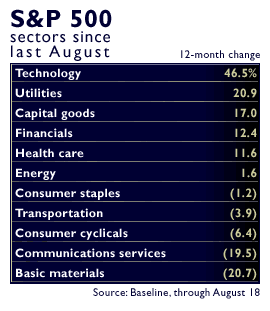

NEW YORK (CNNfn) - What a difference six months makes. Cull out the returns for this past half-year, and you'd find some decidedly boring industries have been the place to make money. Real estate investment trusts. Utilities. Energy stocks. Financials.

Sectors and industries that have been out of favor for years "finally had their turn in the barrel," said David Fleischer, a utilities analyst and a managing director at Goldman Sachs & Co. He says he's seen enough of these cycles to know it would happen eventually.

But what about the Internet? E-commerce? Cell-phone makers? For a while there it seemed like everyone was in on the high-tech act, from your broker to your baker and probably your candlestick maker, if you can find one anymore. LEDs, you know.

"There are reasons why people pay for high growth, and they typically overpay," Fleischer said. Once that happens, there's a correction, and people move their money into other sectors, looking elsewhere for the good returns they had come to expect. "It's a fool's game, and it keeps going until it doesn't keep going."

Fair-weather investors quiet this summer

What's an investor to make of it all? It's not exactly time to ditch everything and put it in electric utility Duke Energy (DUK: Research, Estimates) or REIT First Industrial Realty Trust (FR: Research, Estimates). But the sector shift illustrates the beauty of balance.

You've heard that somewhere before?

"It sounds like a broken record, and it's boring," said Scott Kahan, a certified financial planner and president of New York-based Financial Asset  Management. "It's something we definitely don't want to keep rubbing in people's faces. But it goes to show that diversification works." Management. "It's something we definitely don't want to keep rubbing in people's faces. But it goes to show that diversification works."

That theory was a hard sell when the market was running rampant. Kahan says he had a few fairly new investors tell him they were watching the market closely when it was doing well.

They had lots of ideas for managing their money. Then the market peaked.

"All of a sudden, March came. Now the same people are saying, 'You know, I don't even look at it [the market] anymore. It's too complicated.' They realize it's not something you can just play with and make money in anymore."

Cooling economy explains some of newfound zip

There's more to the rotation than a popularity contest between high-tech stocks and value stocks, of course. For starters, the industries and sectors that investors have migrated to are traditional hedges against inflation and higher interest rates. And, despite yesterday's decision by the Fed to leave rates steady, rates have been trending up.

But inflation has been more of a threat than a factor. At a time when utility deregulation has made that sector more volatile and exciting than it used to be, the old inflation hedges aren't what they used to be either.

The Fed's attempts to cool the economy have produced an increase in interest in untrendy sectors, such as utilities, because they tend to power through with surer earnings growth when times get hard.

Electric and, to some extent, gas and water utilities hold up with decent earnings growth even in a slowing economy, explained Hugh Johnson, chief investment officer at First Albany. Electric and, to some extent, gas and water utilities hold up with decent earnings growth even in a slowing economy, explained Hugh Johnson, chief investment officer at First Albany.

So do some consumer noncyclical companies such as drinks maker Pepsico (PEP: Research, Estimates) or food store Safeway (SWY: Research, Estimates).

"It's a migration toward value as a reflection that investors believe the growth rates of earnings are slowing," Johnson said. "It will continue until investors are convinced that the Fed will take its foot off the break, or reduce interest rates."

A fixed-income alternative?

REITs and utilities are also seen as being very good defensive stocks because they tend to pay extremely strong dividends. So investors can rely on them for current income. The appreciation they've been getting in the stocks this year gives the total return a double pump of jet fuel.

"If people feel that these stocks are going to hold at the levels they're at, the yields become very attractive," Jim Glickenhaus, general partner and portfolio manager of Glickenhaus & Co., pointed out.

In fact, REITs may offer an interesting alternative to the fixed-income portion of a portfolio, particularly when bonds haven't been as predictable as they used to be. Click here for a more-thorough explanation of how REITs work.

"They're paying bond-like returns, and you're going to get capital appreciation from these things," said Don Boegel, a certified financial planner in Plymouth, Minn., who says he has been recommending REITs to clients for a couple of years. He hopes and expects REITs to see double-digit returns over the next five years.

Still, he also recommends bonds again for older investors -- someone who has recently retired, for example. "You could see double-digit returns on bonds again," Boegel posited, "returns comparable to what you'd expect on common stocks, but hopefully not with the volatility."

How long can this keep going on?

Will the trend toward unsexier sectors of the market continue? Gas companies may benefit from the deregulation of electric utilities because gas went through its deregulation years back, Fleischer said.

"The gas companies have spent 15 years learning how to work in a deregulated environment," he said. They could put that to use selling other types of energy, like electricity. There's also been a fair bit of merger activity in utilities, partly as a result.

Strong energy companies like Dynegy (DYN: Research, Estimates) and Enron (ENE: Research, Estimates) have seen even greater growth, though the whole pack has gained ground, Fleischer said.

Other stock watchers say they see no reason why tech's ugly sisters like utilities and real estate can't stay at the ball a year or two past midnight, now they've arrived.

There's not a lot else to get excited about. Signs of a significant summer rally for techs, or in general, are few and far between. Volume is low. There is relatively little in the way of mergers and new product releases to spark interest in specific stocks.

And the market is well into its second-worst month for returns, August, and about to enter its worst, September. In fact, according to Yale Hirsch's research for the Stock Trader's Almanac, those are the only two months that have averaged losses in the S&P 500 over the last 50 years.

Let's put that broken record on for another spin

Still, if Fleischer knew for sure what was going to happen, he says he'd be sitting on a beach.

Neither he nor anyone else has gained 35.6 percent this year by having their whole portfolio in utilities. And chasing those returns now can be dangerous. Then again, diversified investors haven't lost it all in Internet stocks.

"There's always something that comes out and hits the cover off the ball, and everybody says, 'Geez, why didn't I get a piece of that?'" Boegel said.

So unsexy is in this summer. And the hindsight that lets investors ogle that latest investing trend is still 20/20.

Boegel says the conclusion he prefers people to draw from the market so far this year is, "'Gee, the advice that I got to stay with a diversified portfolio paid off.' The hottest sectors always cool off - whether they're techs or utilities."

Kahan agrees. "It's been a hard lesson for some, and a good lesson for most people," he said.

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|