|

Intel cooling on Rambus?

|

|

August 23, 2000: 5:44 a.m. ET

Intel continues to endorse tech supplier Rambus, but rift may be forming

By Staff Writer David Kleinbard

|

SAN JOSE, Calif. (CNNfn) - Speaking Tuesday at a conference of 5,000 hardware and software engineers from around the world, Intel President and CEO Craig Barrett repeated the chip giant's previous endorsements of Rambus Inc., a maker of technology used in memory chips.

However, comments made by Barrett and other Intel executives gathered at the Intel Developers Forum here indicate that the chip giant is unhappy with the persistently high price of memory chips made using Rambus' technology, creating the potential for a rift between the two companies, which have been in a licensing agreement since 1996.

In a question and answer session with reporters at the forum, Barrett said that Santa Clara, Calif.-based Intel (INTC: Research, Estimates) will not allow itself to become "hamstrung" by a memory technology whose price-performance ratio doesn't decline over time, and that industry economics, rather than Intel, will determine whether Rambus' technology succeeds.

Rambus (RMBS: Research, Estimates), based in Mountain View, Calif., created a technology that addresses the performance speed gap between computer microprocessors and dynamic random-access memory (DRAM), which stores instructions and data needed by the microprocessors. In recent years, microprocessors and controllers have become substantially faster and more powerful than DRAM. Rambus makes money by licensing its technology to most of the world's major chipmakers, including Intel.

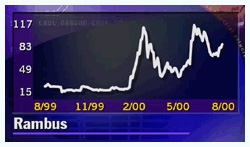

Rambus' stock has soared because Intel has endorsed its technology and incorporated it into chipsets used with its high-end Pentium III processors. The company has achieved a market cap of $8.8 billion, even though its royalty revenue totaled only $6.6 million from shipments made between January and March of this year. Rambus' stock has soared because Intel has endorsed its technology and incorporated it into chipsets used with its high-end Pentium III processors. The company has achieved a market cap of $8.8 billion, even though its royalty revenue totaled only $6.6 million from shipments made between January and March of this year.

Rambus' memory, called RDRAM, competes with a much cheaper and more standard form called synchronous DRAM, or SDRAM. In addition, several semiconductor companies are making a form of memory called Double Data Rate SDRAM, which can have twice the performance of the equivalent SDRAM. The result is a three-way horse race whose outcome will be shaped by discussions between engineers at the Intel Developers Forum and the future pricing of RDRAM and the Double Data Rate version.

So far, the reviews that Rambus memory has received in the computer trade press haven't been nearly as enthusiastic as the hype surrounding its stock.

"For months, we've wondered when Rambus DRAM would begin to demonstrate real-world performance benefits. We're still wondering," PC World magazine said in June. "Head-to-head against today's standard SDRAM PC memory, it's a wash, at best."

In its most recent issue, PC World magazine bench tested RDRAM against SDRAM and found that "RDRAM typically adds around $200 to $400 to the cost of a preconfigured PC--not an absurd premium, but disproportionate to its piddling speed increase."

Intel will consider lower cost alternatives

When CNNfn.com asked Intel's Barrett about these test results, he said, "We still support Rambus. We like its performance at the high end of the product line." However, he also said that Intel would use whatever memory technology its customers demand in the future, rather than being tied to one solution.

Linley Gwennap, founder and principal analyst at the Linley Group, a semiconductor research firm, said he sees a rift growing behind closed doors between Intel and Rambus because the price of Rambus memory hasn't come down as fast as Intel had expected it would.

"The biggest thing that they are not happy with is the price," Gwennap said. "Intel will make sure that they have some memory alternative available for the Pentium 4." The Pentium 4 is the next-generation microprocessor Intel plans to introduce in the fourth quarter of this year.

In a meeting with a small group of reporters, Albert Yu, senior vice president of Intel's Architecture Group and one of the chip giant's highest-ranking executives, made a similar statement about Rambus memory.

"We have been in favor of RDRAM because you need to have a high bandwidth memory to keep up with the processor. Technologically, it's the way to go," Yu said. "However, there is a separate business issue. We were hoping that Rambus memory would sell at a 5 to 10 percent premium over SDRAM, but that is not where it is today. The price premium for Rambus memory is what causes people to look at Double Data Rate."

"We've very quickly moved to a more pragmatic state," Yu added.

Intel's Timna chip illustrates some of the problems Intel has had with the high price of Rambus memory. Timna is a value-priced processor for ultra-low-cost computers that Intel plans to introduce in the first quarter of 2001. Timna was originally designed to work with Rambus memory. However, it had to be redesigned to work with SDRAM because Rambus memory didn't come down in price fast enough to make it a logical counterpart for a value-priced chip.

In addition, Intel recently disclosed that it would come out with a chipset next year for the Pentium 4 geared to work with SDRAM. The chip giant originally planned to use only Rambus memory chipsets with its new, high-end Pentium 4. That decision shows Intel is still unclear about the future pricing for Rambus memory and whether it will be manufactured in sufficient quantity to support the launch of the Pentium 4.

Intel's commitment to Rambus memory enabled Via Technologies, a competitor based in Taiwan, to gain market share from Intel in the chipset area, The Linley Group's Gwennap said. Intel offered a low-end chipset adapted for SDRAM and a high-end one for Rambus memory, but nothing in the middle, Gwennap said. This enabled Via Technologies to move into that middle ground and capture market share.

|

|

|

|

|

|

|