|

T-Online deals cause loss

|

|

August 31, 2000: 6:10 a.m. ET

German ISP's buyout trail drives it to a loss, but sales nearly double

|

LONDON (CNNfn) - Germany's T-Online International AG tumbled into the red in the first half of 2000 as spending on acquisitions to boost customer numbers across the continent wiped out the slender profit that Europe's largest Internet service provider generated a year earlier.

Just days after the surprise resignation of Chief Executive Officer Wolfgang Keuntje, T-Online said the first-half loss of  73.4 million ($65.6 million) from ongoing activities followed earnings of 73.4 million ($65.6 million) from ongoing activities followed earnings of  3 million in the same period of 1999. However, the company said that excluding changes to the structure of the group, income from ordinary activities would have risen to about 3 million in the same period of 1999. However, the company said that excluding changes to the structure of the group, income from ordinary activities would have risen to about  30 million. 30 million.

Sales jumped 96 percent to  353 million ($315.5 million). 353 million ($315.5 million).

Earnings before interest, taxes, depreciation and amortization fell to  10.1 million in the first half of 2000, from 10.1 million in the first half of 2000, from  14.2 million a year ago. That excludes the cost of acquisitions, including its buyout of Club Internet in France. 14.2 million a year ago. That excludes the cost of acquisitions, including its buyout of Club Internet in France.

T-Online said its customer rolls more than doubled to 6 million, about 500,000 of whom are outside of Germany.

The company, which recently listed on Germany's Neuer Markt exchange for growth stocks, is still 90 percent controlled by parent Deutsche Telekom AG.

"T-Online continues on a growth course, in terms of both client numbers and sales," Detlev Buchal, provisional chief executive officer, said in a statement. "The numbers clearly prove that our market concepts are absolutely on target. We will press ahead with our proven strategy and will pursue them even more intensively in the areas of e-commerce and portals."

The German ISP, recently the subject of speculation it would seek to buy British counterpart Freeserve (FRE), said it was keeping its eyes open for other purchases.

"T-Online is carefully monitoring all the important markets in Western Europe and will, should the occasion arise, opt for additional acquisitions," the company said in its earnings statement.

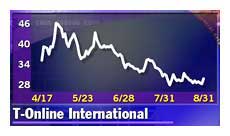

Shares of T-Online (ATOI) jumped  1.1, or 3.9 percent, to 1.1, or 3.9 percent, to  29.20 on the Neuer Markt after the report Thursday. Like many other Internet stocks, the company's shares have come under pressures in recent months, after being sold at 29.20 on the Neuer Markt after the report Thursday. Like many other Internet stocks, the company's shares have come under pressures in recent months, after being sold at  28 in April. 28 in April.

|

|

|

|

|

|

|