|

IPO Focus: Old economy boom

|

|

September 3, 2000: 7:00 a.m. ET

Attracting investors is more than making pizza; IPO market broadens for retailers

By Staff Writer Luisa Beltran

|

NEW YORK (CNNfn) - A year ago at this time, IPO investors would have done little more than window shop old economy retail offerings before moving on to something dot.com. Now, companies like California Pizza Kitchen and Krispy Kreme Doughnuts Inc. are dishing out some of the year's hottest initial public offerings, brightening the prospects of those still left to come, like Coach Inc.

It wasn't always this way. Until the second quarter, so-called old economy stocks like food retailers were scarce in an IPO market that consistently favored dot.coms or anything related to the Internet.

But a glut of dot.coms crashed in the early part of 2000, with the most notorious online retailers such as Pets.com (IPET: Research, Estimates) and Varsity Group Inc. (VSTY: Research, Estimates), falling nearly 90 percent since their February IPOs.

The technology sell-off in April gave Wall Street a further push to look beyond Internet buzz to more fundamental issues such as revenues, products and profits. This reawakening helped open the door for traditional companies like California Pizza Kitchen and Krispy Kreme. The technology sell-off in April gave Wall Street a further push to look beyond Internet buzz to more fundamental issues such as revenues, products and profits. This reawakening helped open the door for traditional companies like California Pizza Kitchen and Krispy Kreme.

After the technology sell-off in second quarter, the IPO market was fluctuating. "Both CPK and Krispy Kreme bought stability to the calendar," said analyst Mike Falbo, of IPOpros.com. "Both are old economy companies that are profitable."

"The market is now more broad so you don't have to be an Internet company to go public," added analyst Andrew Barrish, of Robertson Stephens, which was also a co-manager of California Pizza Kitchen's IPO. "The investment community is now paying attention to fundamentals."

Another traditional retailer

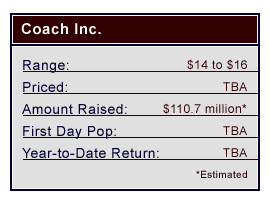

The broadening of the IPO market is now set to give leather goods maker Coach Inc. a strong bounce when it opens in September. On August 28, Coach filed to sell 7.38 million shares at $14 to $16 each via lead underwriters Goldman Sachs. Coach is expected to trade under "COH" on the New York Stock Exchange.

The 60-year old Coach makes leather goods such as handbags, wallets and gloves and scarves. Coach, a unit of Sara Lee Corp. (SLE: Research, Estimates), sells these items through major retailers such as Nordstrom and its own 106 stores as well as direct mail catalogs and its Web site, Coach.com.

New York-based Coach is also profitable with net income of $38.6 million on revenue of $548.9 million for the fiscal year ended July 1. New York-based Coach is also profitable with net income of $38.6 million on revenue of $548.9 million for the fiscal year ended July 1.

After the IPO, Sara Lee will hold an 82.6 percent stake in Coach. Coach plans to split off from Sara Lee where it will offer to exchange shares for Sara Lee's within 18 months of the its IPO. Sara Lee may also distribute stock through some other method, Coach said in an SEC filing.

Analysts expect Coach to ride its strong brand name to a good premium once its opens in mid-September.

"This will get a good investor reception," said Steve Tuen, of IPO Value Monitor. "They certainly have enough brand recognition out there. In general, these companies do well at least initially."

More than pizza and doughnuts

Also helping the company's prospects is the fact that unlike dot.coms, which usually have scant earnings and little experience, companies such as California Pizza Kitchen (CPKI: Research, Estimates), Krispy Kreme (KREM: Research, Estimates) and Coach have obvious products and years of practice.

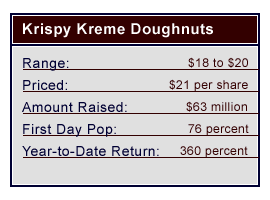

Krispy Kreme has been making doughnuts for 77 years while California Pizza opened its first restaurant in 1985. Krispy Kreme rode it's cult-like following to a 76 percent first-day gain in April and the company is now nearly 360 percent above its IPO price.

On August 24, the doughnut maker reported that sales for store chains surged nearly 40 percent for the quarter ended July 30. Net income for Winston-Salem, N.C.-based Krispy Kreme rose to $3.6 million, or 25 cents per share, outpacing analysts' expectations. Total company revenue -- which includes sales from company stores, franchise fees and royalties, and support operations sales -- rose 36.3 percent to about $70 million.

Wall Street analysts on average had been expecting the newly public company to report a profit of 18 cents per share, according to research firm First Call/Thomson Financial. Krispy Kreme debuted on Nasdaq on April 5. Wall Street analysts on average had been expecting the newly public company to report a profit of 18 cents per share, according to research firm First Call/Thomson Financial. Krispy Kreme debuted on Nasdaq on April 5.

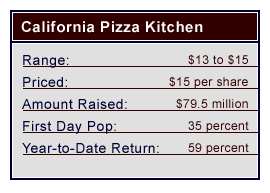

California Pizza Kitchen may lack Krispy Kreme's following, but its salads and unique pizzas offer a healthy alternative at a relatively inexpensive price, said the company's CEO, Fred Hipp. On average, customers spend about $10.50 a visit.

"We have fresher and lighter food that appeals to the pocketbooks of a mass audience," Hipp said.

California Pizza also earned nearly $2 million in net income on revenue of $101 million for the six months ended July 2. The company has more than 100 restaurants and take-out shops in 21 states.

On August 1, the Los Angeles-based California Pizza rose 35 percent in its first day of trade and the company is now 60 percent above its IPO price.

The decision to push for an IPO came in the early spring, Hipp said. The technology sell-off did not prompt California Pizza to pursue an IPO but it did help steer investors to consider more traditional stocks, he said.

Hipp floated the IPO idea to some buy side investors and their strong response helped him recognize that a California Pizza deal might receive a good reception from Wall Street.

"We realized there was some demand for a visible consumer company that had a proven track record, a story to tell and a solid earnings track record," he said.

On Friday, California Pizza fell $1.12 to $23.81 while Krispy Kreme rose $3.50 to close at $96.50.

On Monday: An in-depth look at California Pizza Kitchen's journey to Wall Street.

|

|

|

|

|

|

|