|

Serving a hot pizza IPO

|

|

September 4, 2000: 9:10 a.m. ET

Anatomy of an offer: Success involves road show, timing and strong banker

By Staff Writer Luisa Beltran

|

NEW YORK (CNNfn) - Tapping the initial public offerings market often seems like a quick way for a company -- and its employees -- to make loads of money. But the road to an IPO really involves a lot of hard work, timing and spinning a story that Wall Street will love.

To be sure, the IPO market is littered with companies that chose to launch their deals too late. E-tailers were strong in 1999 but took a hit in the first quarter of 2000 along with Web consultants.

Consider the Boston-based Digitas Inc. (DTAS: Research, Estimates), which chose to launch its deal at end of first quarter when the Web consulting sector was no longer thriving. The company sold 9.3 million shares at $24 and rose 23 percent in its debut on March 14. However, the stock has since plunged more than 50 percent and closed Friday down 69 cents to $13.06.

Since Digitas, Internet consultants have also largely crashed and burned, leaving analysts with dim hopes for such deals, even from mammoth names such as KPMG Consulting, which is expected later this month. The unit of global accounting firm KPMG LLP filed to sell 324 million shares at $6.75 to $8.75 each via underwriters Morgan Stanley Dean Witter, but few are expecting much of a first-day gain.

Click here to read this week's IPO focus story on "old economy" offerings

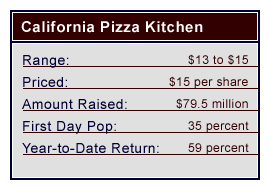

Timing is really the key, analysts said, and the hot sectors now are anything involved with biotechnology and building computer networks. Even non-tech businesses such as California Pizza Kitchen (CPKI: Research, Estimates) and Krispy Kreme Doughnuts Inc. (KREM: Research, Estimates), companies that would have generated hardly any buzz just eight months ago, have also received a boost.

Krispy Kreme rode its cult-like following to a 76 percent first-day gain in April, and the company is now nearly 360 percent above its IPO price.

California Pizza, a 15-year-old company that sells pizza, salads and soups, launched its IPO in August and isn't far behind, having climbed 35 percent in its first day of trade on Aug. 1. The company is now nearly 60 percent above its IPO price. California Pizza, a 15-year-old company that sells pizza, salads and soups, launched its IPO in August and isn't far behind, having climbed 35 percent in its first day of trade on Aug. 1. The company is now nearly 60 percent above its IPO price.

Both companies are a throwback to the days when successful IPOs were dominated by tangible things such as earnings or proven products, not techno-gadgets or concepts that hold a lot promise but little else. Few involved in the process will deny there is some amount of luck involved in crafting a successful IPO, but if anything the job of selling a non-tech company on Wall Street is made even more difficult by the unlikely chance that it will turn an investor into a millionaire overnight.

The banker

California Pizza's road to becoming a public company involved several steps. One of the first -- and one of the most important -- involved picking a banker. Investment banks play an important role and top-tier firms, such as Goldman Sachs or Morgan Stanley, can often ensure a strong first-day pop.

Wall Street will question an otherwise good deal if it is led by a third-tier underwriter, analysts said. Also, some bankers are better in certain sectors. SG Cowen usually brings good biotech IPOs, while Credit Suisse First Boston is especially strong in technology.

The investment banker is responsible with filing and printing the preliminary prospectus, the S-1. Companies must file their deals with the Securities and Exchange Commission, and any changes or additions in a deal require the underwriters to print and file a new S-1. Printing costs are one of the biggest expenses of the IPO process, said John Fitzgibbon, editor of WorldFinanceNet.com.

The underwriter also arranges the "road show" for clients. For two weeks, companies will travel with their bankers all over the country to cities such as Chicago, New York and San Francisco, and pitch their deals to potential investors. Road show attendees can run the gamut from high net worth individuals to fund managers. Bankers are also known to arrange private meetings with key buyers to tell them about a company, Fitzgibbon said.

From the road show, bankers are able to determine demand for a deal by collecting orders from investors at a price they are willing to pay. California Pizza had demand for 40 million shares, the company's chief executive, Fred Hipp said.

The buzz from a road show will affect the IPO and a lot of people attending usually means strong interest, analysts said.

The lead manager will also form a syndicate to help sell the shares. For California Pizza Kitchen, Bank of America Securities and Deutsche Bank Alex. Brown served as lead managers while Robertson Stephens filled out the team as co-manager.

A lead manager can also help support a company's shares in the aftermarket when a deal falls below expectations. For example, California Pizza priced its shares at $15 and opened at $20.25 on Aug. 2. However, if the pizza company had opened below $15, the lead underwriters may opt to buy shares at $15 to ensure that the stock does not drop below its offer price.

"They buy to ensure the distribution is complete and that it is stabilized," Fitzgibbon said. "It's the same function as a market maker."

Not every deal receives such treatment, Fitzgibbon said, and there is no time limit on how long bankers will back a deal. But once the support has ended, the banker will issue a release notifying the public.

For all of this, the banking syndicate receives 7 percent of gross proceeds on a deal, but can also get an extra amount to cover miscellaneous expenses, Fitzgibbon said. Book runners, or co-managers on a deal, receive the lion share of the 7 percent.

Rigors of the road show

California Pizza Kitchen talked to many of the top investment bankers to find one that understood their image, had a good relationship with buy-side investors and had experience in consumer deals. Most "A-list" firms, such as Goldman and Morgan, fit the bill -- but the company passed on those they thought were too traditional.

"We are hip and they were stuffy," said Fred Hipp, California Pizza Kitchen's chief executive. "[The bankers] were not bad people. We just wanted someone that relates to what we are trying to sell but at the same time is highly respected."

California Pizza's lead bankers, Bank of America Securities and Deutsche Bank Alex. Brown, worked with Hipp and the company's chief financial officer, Carey Carrington, to make sure their presentation was finely tuned to the buy-side investors. Hipp, who has a tendency to talk too much, was told to be brief. California Pizza's lead bankers, Bank of America Securities and Deutsche Bank Alex. Brown, worked with Hipp and the company's chief financial officer, Carey Carrington, to make sure their presentation was finely tuned to the buy-side investors. Hipp, who has a tendency to talk too much, was told to be brief.

"They said we had to be in and out in 30 minutes," Hipp said. "We gave a really fine-tuned presentation."

Hipp and Carrington made 85 presentations during their two-week road show. Hipp usually started his day at 6 a.m., and met and pitched his deal to different investors until about 10 p.m. each night, excluding weekends.

The rigorous schedule allowed investors to get a sense of the company, or "kick their tires." Many at the road show were already familiar with California Pizza, having eaten at its restaurants, Hipp said.

But the two weeks were not all fun and games. Some road show attendees grilled Hipp to see if he actually knew the restaurant business. One investor, Hipp recalls, asked how California Pizza would meet its growth projections since it attracts mostly affluent customers. Another asked Hipp what the company would do if El Nino wiped out the produce crop in California.

Hipp, who has been CEO of California Pizza since 1998 and was formerly head of Kansas City, Mo.-based Houlihan's Restaurant Group, drew upon his 27 years in the casual dining industry to answer such questions.

Produce has a six-week recovery cycle, so California Pizza would not be adversely affected for long in case of a catastrophic event, Hipp said.

"What sells stock in the road show is the feeling the buyer gets about the management. Is this guy credible and is he telling the truth?" he said.

A one-month wonder or a long-term success?

Ultimately, on Aug. 2, the Los Angeles-based pizza company raised $79.5 million after selling 5.3 million shares at $15 each.

Company executives will not deny their good fortune. The 15-year old pizza company floated its deal when dot.coms were no longer in vogue and Wall Street was looking for earnings, revenue and products -- something a successful restaurant chain such as California Pizza could clearly provide.

Four weeks later, though, the company's stock remains in vogue. California Pizza is now trading 60 percent above its IPO offer price. With a successful road show behind him, Hipp believes the most important aspect of the IPO process is connecting with investors.

"When people are investing in a company, they still want to meet the management," Hipp said. "The IPO process still continues to drill down the importance of face-to-face contact and giving the investor an opportunity to evaluate the management."

|

|

|

|

|

|

|