|

Daimler reopens Japan talks

|

|

September 4, 2000: 6:55 a.m. ET

German automaker may raise Mitsubishi stake to 40%, report says

|

LONDON (CNNfn) - DaimlerChrysler AG, the world's fifth-largest automaker, said Monday it's in talks with Mitsubishi Motors Corp. about the future of its alliance, after the Japanese company admitted covering up customer complaints over the past two decades.

Germany's DaimlerChrysler will raise its stake in Mitsubishi to 40 percent and take a fourth seat on the board, according to Japan's NHK public television news. The Stuttgart-based automaker agreed in March to buy 34 percent for about $1.9 billion.

"We are in talks about the future of our alliance," DaimlerChysler told CNNfn. The talks were "very fruitful and are progressing in a cooperative spirit." Daimler declined to comment on the report that it planned to take a bigger stake in Mitsubishi than it first agreed.

The admission by Japan's fourth-largest carmaker that it systematically covered up customer complaints for more than 20 years, has put pressure on company President Katsuhiko Kawasoe to resign, and forced Mitsubishi to recall more than 1 million cars. The admission by Japan's fourth-largest carmaker that it systematically covered up customer complaints for more than 20 years, has put pressure on company President Katsuhiko Kawasoe to resign, and forced Mitsubishi to recall more than 1 million cars.

DaimlerChrysler board members Eckhard Cordes and Manfred Bischoff have traveled to Tokyo to discuss the crisis at its Japanese partner and are trying to cut the  2.1 billion ($1.9 billion) price paid for the initial stake, media reports said. 2.1 billion ($1.9 billion) price paid for the initial stake, media reports said.

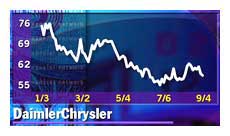

DaimlerChrysler's offer was worth ¥450 ($4.25) per share. Mitsubishi Motors shares rose ¥9, or 2.6 percent, to end the session at ¥349 in Tokyo, but are still down 26 percent in value since the scandal surfaced in mid-July. Shares in DaimlerChrysler (DCX) rose 1.2 percent to  58.65 in midday trading in Frankfurt. 58.65 in midday trading in Frankfurt.

Mitsubishi group companies, which are also major shareholders in the Japanese automaker, will not oppose any move by DaimlerChrysler to boost its holding, Minoru Makihara, chairman of trading company Mitsubishi Corp. told reporters.

Mitsubishi group companies' combined holding in Mitsubishi Motors is expected to fall to 33 percent from 48 percent with DaimlerChrysler's purchase of a 34 percent stake, which is to be completed by the end of November. That stake will be enough to give the German company veto power over boardroom decisions at Mitsubishi Motors.

--from staff and wire reports

|

|

|

|

|

|

|