|

APBNews to be dissolved

|

|

September 6, 2000: 3:57 p.m. ET

Online crime news service's assets to be auctioned off in bankruptcy court

|

NEW YORK (CNNfn) - APBNews.com, which has been operating under bankruptcy protection since early July, will have its assets auctioned off in a U.S. bankruptcy court Thursday after a startup Internet firm retracted an offer to revive the cash-strapped news outfit.

Founded in 1998, New York-based APBNews.com is an Internet news service focusing on crime reporting. It was established by two former investment bankers, Marshall Davidson and Matthew Cohen, and former investigative reporter Mark Sauter.

Since its inception, APBnews.com has established itself as a first-rate Internet news site, winning several awards for its reporting. It currently has content distribution agreements with the likes of America Online, Yahoo! and MSNBC.com.

However, like a host of other Internet startups, APBNews.com exhausted its funding. However, like a host of other Internet startups, APBNews.com exhausted its funding.

It raised roughly $104 million last August through a private placement to institutional investors. However, a third try at financing in March failed when the market for Internet companies took a turn for the worse. That rendered APBnews.com unable to pay back roughly $7 million in outstanding debt and prompted it to file for Chapter 11 bankruptcy protection in early July.

Late last month, it appeared as if the company had found a savior in SafetyTips.com Inc., an Internet information company focused on safety issues at home and in the workplace.

The Waltham, Mass.-based company had agreed to pay the $950,000 for all of APBnews.com's assets. It had also said it would fund a debtor-in-possession borrowing agreement of $500,000 to enable APBNews.com to continue to operate as it moved through the bankruptcy proceedings.

However, less than a week later SafetyTips.com rescinded that offer after it said it examined the company's financial records more closely.

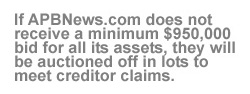

Thursday's auction will take place in Manhattan at the U.S. Bankruptcy Court for the Southern District of New York. The company said it has received permission from the court to sell its assets at a minimum of $950,000. If that minimum is not met, the court will auction portions of APB's assets in lots to meet creditors' claims.

|

|

|

|

|

|

APBnews.com

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|