|

Crude prices tumble

|

|

September 8, 2000: 5:06 p.m. ET

Futures plummet as OPEC meeting, anticipated production increase, loom

|

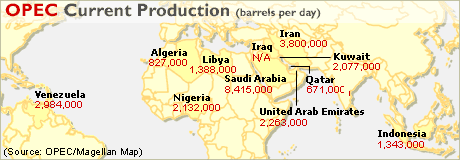

NEW YORK (CNNfn) - Oil prices skidded Friday afternoon as OPEC ministers headed into a weekend meeting expected to result in increased production that could lower prices -- which are at the highest level in a decade.

U.S. light sweet crude futures of October delivery fell $1.79, or 5.1 percent, to close at $33.60 a barrel on the New York Mercantile Exchange. London's benchmark Brent for October delivery dropped $1.80 to $32.75.

|

|

VIDEO

|

|

CNNfn's Diana Muriel previews OPEC's weekend meeting.

CNNfn's Diana Muriel previews OPEC's weekend meeting.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Analysts said action by both President Clinton and U.S. Energy Secretary Bill Richardson triggered the decline. "The risk now is that production is going to be more rather than less," said Shaun Reynolds, oil analyst at Goldman Sachs in New York.

Clinton appealed directly Thursday to the Crown Prince of Saudi Arabia, the world's largest oil producer, which is seen as one of the few exporting countries with the capacity to hike output. The president said Prince Abdullah agreed that high oil prices threaten to tip the world economy into recession.

Reports said the prince promised Clinton an increase of 700,000 barrels a day, but other recent reports said OPEC could raise output by only 600,000 barrels per day.

"It is important to have more production," Richardson told CNN. Referring to OPEC's target price band of $22 to $28 a barrel, Richardson said, "the ideal price is between $20 and $25 -- that is good for producer countries and consumer countries."

Oil prices have soared this week to levels not seen since the Persian Gulf War. Many dealers said the market was clearly overbought as the high levels were not sustainable.

By Friday, oil prices had averaged more than $28 per barrel for the previous 19 days. Under an informal mechanism agreed between OPEC producers in June, if the average price of the cartel's seven crude oils stays above the $22 to $28 band for 20 working days, members will collectively increase crude production by 500,000 barrels a day to try to bring the price back into the range. By Friday, oil prices had averaged more than $28 per barrel for the previous 19 days. Under an informal mechanism agreed between OPEC producers in June, if the average price of the cartel's seven crude oils stays above the $22 to $28 band for 20 working days, members will collectively increase crude production by 500,000 barrels a day to try to bring the price back into the range.

How much more oil?

Oil market analysts said they are counting on some sort of production increase after the weekend OPEC meeting.

"I think it's a sure thing they are going to raise by a certain amount -- the question is how much more are they going to produce," said Peter Gignoux, an oil industry analyst at Salomon Smith Barney in London.

Saudi Arabia, despite the urgings from Clinton, must tread a delicate line because it doesn't want to alienate its OPEC allies, Gignoux said. "What they have said is that if the other OPEC countries can't increase output proportionately [with Saudi Arabia], then the Saudis will take up the slack -- but they want to avoid the argument that it's a unilateral increase," he said.

Iran and Venezuela agreed to follow Saudi Arabia and Nigeria this week in announcing their intention to help stabilize the crude oil market.

Any accord to raise production would be the third this year. Crude prices have tripled since early 1999 when costs hovered at rock-bottom levels near $11 per barrel.

Europeans protest high prices

Rising prices have led to finger-pointing between OPEC and consumers in the United States -- while protests by truckers, farmers and fishermen calling on their governments to combat the oil price bite by lowering energy taxes have broken out in Europe, especially in France.

In Europe, analysts said, the impact of higher oil prices is all the more acute because it coincides with the record weakness of the euro. Crude oil is bought and sold in dollars, which means that euro zone users face an extra cost when they buy dollars to finance fuel purchases.

TotalFina Elf (PFP), the largest French oil company and the fourth-largest worldwide, said blockades of refineries by protesting truckers and farmers have left 80 percent of France's gas stations affected by fuel shortages.

The French government has explored imposing levies on oil companies, which typically enjoy higher profits as prices climb. On the other hand, chemical companies, such as U.S.-based DuPont (DD: Research, Estimates), have suffered from the spiraling cost of their main raw material.

OPEC blames industrialized powers for taxing petroleum products too heavily. In many European countries, tax rates on gasoline are among the highest in the world, accounting for as much as three-quarters of the price of a gallon of fuel.

Criticism of the U.S. government's conduct amid rising prices have centered on its strategic petroleum reserve (SPR), which advocates of lower prices say it could release into the market to ease the price crunch.

"One of the legs this (oil price) rally stands on is low crude oil inventories, and releasing some of the SPR would take them to an acceptable level," said Gignoux. He said U.S. law allowed for the president to release about 30,000 barrels without consulting Congress. "Why is Washington dithering?," he asked.

Energy Secretary Richardson said Friday that President Clinton "is ready to exercise all options."

-- from staff and wire reports

|

|

|

|

|

|

|