|

AT&T may avoid divesting

|

|

September 12, 2000: 3:50 p.m. ET

Telecom talks to Congress about possible options in MediaOne deal

|

NEW YORK (CNNfn) - AT&T Corp. is talking to members of Congress about options that may allow it to avoid divesting some of its cable system assets in order to complete its acquisition of MediaOne Group Inc.

AT&T spokesman Jim McGann confirmed reports CEO C. Michael Armstrong is in Washington meeting with members of Congress about the merger. But he stressed AT&T "absolutely, fully intends to comply with the merger conditions" set down by the Federal Communications Commission when it approved the deal.

McGann said AT&T (T: Research, Estimates) has had "concern" for a long time about the FCC's rule that prohibits a single cable operator from reaching more than 30 percent of the nation's subscribers. He said the company is "talking to people" about it, but hasn't made a decision about how AT&T might try and get the rule changed.

A source at the Senate Appropriations Committee told CNNfn legislative efforts to help AT&T with the FCC rule aren't "in the works" for now. A source at the Senate Appropriations Committee told CNNfn legislative efforts to help AT&T with the FCC rule aren't "in the works" for now.

According to the Washington Post AT&T already has gained the support of Sen. Ted Stevens, R-Alaska, the chairman of the Senate Appropriations Committee.

Stevens is preparing an appropriations bill amendment that effectively would end federal rules limiting the number of cable systems a single company can own, according to the paper. Such a development would let AT&T hold its existing cable assets along with MediaOne cable assets.

The Post said AT&T has indicated that if it is forced to divest cable systems, it would sell those in rural and inner-city neighborhoods, thus widening the so-called "digital divide" between affluent and less affluent areas.

The paper also said AT&T is looking to avoid an asset sale because it wants a stronger position if it is forced by the Federal Trade Commission to divest a 25 percent stake in Time Warner Entertainment, a cable venture with Time Warner Inc., the parent of CNNfn. The FTC is expected to seek the divestiture in light of Time Warner's acquisition by America Online in an effort to increase competition between the AT&T and the new entity.

AT&T has spent over $100 billion over the last two years on cable system properties, the paper noted. The MediaOne purchase cost the company $58 billion and brought in 5 million new customers.

Today, lobbying efforts by companies like AT&T came under criticism from FCC Chairman William Kennard. In remarks prepared for a speech in Atlanta, Kennard said "all too often companies work to change the regulations, instead of working to change the market."

"It's always easier to prowl the halls of Congress than compete in the rough an tumble of the marketplace," Kennard added.

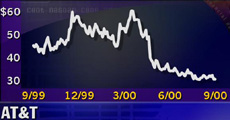

AT&T shares rose 19 cents Monday to $30.69.

|

|

|

|

|

|

AT&T

MediaOne

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|