|

Bank buyout buzz goes on

|

|

September 13, 2000: 3:13 p.m. ET

Lehman Bros., Bear Stearns eyed as merger targets, but shares fall

By Staff Writer Kim Khan

|

NEW YORK (CNNfn) - As the market gauged investor reaction to Chase Manhattan's $33 billion acquisition of J.P. Morgan Wednesday, shares plunged for two firms identified by analysts as the next likely takeover targets.

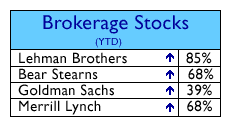

With J.P. Morgan swallowed, Lehman Brothers Holding Corp. and Bear Stearns Cos. are the only midsize brokers left to merge, according to analysts. But shares of those companies dropped sharply in afternoon trading.

Bear Stearns (BSC: Research, Estimates) dropped $2.50 to $69.13, while shares of Lehman (LEH: Research, Estimates) lost more than 4 percent, falling $6.50 to $152.

Investors who bet on J.P. Morgan (JPM: Research, Estimates) in the wake of Credit Suisse Group's purchase of Donaldson Lufkin and Jenrette (DLJ: Research, Estimates) got a nice 36 percent return on their investment, based on the purchase price of $207 per share announced by the companies. Investors who bet on J.P. Morgan (JPM: Research, Estimates) in the wake of Credit Suisse Group's purchase of Donaldson Lufkin and Jenrette (DLJ: Research, Estimates) got a nice 36 percent return on their investment, based on the purchase price of $207 per share announced by the companies.

With J.P. Morgan out of the picture, both Lehman and Bear Stearns could be under the microscope as global financial institutions look to add to their investment banking arms. But these stocks may already have a merger priced in, leaving little room for growth.

Charles Peabody, analyst with Mitchell Securities, said he is expecting a post-deal letdown in financial stocks because they have reached their peak.

"These stocks already reflect liquidation value," Peabody said.

If a play is made for an investment bank, Lehman seems to edge out Bear Stearns as the top candidate.

"Between the two, in terms of which is the easiest pill to swallow, it's Lehman because the culture is easier to tolerate than Bear Stearns," said Steve Eisman, analyst with CIBC World Markets.

Peabody said Bear Stearns Chairman Alan Greenberg is on record as saying he will sell at four times book value, but that might put off potential suitors. Peabody said Bear Stearns Chairman Alan Greenberg is on record as saying he will sell at four times book value, but that might put off potential suitors.

"It's a really high price and not many people are willing to pay that, so I think Lehman is the more obvious," Peabody said.

But Lehman would also command a high price, as shares of the company have risen about 85 percent since the beginning of the year.

Reverse situation

With a limited number of independent investment banks left, one analyst said the sector could see a turnaround, with large investment banks going after banks.

"From here on in we can start looking at some of the bank stocks (as targets), because investment banks are going to start looking at banks going in the reverse direction," said Andrew Collins, analyst at ING Barings. "Everybody wants to be a one-stop shop."

Collins likes FleetBoston Financial Corp. (FBF: Research, Estimates) as an acquisition candidate for one of the top four or five investment banks looking to add retail banking services.

He also said Wells Fargo (WFC: Research, Estimates) looked attractive, even as a stand-alone stock with a strong Internet segment and a cheap share price.

Who has a shopping list?

Also getting shorter is the list of companies looking to shore up their investment banking or brokerage segment.

Chase Chairman and CEO William Harrison told CNNfn that J.P. Morgan Chase & Co. -- the new name of the merged company -- would not be on the lookout for large acquisitions. Harrison did not rule out fill-in deals to add services in which the company may be weak, but said the company had reached the platform it wants to work from.

Chip Dickson, managing director and banking analyst at Lehman, said Chase has too much to integrate now to go looking for another large deal. (352K WAV) or (352K AIFF)

One name that remains is Deutsche Bank. German financial weekly Wirtschafts Woche reported on Sept. 6 that Deutsche was in talks to acquire J.P. Morgan.

"Deutsche certainly is left out in the lurch in this one, so they're going to be that much more eager to do a deal over here," Collins said.

J.P. Morgan Chairman and CEO Douglas Warner did not deny he had discussions, saying everyone in the financial sector is talking to everyone else, but he stressed the only conversation "important today" was with Chase (CMB: Research, Estimates).

|

|

|

|

|

|

|