|

Kuwait can't meet oil quota

|

|

September 14, 2000: 11:04 a.m. ET

OPEC member warns prices will remain high; UK gas-tax blockades end

|

LONDON (CNNfn) - Kuwait's oil minister said Thursday that his country does not have the capacity to produce as much oil as it promised under OPEC's new quota agreement announced last Monday, raising doubts about whether the oil cartel's pledge to boost global supply is a realistic endeavor.

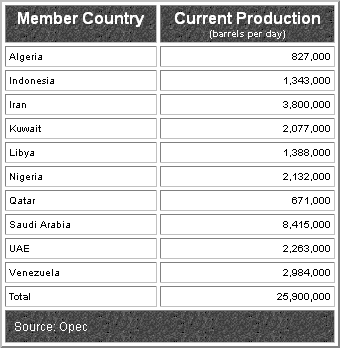

"The capacity of OPEC to increase production is very limited," Kuwaiti Oil Minister Saud Nasser al-Sabah's said in an interview with pan-Arab daily newspaper al-Hayat in Paris. "We have reached our maximum production capacity," he said, adding that only Saudi Arabia and the United Arab Emirates have a margin of extra production capacity. "The capacity of OPEC to increase production is very limited," Kuwaiti Oil Minister Saud Nasser al-Sabah's said in an interview with pan-Arab daily newspaper al-Hayat in Paris. "We have reached our maximum production capacity," he said, adding that only Saudi Arabia and the United Arab Emirates have a margin of extra production capacity.

He added that he foresaw no let-up in the inflated price of the commodity until next year, and his remarks came as the implications of the oil situation continued to reverberate around Europe.

All week, the price of oil has slowly drifted lower in the wake of a decision by the 11 members of the Organization of Petroleum Exporting Countries this past weekend to raise production by 800,000 barrels per day beginning on Oct. 1. Brent crude for November delivery fell 60 cents to $31.40 on the International Petroleum Exchange in London Thursday.

KLM to up fares

A slew of events Thursday failed to reverse that trend. KLM Royal Dutch Airlines (KLM: Research, Estimates) said Thursday it would raise the tariffs it charges on all its tickets beyond Nov. 1 by 4 percent as a result of higher fuel prices. That follows a 3-percent increase at the beginning of July.

Separately, Esso, the U.K. arm of Exxon Mobil Corp. (XOM: Research, Estimates) announced it had raised the price of unleaded gasoline at U.K. pumps by 2 pence a liter; it raised the price of diesel by 4 pence a liter.

At issue is the amount of oil slushing around in global markets, and whether it will be enough to meet what is expected to be strong winter demand. So far, most analysts and now at least one senior OPEC official believe production will fall short, prompting investors to maintain the price of crude oil around 10-year highs. At issue is the amount of oil slushing around in global markets, and whether it will be enough to meet what is expected to be strong winter demand. So far, most analysts and now at least one senior OPEC official believe production will fall short, prompting investors to maintain the price of crude oil around 10-year highs.

"We did not agree to increase production," Saud said. "We said we will meet on Nov. 12 to evaluate the oil market.... if the oil price is over $28 a barrel we will increase production by half a million barrels per day, but who in OPEC can add half a million barrels per day to its current production?"

Taxes, not price at issue

And that's what most investors and consumer want to know - whether an increase in production will put an end to near-record prices for oil and stop companies from passing on their rising energy costs in the form of price increases.

One piece of goods news came from German flag carrier Deutsche Lufthansa AG (LHAG), which said Thursday that successful hedging on crude oil prices has protected it against higher fuel costs, allowing it to keep its prices steady. One piece of goods news came from German flag carrier Deutsche Lufthansa AG (LHAG), which said Thursday that successful hedging on crude oil prices has protected it against higher fuel costs, allowing it to keep its prices steady.

Saud also addressed current gasoline prices, which have become the object of public protests in the U.K. and other countries because of what critics have called unreasonably high taxes.

Saud said it was high taxes on products such as gasoline -- not a lack of oil -- that were responsible for the current surge in global oil prices.

"They are high because of taxes. I have said my point of view. The current price is realistic and normal. Whatever we do now, whatever decision we take tomorrow or the day after tomorrow to increase production will not affect the market because it realizes that there is no country capable of increasing its production in a big way."

Protests wind down

In the U.K., where almost 80 percent of the pump price of a liter of gasoline goes into the government's coffers, Prime Minister Blair defended the taxes, pointing out that the collections go toward paying down the country's outstanding deficit.

Fuel tax protesters whose demonstrations had dried up tanks at U.K. gas stations called off a slew of key blockades Thursday, saying they won a moral victory and would have lost public support had they continued.

Demonstrations ended at 10 fuel refineries and depots, roughly a quarter of the facilities hit by people angry over the cost of fuel in the U.K. In a nationwide televised address, Blair said his government was prepared to listen to the concerns that triggered the crisis, though he did not promise any relief to motorists from high fuel taxes.

-- from staff and wire reports

|

|

|

|

|

|

|