|

Currency fears hit Europe

|

|

September 18, 2000: 1:07 p.m. ET

Euro at record low, oil near highs spark concern over interest rates, profits

|

LONDON (CNNfn) - Nervousness about the outlook for earnings, inflation and interest rates combined to send most European markets sharply lower Monday, with both "new-economy" high-tech shares and more traditional manufacturing companies feeling the squeeze.

With inflationary pressures gathering in the form of near-record lows for Europe's common currency and oil prices at 10-year highs, concern resurfaced that the European Central Bank soon will hike interest rates. Stocks in the U.K., which doesn't use the euro, remained mostly unscathed.

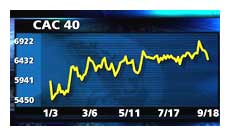

In Paris, the CAC 40 index dropped 1.4 percent to 6,522.38, led by telephone equipment maker Alcatel (PCGE) with a slide of 4.5 percent. The high price of oil dented shares of manufacturers such as carmaker Renault (PRNO), falling 3.5 percent, and electrical engineering company Schneider Electric (PSU), which shed 2.9 percent. In Paris, the CAC 40 index dropped 1.4 percent to 6,522.38, led by telephone equipment maker Alcatel (PCGE) with a slide of 4.5 percent. The high price of oil dented shares of manufacturers such as carmaker Renault (PRNO), falling 3.5 percent, and electrical engineering company Schneider Electric (PSU), which shed 2.9 percent.

Frankfurt's Xetra Dax index fell 107.85 points, 1.5 percent, to 6,891.69, with airline Deutsche Lufthansa (FLHA) among the leading losers, posting a drop of 3.3 percent as investors increasingly took a pessimistic view of the impact high fuel costs will have on profit. Other oil-dependent companies went out of favor on worries about raw material costs: among chemicals makers, Henkel [FSE:FHEN3] lost 3.5 percent and BASF (FBAS) fell 2.5 percent.

London's benchmark FTSE 100 was the exception among Europe's main markets, ending the day at 6,410.2, little changed from Friday. High-tech firms suffered the most as Nasdaq's recent declines produced a hangover, but they were offset by gains in sectors from media to utilities.

In other European markets, Amsterdam's AEX index closed down 1.2 percent at 668.43, the SMI in Zurich slipped 1 percent to 7,935.9 and Milan's MIB 30 fell 1.2 percent to 46,619.

New low for euro

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, fell 0.5 percent. Its computer services segment shed 3.1 percent while the electrical and electronics sub-index was down 2.4 percent.

Concern over the impact of the weak euro continued to take a toll on Wall Street on Monday, with a flurry of companies warning that the single currency's decline could dent their profits from overseas. By midday, the Dow Jones industrial average had fallen 64 points to 10,863, while the tech-rich Nasdaq composite was showing a loss of 2.2 percent at 3,749.64. Concern over the impact of the weak euro continued to take a toll on Wall Street on Monday, with a flurry of companies warning that the single currency's decline could dent their profits from overseas. By midday, the Dow Jones industrial average had fallen 64 points to 10,863, while the tech-rich Nasdaq composite was showing a loss of 2.2 percent at 3,749.64.

In the currency market, the euro plumbed another record low, weakening to about 85 U.S. cents before recovering slightly to 85.26 cents. It had fetched 85.32 cents in late New York trading Friday.

On European exchanges, oil companies got a boost from the strength of the price of crude. BP Amoco (BPA) rose 2.7 percent in London while Shell Transport & Trading (SHEL) gained 2.4 percent.

Cadbury Schweppes (CBRY) gained 3.5 percent after the U.K. candy and beverage maker agreed to snap up Snapple Beverages Group from Triarc Companies (TRY: Research, Estimates) for $1.45 billion in  cash and debt. The deal includes Snapple, Mistic, Stewart's and Royal Crown Cola brands. Triarc closed unchanged at $24.25 in the U.S. Friday. cash and debt. The deal includes Snapple, Mistic, Stewart's and Royal Crown Cola brands. Triarc closed unchanged at $24.25 in the U.S. Friday.

London's tech decliners included Internet security provider Baltimore Technologies (BLM), shedding 6.3 percent, computer chip designer ARM Holdings (ARM), which fell 3.2 percent, and telecom operator Cable & Wireless (CW-) tumbling 8.2 percent.

Shares of European technology companies have endured a series of losses amid concern that corporate earnings growth may be slower than expected, undercutting stock prices that have risen to levels that would then look unjustifiable.

|

|

|

|

|

|

|