|

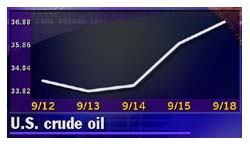

Crude oil hits 10-year high

|

|

September 18, 2000: 3:59 p.m. ET

Oil prices continue to climb as tensions mount in the Middle East

|

NEW YORK (CNNfn) - U.S. crude oil futures briefly topped $37 a barrel Monday, a new post-Gulf War high, as tensions between Iraq and Kuwait heighten supply concerns.

In late trading, U.S. light sweet crude for October delivery rose 93 cents to $36.85 a barrel on the New York Mercantile Exchange. London's benchmark Brent for November delivery gained 47 cents to $34.45 a barrel.

Iraqi President Saddam Hussein stepped onto the volatile world oil stage, warning fellow OPEC members against pressure mounted by "superpowers" on producers to knock down blazing prices.

"The superpowers will fasten their grip on oil producing countries," the Iraqi  press on Monday quoted Hussein as telling a cabinet meeting late on Sunday. press on Monday quoted Hussein as telling a cabinet meeting late on Sunday.

As fears mount over surging oil prices and possible shortages of heating oil this winter, analysts said it takes only a rumor or minor news to impact price movement.

"The market is looking for any reason to bid the price of oil higher," said Jordan Horoschak, oil analyst at Standard & Poor's. "The reason now is potential political or military tension in the Middle East."

In the Middle East, Iraq has revived accusations that Kuwait was stealing its oil and warned of unspecified measures against the neighbor it invaded in 1990, leading to the U.S.-led Gulf War in 1991.

Kuwait's cabinet on Sunday issued a statement saying that Iraq posed a real and present threat to the strategic oil-rich Gulf and urged international steps to contain its former occupier.

U.S. Defense Secretary William Cohen on Sunday warned Iraqi leader Saddam Hussein to avoid taking "any kind of aggressive action" against his country's neighbors.

Protests in Europe continue

As OPEC weighed its production policy options, the wave of fuel protests sweeping through Europe picked up fresh momentum on Monday after a weekend lull.

In Norway, demonstrators blocked 11 oil terminals at key ports along the south and west coasts, while Spanish fishermen sealed off the port of Barcelona and truckers laid siege to fuel distribution points.

The protests even threatened to spread outside Europe for the first time, when Israeli haulers said they would disrupt highway traffic on Tuesday. The protests spread as oil-consuming nations joined forces to persuade OPEC to boost supplies. Several European governments have put together compensation packages following widespread consumer protests against escalating fuel costs.

--compiled from staff and wire reports

|

|

|

|

|

|

API

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|