|

Chip earnings in question

|

|

September 18, 2000: 6:01 a.m. ET

Semiconductor profits expected to rise, but opportunities are narrowing

|

NEW YORK (CNNfn) - Semiconductor stocks have been among some of the strongest performers this year as investors, lured in large part by the solid earnings growth these companies had posted in comparison with some other tech names, converged on the sector.

Most industry experts agree that the chip sector as a whole will continue to post strong profits. But there have been mounting concerns that slower-than-expected growth in some key areas, specifically chips used in personal computers and wireless handsets, could cause some companies to fall short of the lofty financial goals they have set for themselves.

"It's semiconductors that are driving better-than-normal growth in the technology sector as a whole," said Chuck Hill, director of research at First Call, a firm that tracks companies' earnings performance.

On an annual basis, semiconductor company profits were up 93 percent in the first quarter of this year. Excluding the results of a $2.3 billion investment gain that chip-industry leader Intel included in its results, semiconductor companies posted a 120 percent rise in earnings during the second quarter, Hill said.

The industry is expected to continue to post strong earnings in the third and fourth quarters, although the growth is slowing somewhat. Chip companies are expected to post 104 percent earnings growth in the third quarter, and 64 percent in the fourth quarter, Hill said.

Part of that slowdown, however, can be attributed to tougher comparisons, according to Hill. In 1999, chip companies recovered from a major slowdown that had dogged the industry throughout 1998.

"We were on such a steep upslope last year that it would be hard to maintain that kind of growth this year," Hill said. "But still, we're coming off that strong year and still having these huge gains."

PC demand weakening?

However, earnings growth in the third and fourth quarters is not likely to be as broad-based as it has been in the past, noted Drew Peck, semiconductor analyst at SG Cowen.

"For the last three quarters, the whole industry has been on fire," Peck said. "My current feeling is that it's going to be a mixed bag for the semiconductor industry, not nearly as uniformly strong as we've seen. That is the beginning of a general deceleration in the industry, but that deceleration is going to be very sector specific."

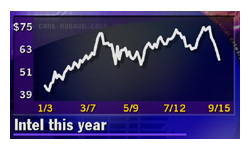

One of the areas in question is the PC segment, Peck said. The leader in that space is Intel, the world's largest supplier of PC microprocessors.

When the company reported its second-quarter earnings results, executives at Intel said they expected continued strong demand for microprocessors.

Likewise, executives at Advanced Micro Devices (AMD: Research, Estimates), Intel's chief rival in the PC processor market, also forecast uncharacteristically strong third-quarter demand for microprocessors when they reported their second quarter results. Likewise, executives at Advanced Micro Devices (AMD: Research, Estimates), Intel's chief rival in the PC processor market, also forecast uncharacteristically strong third-quarter demand for microprocessors when they reported their second quarter results.

But so far, that demand does not appear to be as robust as originally anticipated. Earlier this month, Piper Jaffray analyst Ashok Kumar cut his rating on Intel, citing weakness in processor demand among the reasons.

Kumar said that PC makers could post disappointing results for the third quarter as well.

Other indicators signaling weaker-than-expected growth in PCs are: an earnings warning from SCI Systems (SCI: Research, Estimates), a contract electronics manufacturer that derives roughly 37 percent of its revenue from the PCs; slower monthly sales of processors as reported by the Semiconductor Industry Association earlier this month; and weakening prices for computer memory chips on the spot market, which analysts say is the result of PC manufacturers selling off chips they don't need.

"We saw a sharp drop in demand for processors," Peck said. "If that sustains, then it's likely we'll see some disappointments in the PC sector and related component companies." "We saw a sharp drop in demand for processors," Peck said. "If that sustains, then it's likely we'll see some disappointments in the PC sector and related component companies."

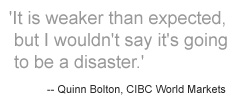

Quinn Bolton, semiconductor analyst at CIBC World Markets, agreed that PC demand has not kept pace with expectations. However, he said Intel would likely be able to counter any weakness in demand for desktop PCs with strength in other areas.

"It is weaker than expected, but I wouldn't say it's going to be a disaster," Bolton said. "Demand for workstations, servers and notebooks is still very strong, and these are the most profitable business lines for Intel, with the highest prices and margins for processors. I would expect Intel to be able to offset some of the weakness on the desktop PC with sales of processors into the other areas."

Communications sector still red hot

Although he said there are some questions about the forecast growth for chips that go into wireless handsets, SG Cowen's Peck said the communications segment holds the most promise for future earnings growth.

"The rest of the communications market still looks like it's on fire: cable modems, Internet infrastructure, high-speed switches, optical, all that. It looks like [it's] still soaring right along without any interruptions," Peck said.

While PCs remain the largest single market for semiconductors, the Semiconductor Industry Association expects communications chips -- including digital signal processors (DSPs), flash memory and chips used in fiber-optic networking -- to represent an increasing portion of total end-market demand moving ahead. While PCs remain the largest single market for semiconductors, the Semiconductor Industry Association expects communications chips -- including digital signal processors (DSPs), flash memory and chips used in fiber-optic networking -- to represent an increasing portion of total end-market demand moving ahead.

In its most recent growth forecast, the SIA said it expects worldwide semiconductor sales to rise 31 percent in all of 2000. However, the forecast calls for PC microprocessor growth of only 16 percent during that time. Meanwhile, DSPs are expected to post a 55 percent growth rate, while flash memory sales are expected to rise 116 percent.

CIBC's Bolton recommends companies that make programmable logic devices, such as Xilinx (XLNX: Research, Estimates) and Altera (ALTR: Research, Estimates); standard analog chips, such as Maxim (MXIM: Research, Estimates) and Linear Technology (LLTC: Research, Estimates); and "anything going into the communications space" as the safest semiconductor bets moving ahead.

"If you're worried about where we are in the semiconductor cycle or worried about a potential slowdown in cell phones or PCs, I think the pure communication IC or standard linear names probably give you the best resilience or immunity to market slowdowns," he said.

* Disclaimer

|

|

|

|

|

|

|