|

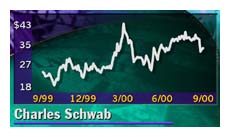

Schwab up on deal rumors

|

|

September 22, 2000: 1:03 p.m. ET

Renewed speculation on merger talks with Goldman Sachs pushes stock up 10%

|

NEW YORK (CNNfn) - Shares of Charles Schwab Corp. surged more than 10 percent Friday as rumors once again surfaced that Goldman Sachs & Co. is interested in buying the discount broker.

Schwab (SCH: Research, Estimates) shares jumped $3.50 to $33.50 by noon after BusinessWeek magazine's "Inside Wall Street" column reported the companies have held periodic discussions about combining their operations.

The column, which quoted an unnamed investment banker, said the discussions have yet to produce definite results and no deal is imminent. However, it also said neither side had closed the door on a possible merger.

A Schwab spokeswoman declined to comment on the speculation, calling the rumor "just that: A rumor." A Goldman Sachs spokeswoman likewise declined to comment, citing company policy never to comment on market rumors. A Schwab spokeswoman declined to comment on the speculation, calling the rumor "just that: A rumor." A Goldman Sachs spokeswoman likewise declined to comment, citing company policy never to comment on market rumors.

Speculation of a possible union between Goldman Sachs, one of the last remaining prestigious white-collar investment banks on Wall Street, and Schwab, known more for its pioneering efforts in online trading, have circulated on-and-off for more than a year now, most recently earlier this month when Goldman purchased market maker Spear Leeds for $6.5 billion.

One source knowledgeable with Goldman Sachs' thinking said Friday the rumor was "by no means a new story."

"This is very old stuff," the source said, noting that the company made a point of saying it believed it was very well positioned in its current form after the Spear Leeds transaction.

The BusinessWeek article quoted an "insider" as saying Charles Schwab, who owns 21 percent of the company that bears his name, had yet to fully embrace the idea of a merger with Goldman.

Goldman Sachs (GS: Research, Estimates) shares shed $2.38 to $110.88 in mid-day trading Friday.

|

|

|

|

|

|

|