|

Europe rocked, then rolls

|

|

September 22, 2000: 1:33 p.m. ET

Bourses end higher as tech losses offset by bank, chemical gains and euro defense

|

LONDON (CNNfn) - Europe's markets nosed higher Friday, staving off a selling blitz in the chip sector as financial, chemical and consumer goods companies posted gains. Bourses also got relief from the European Central Bank, which led a joint effort of central banks to revive the beleaguered euro.

The bourses went through an erratic day, slumping early on after a profit warning late Thursday by U.S.-based chip bellwether Intel (INTC: Research, Estimates) pulled down tech issues. But fund managers, who had been ready to sell their European equities because the weak euro, opted to hold their shares after the ECB bought euros in the open market, analysts said.

"It was a case of the panic being overdone," said Philip Shaw, chief economist at Investec Bank UK. "U.S. institutional investors were going to sell their European assets, but the coordinated action removed the fear about a weaker euro."

London's benchmark FTSE 100 closed up 6.7 points, or 0.1 percent, to 6,205.9, with banking stocks pulling the index higher. It had fallen as much as 2 percent earlier. For the week, the FTSE fell 3.3 percent.

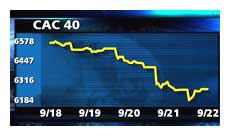

The blue-chip CAC 40 in Paris ended up 3.8 points, or 0.1 percent, to 6,258.58 after falling as much as 2.7 percent. For the week, the CAC was down 4.9 percent.

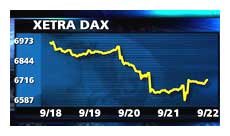

After the other top bourses closed, Frankfurt's electronically traded Xetra Dax was up 0.2 percent to 6,698.86, after earlier tumbling as much as 3.2 percent. Chemicals stocks did much of the heavy lifting to revive the German index.

Among other bourses, in Amsterdam, the AEX closed down 0.5 percent, while Milan's MIB 30 index jumped 1.2 percent. The SMI in Zurich, which is less exposed to technology stocks, added 1.4 percent. Helsinki's HEX index dropped 2.3 percent, leading the continent's losers.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, was down 0.1 percent. Its information technology hardware segment fell 2.1 percent and the electrical components and electronics sub-index fell 3.7 percent. But the chemicals sub-index rose 1.8 percent and its insurance sector component climbed 2.1 percent.

On Wall Street, the Nasdaq composite was down 2.9 percent as bourses closed, after earlier falling as much as 5.6 percent due largely to Intel's woe. The Dow Jones industrial average -- Intel is one of its 30 members - fell 1 percent.

In the currency market, the euro rose to 88.05 U.S. cents, up from 86.10 cents late Thursday in New York after the European Central Bank, the Bank of Japan, the U.S. Federal Reserve and the Bank of England announced they had bought euros.

The currency briefly rose over the 90-cent mark for the first time since Sept. 4. Its record low is 84.37 U.S. cents, which it reached Wednesday.

Techs, telecoms weigh ...

A leading chip stock in London returned from the brink. Chip designer ARM Holdings (ARM) fell 0.1 percent, after tumbling as much as 14 percent earlier in the session.

In the French telecom sector, telecom and construction firm Bouygues (PEN) led CAC losers, down 4.7 percent, while rival France Telecom (PFTE) fell 1.3 percent and network operator Equant (PEQU) shed 4.1 percent. But reviving was telecom equipment firm Alcatel (PCGE), closing up 1 percent.

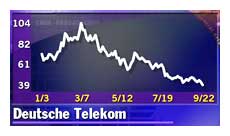

Germany's Deutsche Telekom (FDTE) was down 1.9 percent.

But techs elsewhere in Europe remained in the red. French chipmaker STMicroelectronics (PSTM) closed down 3 percent. In Frankfurt, Siemens (FSIE) fell 5.1 percent, its electronic component subsidiary Epcos (FEPC) dropped 3.1 percent and its chip-making unit Infineon Technologies [FSE: FIFX] slid 4.7 percent.

Media and information technology stocks turned out to be among the top decliners in London. IT consultant Misys (MSY) fell 5.2 percent while industry counterpart CMG (CMG) dropped 3.9 percent. Publisher Emap (EMAP) shed 5 percent and United News & Media (UNWS) fell 4.2 percent.

Among cyberspace stocks, UK Internet service provider Freeserve (FRE) fell 3.4 percent.

... as financials, chemical stocks rally

Financial stocks rallied in London. Mortgage bank Alliance & Leicester (AL-) jumped 8.6 percent, in what traders called renewed speculation about a possible takeover bid. Rival Halifax (HFX) rose 7.8 percent. As for retail banks, Lloyds TSB (LLOY) rose 5.1 percent and Royal Bank of Scotland (RBOS) climbed 4.3 percent.

Dutch airline KLM plunged 21 percent in Amsterdam after announcing late Thursday it was abandoning merger talks with British Airways (BAY), which fell 0.9 percent.

Industrial controls and automation systems maker Invensys (ISYS) rose 6.3 percent in London springing back from a recent loss.

Leading gainers on the CAC was cosmetics maker L'Oréal (POR), gaining 5.6 percent, while automaker Renault (PRNO) rose 5.6 percent.

Chemicals stocks lifted the Dax. Chemicals maker Henkel [FSE:FHEN3] jumped 6.4 percent, while drug and chemical producer Bayer (FBAY) rose 5.1 percent and specialty chemicals firm Degussa Huels (FDHA) added 5 percent.

-- from staff and wire reports

|

|

|

|

|

|

|