|

Techs down but not out

|

|

September 23, 2000: 5:22 p.m. ET

Tech strategists see Intel impact being contained to PC sector

By Staff Writer David Kleinbard

|

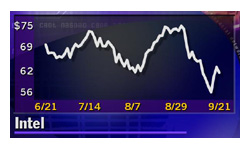

NEW YORK (CNNfn) - In the wake of Thursday's third-quarter revenue warning from tech bellwether Intel Corp., technology stocks are down but not out.

Technology stock strategists said on Friday that the impact of Intel's announcement should be confined to personal computer makers and companies that make components for PCs, especially those with large exposure to European markets. That conclusion caused the Nasdaq composite index to erase nearly all of its earlier 214-point loss Friday, closing down 25.11 at 3,803.76

For companies that aren't heavily exposed to PC demand, such as makers of networking and communications equipment, the water is still safe for swimming, technology stock analysts said. In fact, Friday's sharp decline in Intel's stock price could present a good opportunity to buy the chip giant's shares, they added.

"The problems are really isolated to the consumer end of the PC market in Europe, and that's being reflected in Dell and Gateway," said Andrew Barrett, technology strategist at Salomon Smith Barney. "We downgraded Intel this morning, but the stock's fall has factored in most of the revenue shortfall."

"If Intel shareholders got caught in the crossfire, they should hold," said Ulric Weil, technology analyst at Friedman, Billings, Ramsey & Co. "This is not the end of Intel. They will get out of this situation, although it may take six to nine months. Until then, fiber optics and the disk storage sectors are the preferred place to be, rather than the PC sector."

ABN AMRO semiconductor analyst David Wu, in an interview with CNNfn television, also said that Friday's broad decline in tech stock presented the opportunity to buy companies not exposed to the PC industry. [146KB WAV] [146KB AIF]

Intel drops the bomb

Intel (INTC: Research, Estimates) dropped a financial bomb of sorts Thursday evening by announcing that its third-quarter revenue is anticipated to be below the company's previous expectations, primarily because of weaker demand in Europe. The company now expects revenue for the third quarter to be approximately 3-to-5 percent higher than second-quarter revenue of $8.3 billion. Intel also said that it expects gross margin percentage for the third quarter to be 62 percent lower, plus or minus a point, than the company's previous expectations of approximately 63 to 64 percent.

Investors didn't take kindly to that revelation, sending Intel's stock down $13.53 to $47.94 Friday, a 22 percent loss that shaved almost $91 billion of market value off the microprocessor leader in a single trading session. The market cap of Intel's largest competitor in the microprocessor business, Advanced Micro Devices, is $7.5 billion - so Friday's loss of market value for Intel was like wiping out 12 AMDs.

AMD's (AMD: Research, Estimates) stock closed down $2.56 from Thursday's 4 p.m. close of $27.56

"As direct competitors, AMD and Intel operate within the same end markets and we do not believe that AMD has been immune to the ill effects cited by Intel in Thursday's pre-release," Deutsche Banc Alex. Brown analyst Erika Klauer said in a research note. "As the perennial leader in microprocessor

manufacturing, Intel has been a leading indicator of what demand is like in the marketplace. Therefore, given Intel's current situation and the weaker-than-expected demand picture in Europe, we have become considerably less positive on shares of AMD."

Impact on PC makers, semi equipment stocks

The stocks of PC makers, memory chip makers, and semiconductor manufacturing equipment companies also got hit by Intel's announcement in Friday trading.

As examples, Micron Technology (MU: Research, Estimates), one of the largest makers of dynamic random access memory for personal computers, closed down $3.12 at $52; semiconductor equipment leader Applied Materials (AMAT: Research, Estimates) lost $3.50 to $70; and Dell (DELL: Research, Estimates), the leading direct seller of PCs, lost $2 to $35.94.

Andrew Griffin, Merrill Lynch's European semiconductor analyst, noted that Intel hasn't lowered the amount it plans to spend on factory equipment this year, which could shelter makers of semiconductor manufacturing equipment.

"Crucially, Intel will not be lowering its $6 billion capital expenditure plans this year," Griffin wrote in a research note. "We see this as a sign that the company, an industry bellwether, is still confident about the semiconductor cycle. The company blamed European sales, while other regions were on track."

However, several technology stock analysts have a negative outlook on future DRAM pricing. Salomon Smith Barney analyst Jon Joseph lowered his price target on Micron to $75 from $125 Friday and his fiscal 2001 earnings estimate to $4.90 from $5.60 because of anticipated weakness in DRAM pricing. The spot price for 64 megabytes of DRAM has declined to $6 from $8.50 in recent weeks.

"Intel's pre-announcement goes a long way to explaining softness in the DRAM market," said SG Cowen analyst Drew Peck. "PCs consume well over one-half of all DRAMs."

"Our business hasn't changed," replied Micron spokesman Grant Jones. "Our demand is continuing to be good - we're not seeing a decline. Most of our product is sold into the contract market, not the spot market, and we are seeing prices in the low $8 range for 64 megabytes of DRAM."

While weakness in European demand is expected to hurt PC makers, technology analysts noted that Gateway (GTW: Research, Estimates) has less exposure to Europe than Dell does and that Hewlett-Packard (HWP: Research, Estimates) derives only 18 percent of its revenue from PC sales. In fact, Hewlett-Packard's stock rose $9.19 to $104.19 Friday after the company announced that it should meet revenue and earnings goals for its fiscal fourth quarter and that it will conduct a $1 billion share-buyback program.

Software, networking largely unscathed

While stocks connected to the PC market were hit Friday, software stocks were unscathed, and several companies not connected to the PC market actually gained ground. Microsoft (MSFT: Research, Estimates), whose Windows operating system runs almost all personal computers that aren't made by Apple, lost only 94 cents to close at $63.25

"Microsoft has no comment on Intel, and is in the quiet period leading up to its first-quarter earnings," said Microsoft spokeswoman Caroline Boren. "The company has issued no guidance on its financial results since it announced its fiscal fourth quarter earnings."

Meanwhile, database giant Oracle (ORCL: Research, Estimates) rose $1.78 to $80.72, Computer Associates (CA: Research, Estimates) added $1.50 to $26.50, and customer service and marketing software firm Siebel Systems (SEBL: Research, Estimates) rose $2.25 to $105.

"Despite Intel's report of a difficult economic environment in Europe and currency translation issues, most of the enterprise software companies that we cover have suggested that their overall fundamentals in the U.S. and Europe remain very healthy indeed," said Lehman Brothers analyst Neil Herman in a research note. "The explosion of web-based computing has clearly benefited companies like BEA, Oracle, Veritas, Mercury, and Micromuse."

The stocks of telecommunications and networking hardware companies also escaped damage Friday.

Networking equipment giant Cisco Systems (CSCO: Research, Estimates) lost just 81 cents to $60.31, while Nortel (NT: Research, Estimates) jumped $6.25 to $67.25 and Lucent (LU: Research, Estimates) remained flat at 32.

"We spoke to Cisco last night, and we do not think there is any change in its business," said Merrill Lynch analyst Michael Ching. "We believe the factors impacting Intel's results are largely immaterial to Cisco. Cisco has a very modest exposure of revenues to Europe."

|

|

|

|

|

|

|