|

Protests greet World Bank

|

|

September 25, 2000: 2:39 p.m. ET

Ministers pledge to focus on aid, poverty; demonstrations heat up

By Staff Writer M. Corey Goldman

|

PRAGUE, Czech Republic (CNNfn) - Lining up 20 of the world's poorest nations, relieving their outstanding debt and ensuring that they use the windfall to help alleviate poverty should be the main objective of the World Bank, finance ministers and officials said Monday.

In a communiqué outlining the bank's agenda for the next year, the 24 members of the committee that steers the World Bank said reducing poverty, combating disease, preserving the environment, and encouraging development through investment in communications and technology should be the bank's principal focus.

While ministers and bank officials outlined their objectives for the coming year inside Prague Congress Centre, protesters calling themselves Jubilee 2000 heightened their attack on the bank and its sister organization, the International Monetary Fund, outside. During the late afternoon, three protesters suspended themselves from a bridge near the center and unveiled a banner reading "People, Not Poverty," criticizing the bank and the fund for what they see as the promotion of globalization. While ministers and bank officials outlined their objectives for the coming year inside Prague Congress Centre, protesters calling themselves Jubilee 2000 heightened their attack on the bank and its sister organization, the International Monetary Fund, outside. During the late afternoon, three protesters suspended themselves from a bridge near the center and unveiled a banner reading "People, Not Poverty," criticizing the bank and the fund for what they see as the promotion of globalization.

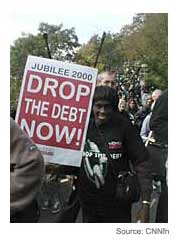

Protesters marched in central Prague's Wenceslas Square Sunday carrying signs reading "Drop the Debt now."

In a press briefing following the release of the committee's statement, World Bank President James Wolfensohn defended the fund's stated intention of helping the world's poor countries get back on their feet by canceling their debt, providing them with programs and advice for fixing up their economies, and clearing the way for private investment as a means to improve quality of life.

Guiding globalization: World Bank

"It is not in the purview of the bank to either start globalization or stop it," Wolfensohn said. "We have to recognize that globalization is taking place and work with that. We can't change it, but we must not ignore the situation. The challenge is to manage globalization."

Prior to the Development Committee press conference, Wolfensohn joined the lead singer of the rock group U2 and Jubilee 2000 spokesman, Bono, and others inside the meeting center in a discussion of globalization. Prior to the Development Committee press conference, Wolfensohn joined the lead singer of the rock group U2 and Jubilee 2000 spokesman, Bono, and others inside the meeting center in a discussion of globalization.

Bono, who said he is accustomed to addressing crowds of no less than 70,000, called Wolfensohn a "moral man" and the "grooviest candidate" for the title of "Elvis" in development economics, at which the international banker danced in his seat, laughing.

Once beyond the joking and mutual appreciation, however, Wolfensohn left to address the Development Committee and Bono eloquently took on the topic of debt relief and internationalization before a room full of somberly dressed international bankers.

"These institutions need to remember that they work for the people, and people don't feel like they are accountable," Bono said, noting he represented many of the thousands protesting the international organizations. "There is now a chance for a giant leap and that is the only thing that is going to please the people outside.

Debt levels "a crisis"

He added that the current level of debt being paid by the world's poorest nations has become a crisis, and "when there is a crisis, you should put other things aside."

Before an early exit to meet with U.S. Treasury Secretary Larry Summers, Bono had one parting shot: "The countries that meet the strict conditions [set up in the Heavily Indebted Poor Countries Initiative] are receiving 100 percent bi-lateral debt forgiveness; why can't the [World Bank and IMF] do the same?"

"I did embrace him (Bono) but I did not agree with him," Wolfensohn said later at a briefing when pressed on the issue. "For him, the top of the mountain is complete debt relief, and for me it's 65 percent," he said, quipping that perhaps he could boost his profile and subsequent cause with the public "by wearing a black jacket and dark sunglasses" similar to Bono's. "I did embrace him (Bono) but I did not agree with him," Wolfensohn said later at a briefing when pressed on the issue. "For him, the top of the mountain is complete debt relief, and for me it's 65 percent," he said, quipping that perhaps he could boost his profile and subsequent cause with the public "by wearing a black jacket and dark sunglasses" similar to Bono's.

While the discussion focused on the rock star and his message, other panelists were undaunted in their efforts to be heard by the audience and World Bank-IMF officials.

"We don't dislike globalization; we think it is inevitable," said Elizabeth Tang, chief executive of the Hong Kong Federation of Unions, one of the many non-governmental organizations observing this year's meetings. "What we don't like are the decisions by the World Bank and the IMF that cause people to lose employment and benefits. It remains a challenge how the Bank and the IMF will bring in civil society."

Debt reduction target positive

As for the ministers, they welcomed the bank's progress in getting 10 countries to qualify and agree to assistance under the Heavily Indebted Poor Countries (HIPC) initiative, and noted that the bank's efforts to enlist another 10 by year's end appeared promising. Assuming all 20 countries ultimately do qualify for HIPC and accept the terms, they would receive well over $30 billion.

Together with traditional debt relief mechanisms, a joint communiqué said, a total of some $50 billion will be provided.

To be sure, high oil prices also factored into the ministers' discussions. They noted that high oil prices could undo the progress made by countries to qualify for debt relief as exports become more difficult to sell at a fair price and imports become more expensive.

Wolfensohn reiterated his previous promise that the Bank would have funds ready to help out in such a case, but cautioned that "HIPC is not a solution to poverty. HIPC is one step."

Earlier during the meeting, U.S. Treasury Secretary Lawrence Summers indicated that it might be necessary to demand constraints on borrowing by countries that benefit from debt relief under the HIPC. It is important "not to lose sight of the fact that one of HIPC's core objectives is to enhance countries' future prospects for debt sustainability," he said.

Slow, careful steps

"While I share the desire to have eligible countries qualify for debt relief as rapidly as possible, the desire for speed cannot supersede the need to ensure lasting development results," he said.

According to the World Bank and IMF, at the moment 10 countries have reached the so-called "decision point" on whether they will qualify for HIPC debt relief, while there is a strong push to raise the number to 20 by year-end. Summers' remarks appeared to insert a cautionary tone into that scenario.

Developing countries, for their part, are complaining about the slow progress of implementing the HIPC initiative, in addition to the more immediate problem that funding for the initiative is still not yet fully in place.

While Monday's flag-bearing demonstration near the Prague Congress Centre was small and short-lived, activists plan a much larger protest Tuesday, aiming to block delegates inside the center and not let them out until they agree to abolish themselves.

|

|

|

|

|

|

|