|

Stocks: 401(k) assassins

|

|

September 25, 2000: 8:57 a.m. ET

Watch the mine fields if you choose stocks over funds in your retirement plan

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - If you think bad mutual funds can kill your 401(k), that's nothing compared to what will happen if you pick the wrong stocks.

With the evolution of "self-directed" 401(k)s that allow you to invest in virtually anything you want, more people are putting stocks in their retirement portfolios. But making a 30-year bet on a company is a lot riskier than investing with a mediocre fund -- like the difference between sky diving and hiking down a steep hill.

"You could destroy your 401(k) by buying horrible stocks," said Doug Flynn, a certified financial planner in New York. "It's probably the single biggest asset people have besides their homes. A lot of people shouldn't do it."

A self-directed 401(k) plan is where your retirement account is affiliated with a broker, so you can buy any stock, bond or fund. Only about 16 percent of company retirement plans have such an option, but Flynn said the number will probably rise. A self-directed 401(k) plan is where your retirement account is affiliated with a broker, so you can buy any stock, bond or fund. Only about 16 percent of company retirement plans have such an option, but Flynn said the number will probably rise.

"The more money flows into 401(k)s, the more pressure there will be to open them up," Flynn said. "It's still very expensive to do."

Stock picking isn't for everybody

With online investing in the mainstream, many people like to manage their own portfolios. But financial pros say stock-picking for retirement isn't easy.

Many Wall Street advisers will say flat-out that you shouldn't try investing in stocks in your 401(k). They say a mutual fund manager with a team of analysts helping him will do a better job.

"It's like being your own doctor," said Frank Cappiello, president of the investment firm McCullough, Andrews and Cappiello in Lutherville, Md. "I don't know anybody who has the ability to pick stocks five years out ... How can a worker on the assembly line in Detroit or a doctor performing surgery keep track of them?"

Stock picking will also require you to do your homework. And you'll need a hefty 401(k) with at least $100,000, the experts say.

Time and money

"It's OK if you have time to do the research and you know what you're doing," said Ron Roge, a certified financial planner and president of R.W. Roge & Co. in Bohemia, N.Y. "But the majority of the people don't have the time or the skills to do it."

Larry Johnson, a certified financial planner with Sterling Financial Advisory Services in Itaska, Ill., said many people have been lulled into thinking they are aces at picking winners because of the heady gains of the Nasdaq until its correction in the spring.

"The stock market has done so well, and the rising tide lifts all ships," Johnson said. "People thought they could buy any stock in the Nasdaq and it would do well." "The stock market has done so well, and the rising tide lifts all ships," Johnson said. "People thought they could buy any stock in the Nasdaq and it would do well."

He said investors don't realize that in the past 60 years, small-cap stocks have average annual returns of 10 percent, while large-caps earned a little less.

"People don't think long-term," Johnson said. "You can wreck your 401(k) with bad stocks. The landscape is littered with stocks that are down 50 percent. And it takes years and years for people to accumulate money in their 401(k)."

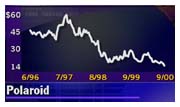

Remember when Polaroid was hot?

Still, Johnson said he doesn't see anything wrong for the right 401(k) investor to look at stocks.

"You need a big portfolio to make it work," Johnson said. One of Johnson's clients who invests in stocks in his 401(k) has an account with $1.5 million, he said.

While the numbers will be different for everyone, Johnson would put no more than 10 percent of a portfolio in stocks. Cappiello said if you have $10,000 to invest, you might pick two or three stocks. If you have $50,000, you could pick 10.

Click here to read about 401(k)s on CNNfn.com.

James Awad, chairman of Awad Asset Management in New York, said investors should look for high-growth, mid-sized stocks.

"You're looking for a growth company in a growth industry with good management and a good balance sheet," Awad said.

For example, Awad would recommend Starteck (SRT: Research, Estimates), which does outsourcing for technology companies. Starteck is growing at 30 percent a year and is an inexpensive way to play the tech sector, he said. Awad also likes a stock like American Tower (AMT: Research, Estimates), a communications tower company.

"If you're buying for 20 years, you want to go for growth," Awad said.

But Cappiello said you can't just buy stocks and forget about them for 20 or 30 years. You'll have to keep track of your stocks every quarter and assess their performance against expectations.

If a stock is down, you need to find out if something has changed with the company or if it's just off because the market has changed. If a stock is down, you need to find out if something has changed with the company or if it's just off because the market has changed.

For example, Cappiello has sold Microsoft (MSFT: Research, Estimates) twice and bought it back three times. The company has been battling a federal antitrust case.

Cappiello pointed out that Polaroid was one of the greatest stocks in the country 30 years ago. Now, it's lagging. Likewise, he asked, who would have thought the hottest stock today would be a data storage company, EMC Corp. (EMC: Research, Estimates)?

"There's no such thing as a stock you can own for 20 years," Cappiello said. "Things can change too quickly."

|

|

|

|

|

|

|