|

Transmeta scores again

|

|

September 25, 2000: 6:03 a.m. ET

Fujitsu is latest to throw its weight behind 'Crusoe' microprocessor

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Transmeta, the upstart chip maker that is poised to make its debut on Wall Street next month, has netted another major design win for its low-power, high-performance microprocessor.

Fujitsu, one of Japan's leading computer makers, will formally announce Monday that it will use Transmeta's processors, called "Crusoe," in two new ultralight notebooks due out in early November.

The company will incorporate the Crusoe into its upcoming "FM Biblo Loox S," which has a built-in DVD player and weighs 3.3 pounds; and its "FM Biblo Loox T," which is designed for mobile communications and weighs 2.2 pounds.

They will be the latest Crusoe-based ultralight notebooks from Japanese manufacturers set to hit the market this fall. Earlier this month, Sony announced that it will use Crusoe in its newest VAIO PictureBook C1VN notebook computer, saying it will nearly double the VAIO's battery life. Those systems are expected to begin shipping next month.

The new Crusoe-based Fujitsu systems are targeting seven and eight hours of battery life when using a six-cell battery, and about four hours using a three-cell battery, which also is nearly double previous systems' battery life, according to Transmeta marketing director Ed McKernan.

Since it took the wraps off the Crusoe processors back in January, the Santa Clara, Calif.-based company has been making a lot of waves in the computing industry. It is targeting the new devices at portable computers and Internet access devices.

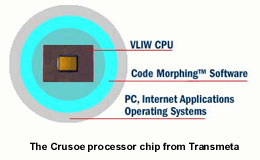

The Crusoe chips are designed using a patented technique the company calls "code morphing." That means they use software to translate the instructions typically handled directly by the transistors on other chips, enabling them to mimic the performance of Intel's x86 architecture, which represents the largest installed base of computers worldwide. The Crusoe chips are designed using a patented technique the company calls "code morphing." That means they use software to translate the instructions typically handled directly by the transistors on other chips, enabling them to mimic the performance of Intel's x86 architecture, which represents the largest installed base of computers worldwide.

The code morphing technology also allows the Crusoe processors to adjust the amount of power they consume for specific applications, which Transmeta says enables them to use less power and run cooler than similar processors.

"These are really creating a new market niche rather then going into an existing type of design," McKernan said.

For its part, Intel -- the world's leading supplier of computer processors -- this summer rolled out a new Pentium III that offers similar power-consumption features to the Crusoe, which it has been shipping in volume since early June.

And while Transmeta still has far to go before it can even come close to representing any real threat to its cross-town neighbor, the company has already been turning a lot of heads.

In addition to Sony and Fujitsu, IBM, Hitachi and NEC also are expected to introduce ultralight notebooks powered by Crusoe processors over the next several months. Gateway also said it will use Crusoe processors to power the Internet access devices it is developing in partnership with America Online, expected to hit the market later this year.

IPO on the horizon

And Transmeta is hoping that kind of enthusiasm for Crusoe will spill over onto Wall Street.

The company in mid-August announced its intention to make an initial public offering of its common stock. Morgan Stanley Dean Witter & Co., which has been selected as the lead underwriter for the offering, said it currently has that deal on the calendar for the week of Oct. 19.

In documents filed with the Securities and Exchange Commission, Transmeta said it plans to raise as much as $200 million through the IPO, but didn't specify the number of shares it expects to offer nor the expected price range.

Transmeta was founded in 1995 through venture capital and recently received additional financing from several technology companies including Gateway, AOL, Compal Electronics, Compaq, First International Computer, Phoenix Technologies, Samsung, Sony and Quanta Computer.

In 1999, Transmeta had total revenue of $5.1 million and posted a net loss of $41.1 million, according to the SEC documents. The company said it derived its 1999 revenue primarily by licensing its technology and does not expect any license fee revenue in the foreseeable future.

During the first half of 2000, Transmeta recorded $358,000 in sales and a net loss of $43.4 million. Since it only began shipping products in January, the company said in the filing, that it is difficult to gauge the value of its business at this time.

"We have manufactured limited quantities of our products to date, but have not shipped any products in volume," the company said. "Thus, we have only a very limited operating history with all of our products. This limited history makes it difficult to evaluate our business."

The company also said it expects to significantly increase its product development, sales and marketing, and administrative expenses and does "not expect to achieve profitability in the near future."

|

|

|

|

|

|

Transmeta

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|