|

OPEC love fest to begin

|

|

September 26, 2000: 11:18 a.m. ET

Revival of oil price is cause for joy at cartel, but stability of prices still at risk

|

LONDON (CNNfn) - It's high time for an oil industry love-in.

For the first time in 25 years, the heads of state from the Organization for the Petroleum Exporting Countries are set to meet. The gathering Wednesday and Thursday in Caracas, Venezuela comes against a backdrop of harmony, with crude oil prices surging back from rock-bottom levels just 18 months ago to hit 10-year highs last week.

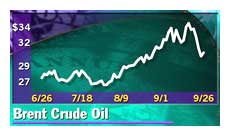

Brent crude for November delivery jumped to $34.98 per barrel last Wednesday, the highest level since the Gulf War. That prompted U.S. President Bill Clinton to reach into his country's emergency fuel reserve to ease the price pressure, leading to three straight days of price declines. On Tuesday Brent was trading at $30.70 in London.

By many accounts, the confab of oil kingpins is likely to produce little more than a round of back-patting after their uncommonly concerted effort to lower output, begun last year, bore fruit -- and then some. Others say that the oil cartel's members, buoyed by their success, may be considering a pact that would graft a quasi-governmental alliance onto their industrial accord.

OPEC may also be mulling reports that European Union ministers have considered tapping their countries' oil reserves, a move that could bring prices down further. European Commission President Romano Prodi and senior executives from seven major oil companies on Monday discussed the possible use of the EU's strategic oil reserves, Reuters reported.

'Terribly pleased'

With fortress-like security and cloak-and-dagger secrecy about the agenda, Venezuelan President Hugo Chavez welcomes his counterparts vowing never to allow the days of depressed oil prices to crop up again. Crude prices under $10 per barrel in early 1999 left many exporters heavily in debt.

"OPEC should be terribly pleased. Its income has gone up mightily last year and this year," said Peter Gignoux, an oil industry analyst at Salomon Smith Barney in London.

To be sure, OPEC is now uneasy about just how well its harmonious approach has worked, driving prices so high that some economists say world economic growth is under threat. A downturn, not to say a recession, would serve largely to harm oil prices in the long run.

The meeting is likely to offer OPEC the chance to publicly beat a defensive drum, after European politicians called for the cartel to lower oil prices.

OPEC vs. Europe

Despite all the griping from Europe, analysts said OPEC has done its part. Its output is at its highest level in 20 years, and member countries have already raised production three times this year to answer the call from consumers to ease the price crunch.

"The organization is not to blame for the high prices of petroleum products, such as gasoline and heating oil, in the consuming countries," OPEC said two weeks ago. "The responsibility for such high prices lies fairly and squarely on the shoulders of those governments that see fit to impose exorbitant levels of taxation on petroleum products."

Added Rilwanu Lukman, OPEC's secretary general, speaking to Europe's high-consumption nations this week: "The correct thing to do for them is not only to ask us to lower the price of crude -- which we are doing anyway -- but also to moderate taxes, which are exorbitantly high." The cartel also blames refinery backlogs and traders' speculation in the futures market for the high oil prices.

OPEC said that in the European Union, only 16 percent of the price of a barrel of refined oil goes to exporters, while 16 percent to refiners and marketers, "whilst the government take averages 68 percent!," the cartel statement said.

""Key consuming nations, particularly those in Europe, have been keen to pass the buck to OPEC," said Mehdi Varzi, an oil industry analyst at Dresdner Kleinwort Benson. "The reality is that if OPEC were to lower prices by, say, 10 percent, it would do a lot less (to reduce gasoline prices) than if those countries were to cut taxes. There has been a lot of lip service from Europe's politicians about lowering the price of oil for consumers."

For now, many analysts are adopting a wait-and-see attitude about how oil prices will react to OPEC's move two weeks ago to raise production by 800,000 barrels a day and the U.S. decision Friday to open up its petroleum reserves in October. For now, many analysts are adopting a wait-and-see attitude about how oil prices will react to OPEC's move two weeks ago to raise production by 800,000 barrels a day and the U.S. decision Friday to open up its petroleum reserves in October.

The relationship with the United States has been better, and Gignoux said that while the U.S. move to tap its reserve has dragged down prices, it was almost certainly done after first telling the world's top producer, Saudi Arabia.

Several analysts and economists said the latest OPEC output increase might be enough to keep a lid on prices in the near term. Still, consumption has been high and rising as the pace of economic growth in Europe and Asia picks up, keeping a floor under prices. Any sharp disruption to supply or climatic calamity could drive prices up again, analysts said.

OPEC ministers are expected to meet again in early November to evaluate whether the production curbs have lowered prices. Earlier this year, the cartel set a target range for crude prices between $22 and $28 per barrel. Cartel executives say supply is not the problem - OPEC President Ali Rodriguez recently said supply outstrips demand by 2 million barrels per day.

-- with additional reporting from CNN's Brent Sadler in Caracas

|

|

|

|

|

|

OPEC

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|