|

Oil poses no threat: IMF

|

|

September 26, 2000: 11:36 a.m. ET

Deputy Chief expects crude prices to stabilize, permit continued growth

By Staff Writer M. Corey Goldman

|

PRAGUE, Czech Republic (CNNfn) - Global oil prices are responding favorably to recent incentives of the International Monetary Fund's policy committee and to U.S. efforts to introduce more supply into world markets, and if they continue to stabilize should pose little threat to global growth, IMF Deputy Managing Director Stanley Fischer said Tuesday.

The policy committee said Sunday it had secured a pledge from leading oil producing nations to cooperate to keep the price of crude within at "reasonable" levels to ensure the global economy does not fall into a slump.

hat, combined with a move by President Clinton to release 30 million barrels of spare oil into world markets, helped alleviate the high price of oil by assuring refiners that additional, already accessible supplies of oil, will be forthcoming. European Union finance ministers are expected to discuss the possibility of releasing some of their own emergency reserves to help boost supply when they gather in Brussels Friday.

"If you're not using your reserves, then it doesn't help all that much," Fischer said in an interview with CNNfn.com. "Certainly in the private sector there is an incentive to hold onto product to obtain the highest price, but in the public domain there is a greater incentive to ensure long-term stable prices."

Balancing supply and demand

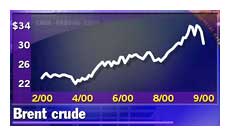

London's benchmark Brent for November delivery rose 36 cents Tuesday to $30.60. The price is still about 10 percent below the $35-plus-mark reached early last week.

Fischer said that lowering traders' expectations of future crude prices will  help maintain long-term price stability. help maintain long-term price stability.

"From a macroeconomic point of view that is the best kind of scenario we can hope for," he said.

Fischer also commented on the euro, noting that generally, "the IMF is not a big fan of intervention." Still, "every once in a while an exchange rate gets out of hand, and nobody can see any fundamental reason why," Fischer said. "When you're in pretty good shape and you're moving in the right direction and the fundamentals are all there, then in some cases more direct measures are needed to realign an exchange rate."

The European Central Bank, along with the Federal Reserve, the Bank of England and the Bank of Canada, on Friday forayed into currency markets, buying up as much as $5 billion worth of euros to reduce the number of notes outstanding and bolster its value. The move helped push the European single currency up more than 3 percent from a level close to its all-time low. The European Central Bank, along with the Federal Reserve, the Bank of England and the Bank of Canada, on Friday forayed into currency markets, buying up as much as $5 billion worth of euros to reduce the number of notes outstanding and bolster its value. The move helped push the European single currency up more than 3 percent from a level close to its all-time low.

Early Tuesday, one euro bought 87.47 U.S. cents, little changed from the previous day.

Protesters clash with police

As for the roles of the IMF and World Bank, Fischer said that, the two institutions - at the urging of many of their member countries -- continue to look at reforms to better distinguish their respective roles. The IMF, he said, will ultimately focus more on lending and crisis prevention while the World Bank will focus its efforts on poverty reduction and implementing social programs, including health services and education.

As Fischer spoke, helicopters hovered above the Prague Congress Centre, where the IMF and World Bank officially kicked off their annual meetings with an opening ceremony Tuesday.

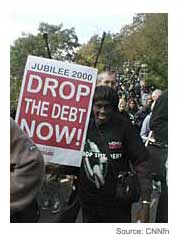

Disrupting those meetings is the direct goal of anti-globalization activists, many of whom clashed Tuesday afternoon with Czech police in central Prague.

"We at the world bank are fighting very hard to help countries attack poverty," Fischer told CNN. "Some of the people who are taking part in the demonstrations have been pushing for debt relief, and that has been constructive. Some of them have not been so constructive. I think those are the ones that you will see out there today."

|

|

|

|

|

|

|