|

Monti: Europe's trustbuster

|

|

October 10, 2000: 1:43 p.m. ET

Huge mergers thrust European bureaucrat onto center stage

By Staff Writer Jamey Keaten

|

LONDON (CNNfn) - Companies are rushing to join forces at breakneck pace, caring little whether they cross national borders or even continents. This urge to merge has thrown the spotlight on Europe's antitrust watchdog, Mario Monti.

Monti is now at center stage as the European Union's Competition Commissioner, and is due to decide Wednesday on whether the world's biggest deal, America Online Inc.'s (AOL: Research, Estimates) takeover of Time Warner Inc. (TWX: Research, Estimates), should proceed.

A former Italian academic, Monti heads a directorate which has been emboldened following its recent successes in thwarting international takeover bids that it saw as threats to consumers across the 15-nation zone.

Cross-border mergers have exploded in number in recent years. Worldwide M&A activity for 2000 now stands at more than $2.8 trillion, according to the research firm Thomson/First Call Securities Data.

Monti, a devotee of dispassionate analysis, has taken on national postal services, telecom companies, car makers, holiday firms, even Europe's soccer federation in his short tenure as the European Union's competition commissioner.

Antitrust lawyers say Monti, 57, only 13 months into his tenure as Europe's leading antitrust chief, is likely to develop on work of his predecessor Karel Van Miert, a media-savvy Dutchman whose tenure was cut short after a scandal led to the resignation of the entire commission last year.

But some differences are beginning to show already, with Monti developing a less confrontational style than his sometimes belligerent predecessor.

"Van Miert was the consummate politician -- Monti is the consummate bureaucrat," said Chris Bright, head of European competition and regulation at international law firm Clifford Chance. "Monti has shown a desire to be tougher than Van Miert, who would generally do a deal -- Monti's prepared to just say 'no'."

|

|

VIDEO

|

|

CNNfn's Jim Boulden takes a look at how AOL Time Warner has become the model for cross ownership.

CNNfn's Jim Boulden takes a look at how AOL Time Warner has become the model for cross ownership.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Van Miert would frighten companies proposing to do a deal, "and then make a statement in the press to put himself in a good bargaining position," said Wilko van Weeld, a partner with law firm with Stanbrook & Hooper in Brussels. "Monti's speeches are those of a civil servant, written by aides, that are by nature less controversial."

Part of Monti's task has been to change Europe's culture and mentality regarding competition abuses, hewing more to the U.S. model that sees antitrust behavior as a cardinal corporate sin.

"Antitrust breaches in the U.S. are seen as immoral, whereas in Europe it has been part of doing business," said Bright.

Above all, Monti has built upon the policies of Van Miert by calling for increased openness in the review process that allows deal makers to fully and fairly present their cases. "The first word that comes to mind with him is 'continuity'," said van Weeld.

Greater openness with merger applicants, thorough analysis of antitrust implications and an increase in "pre-dawn raids" by EU trustbusters could become the earmarks of a Monti tenure, lawyers say.

"Part of the plan is to move from processing and notification ... and have people go out and look for cartels," Alec Burnside, a Brussels-based attorney with law firm Linklaters & Alliance, told CNNfn.com.

On Wednesday, Monti is likely to show a new flexibility in a subject that has given him cause for concern: the Internet. EU insiders say Monti will conditionally approve Internet company AOL's $130-billion purchase of Time Warner, the media company that is the parent of CNNfn.com.

A swelling M&A universe

As the EU docket has grown fatter, so has the tendency to step in and block proposed deals.

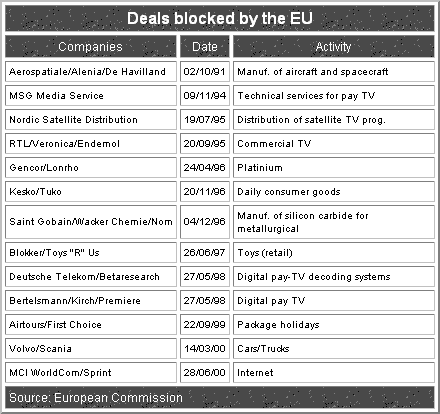

Since 1990, the EU has blocked a total of 13 mergers, but three of those have come within the last year under Monti: travel companies Airtours PLC and First Choice PLC, truck makers AB Volvo and Scania AB and the record-setting tie between U.S. telecom operators WorldCom Inc. and Sprint Corp.

The growing fear of rejection led to the pre-emptive abandonment of another half-dozen deals, most recently a planned joint venture linking Time Warner and U.K. music publisher EMI Group PLC.

Sensing the tough tack from Brussels and EU concerns about control of online delivery of music, Time Warner and AOL have pledged to make the music they will provide online available via at least three unaffiliated player services.

European protectionist?

Two leading U.S. senators have taken aim at Monti, insisting Europe's protectionist tilt may be taking precedence over fair antitrust policy. That comes months after Monti and co. took the unprecedented step of blocking the merger of two U.S. companies - WorldCom Inc.'s $120-billion purchase of rival Sprint Corp.

Others reject the allegations. "That's nonsense," said Burnside. "American businesses need to wake up to the reality that there is a merger review process in Europe ... that is a case of the pot calling the kettle black."

The planned $34 billion buyout of Canada's Seagram Cos. by French utility and media company Vivendi lurked in the back of the minds of EU regulators as the looked at the AOL-Time Warner merger van Weeld said. "The commission is going to take into account every aspect of a deal, and doesn't want to give any better or worse treatment to U.S. companies than European ones," he said.

Monti has defended himself against the charge of anti-U.S. bias by insisting he's been just as tough with deals that haven't involved U.S. companies such as the aborted Scania-Volvo tie.

Building on precedent

Just like the U.S. Justice Department, Monti has a mandate to rip apart monopolies that already exist: Monti's commission has followed the frontal attack of his U.S. counterparts on Microsoft Corp. (MSFT: Research, Estimates) with an investigation of its own into the software firm.

Monti has talked tough on the recent country-by-country auctions of next-generation phone licenses, telling telecom operators that just because they are shelling out massive sums of money in the land grab, they won't be able to pass on those high costs to consumers under his watch.

Also under his purview are pricing tactics. Automaker Opel, a division of General Motors (GM: Research, Estimates), was hit with a $36 million fine recently for preventing U.K. consumers from taking advantage of cheaper prices in places such as the Netherlands. One of the top selling points on the European Union has been its pledge to harmonize the markets of its members.

Several of Europe's other leading auto manufacturers - including France's Renault SA and Peugeot SA and Germany's Volkswagen AG - are also under the Monti microscope for similar reasons, as are many of the region's leading brewers.

Monti has the power to levy swingeing fines. The Commission can fine companies up to 10 percent of their revenue inside the European Union, though in practice penalties have been much more modest.

The EU competition commissioner will soon be granted broader powers to investigate all the way into people's homes - not just their offices. And that may lead to an upsurge in "dawn raids" that lawyers are forecasting.

|

|

|

European Union

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|