|

Take it one stock at a time

|

|

October 11, 2000: 6:21 a.m. ET

Take time to review individual potential before throwing your savings away

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - Investors who turn skittish at the mere mention of the words "overpriced stock" should take comfort in the fact that there are still values to be found and high price-to-earnings (p/e) ratios aren't the kiss of death.

That doesn't mean p/e's -- sometimes referred to as multiples -- should be unilaterally ignored, but there are other factors investors may want to consider when deciding where to put their money. Consider p/e's, say some analysts, but also look at other underlying fundamentals that make a company stand out.

For example, comparing p/e's -- which are calculated by taking the company's share price and dividing it by the company's earnings per share -- against growth could give a good indication of a stock's value.

"You probably want to shy away from things like p/e and look to other metrics like price-to-sales because they're not driven currently by earnings," said David Katz, chief investment officer at Matrix Asset Advisors. "The companies are not motivated to hit the earnings targets, they're motivated to hit the sales targets."

Analysts say a more worrisome aspect is what happens when stocks such as Yahoo! (YHOO: Research, Estimates), Ciena (CIEN: Research, Estimates) or PMC Sierra (PMCS: Research, Estimates), which carry high valuations, miss sales or revenue targets.

"The fundamental issue for each of these companies is generally their growth in revenue vis-a-vis expectations. So if everybody thinks they're going to grow at 30 percent and they grow at 27 (for example), any of the three can be down," said Katz. "We would say they are very risky and the chance of them faltering is out there -- and if they do, you've got significant downside."

That may only be partially justifiable. That may only be partially justifiable.

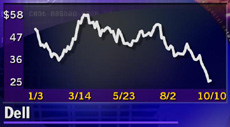

Just last week, Dell Computer (DELL: Research, Estimates) said it was on track to meet third-quarter estimates but would miss fourth-quarter forecasts by "a penny or two" due to weak European sales. Shares of Dell tumbled after its statement, but analysts said the PC firm may now be undervalued.

"We started with this great PC company and a little over a year ago, they started talking about needing different types of product to really ramp up earnings in the future," said Barry Hyman, chief investment strategist at Weatherly Securities. "Here's a company in transition that was always understanding that the PC market was going to be slowing and Wall Street was ignoring those signs."

Over the past year, Dell has been able to meet or beat analyst expectations for its earnings. But last week's warning was the third time this year that Dell advised analysts to lower their revenue growth rate estimates.

"If you look at next year's earnings estimate, it is a value stock -- it's not like it has zero growth. Their top-line growth has been slowing and, for a company that size, it's critical," said Hyman. "Right now it's cheap. I'm not concerned about the downside, but the upside is limited."

So how do you decide when a drop in stock price is justified?

One way is to look at a peg ratio (p/e to growth), according to Hyman. To determine the growth rate, divide next year's earnings estimate by the current year's estimate. To find the peg ratio, divide the p/e by growth and if the number is less than 1, it is value, if it is greater than 1, it is growth.

At this point, Hyman suggests investors need to decide how comfortable they are with the growth number before jumping onto the buying bandwagon.

Who's the fairest of them all?

Just like the Wicked Witch in "Snow White and the Seven Dwarfs," investors are looking in the mirror and asking who is the fairest, or best valued, of them all. And they are hoping to find an answer before the mirror cracks.

While the mirror may not answer their pleas for information, analysts do have some soothing advice.

Kevin Caron, associate strategist at Gruntal & Co., lays out four basic criteria when an investor reviews his or her own portfolio. The first, appropriately enough, is whether or not the company is able to meet or beat analyst expectations for its earnings.

Concerns about earnings and revenue have caused the wild gyrations on Wall Street over the past few weeks as investors become increasingly concerned that technology firms may be losing ground in the race to maintain revenue growth.

Just last week, the tech-heavy Nasdaq composite index lost more than 300 points and is down 20 percent from the start of the year. Just last week, the tech-heavy Nasdaq composite index lost more than 300 points and is down 20 percent from the start of the year.

Among Caron's other stock-picking criteria, he suggests finding companies that are establishing global alliances through mergers and acquisitions in order to expand overseas market share. He also said it was important to see a company keeping up with technological advances, such as the Internet, by integrating network technology into their existing infrastructure. And, investors should make sure companies consistently have available cash flow for deals or stock repurchases.

Don't fear the techs

Just because the tech-heavy Nasdaq has taken a bit of a beating and investors are worried that technology stocks may be overpriced does not mean there are not values in the technology sector.

Picking through the carnage in the technology sector, analysts say investors should be selective and look at forward growth potential, both for earnings and revenue.

While a company such as Dell saw its shares falter after it issued its warning, analysts say the PC maker's stock may have been taken down a little too far. But when e-commerce leader Amazon.com (AMZN: Research, Estimates) saw its shares get killed after several brokerage houses questioned Amazon's ability to deliver on its business model, analysts said the sell-off was justified. While a company such as Dell saw its shares falter after it issued its warning, analysts say the PC maker's stock may have been taken down a little too far. But when e-commerce leader Amazon.com (AMZN: Research, Estimates) saw its shares get killed after several brokerage houses questioned Amazon's ability to deliver on its business model, analysts said the sell-off was justified.

"I don't think you start differentiating and start being the hero and trying to guess some of these beaten down dot.coms," said Weatherly's Hyman. "You have to stay with what has remained strong here. The market doesn't reward the stocks that are perceived as cheap because they've had a poor year and tend to remain cheap in the second half of the year."

While a company such as Amazon took a justified beating, it is still a leader in e-commerce, according to Hyman. "Amazon deserved it because it never proved its business model profitability. In retrospect, it never deserved the premium given to it because it never had an earnings-based model," he said. "Amazon is a very broad company and, at this point, I don't think you have to worry about its viability because it's not valued so incorrectly and there is potential to go profitable."

Analysts agree that market sentiment has taken on a choosier tone as investors can no longer bank on entire sectors but now have to look within winning sectors to find the leaders. Analysts agree that market sentiment has taken on a choosier tone as investors can no longer bank on entire sectors but now have to look within winning sectors to find the leaders.

Take the e-commerce sector, for example. The entire sector has come under fire amid concerns about advertising revenue and volume. Hyman said the lesser known names or highly specialized companies, such as Fogdog.com (FOGD: Research, Estimates), would likely fall off the investor radar leaving companies like Amazon to survive and retain potential for profitability.

"We want a good business, we want good management and we want management that is shareholder-oriented," said Matrix's Katz. "We try to identify a catalyst -- what is going to make the stock go higher."

What to watch?

Every analyst has his or her own strategy in choosing criteria that may provide opportunity for any given stock, but it's up to the investor to decide they've put their money to work in the best possible issues.

Analysts say watch market growth potential. That is, find companies that have an edge and can offer something above and beyond its competitors.

"Try to buy companies that are below market multiple, with better-than-market prospects," advises Matrix's Katz. "That could be pharmaceutical companies, a bunch of technology companies -- but that's not getting caught up in paying 100 times earnings for an Oracle (ORCL: Research, Estimates) but rather buying a good technology company and paying a more reasonable price."

Once an investor has picked his or her stocks, Hyman says watch top-line growth and unit growth going forward. Look at the peg ratio to determine the growth and value of an investment -- if it meets or beats your risk threshold, keep it.

Katz's top five stock picks are Abbott Laboratories (ABT: Research, Estimates), Bausch & Lomb (BOL: Research, Estimates), Verizon Communications (VZ: Research, Estimates), Freddie Mac (FRE: Research, Estimates), and Computer Associates International (CA: Research, Estimates).

"Take a step back, get rid of a lot of noise, and focus on good businesses, good industries and not pay too much," said Katz. "You sleep a whole lot better and you've got a much greater probability of success."

|

|

|

|

|

|

|