|

AMD beats 3Q estimates

|

|

October 11, 2000: 6:56 p.m. ET

Chip maker credits strong sales of flash memory for solid quarter

|

NEW YORK (CNNfn) - Chip maker Advanced Micro Devices on Wednesday reported a third-quarter profit that exceeded Wall Street's expectations by two cents.

The world's No. 2 supplier of PC microprocessors said it earned $219.3 million, or 64 cents per share, during the quarter ended Oct. 1, excluding one-time items.

The latest results compare with a loss of $105.5 million, or 36 cents per share during last year's third-quarter and is two cents better than the per-share profit analysts polled by earnings tracker First Call had expected from AMD.

Meanwhile, AMD's sales rose 81 percent to $1.2 billion from $662.1 million during last year's third quarter. The company also said it remains on track to meet its sales goals for the full year.

AMD's net income - which includes a one-time gain of $336.9 million for the sale of its voice communications business, and charges of $22.9 million related to the retirement of debt - was $262.8 million, or $1.18 per share.

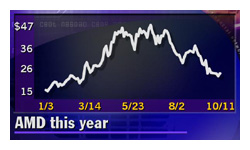

AMD (AMD: Research, Estimates) shares fell 94 cents to $21.81 in New York Stock Exchange trade ahead of the earnings release, which was made after the closing bell. In after-hours trade, AMD shares were up 8 percent at $23.63.

Executives at AMD credited strong sales of flash memory chips in large part for the sales growth.

The company sold 72 million flash memory chips during the quarter, which reflects a 17 percent increase over the immediately preceding quarter and more than a 100 percent jump over last year's third quarter, according to Ben Anixter, AMD's vice president of external affairs. The company sold 72 million flash memory chips during the quarter, which reflects a 17 percent increase over the immediately preceding quarter and more than a 100 percent jump over last year's third quarter, according to Ben Anixter, AMD's vice president of external affairs.

Demand for flash memory chips -- which are used largely in wireless handsets, set-top boxes and other electronics -- has far outstripped supply for several quarters.

AMD expects demand for its flash memory products to continue to exceed supply for the foreseeable future, Anixter said.

"We see no end in sight for supply constraints for AMD flash," he told investors and analysts during a conference call Wednesday evening. "Demand continues to exceed supply for AMD flash. We will be hard-pressed to meet demand."

Processor sales remain strong in 'tougher' market

Sales of PC processors, AMD's core business, rose more than 50 percent from last year's third quarter and 10 percent from the immediately preceding quarter, AMD said.

"In a tougher market than anticipated, AMD achieved record PC processor revenues on record unit sales of nearly 6.9 million units," said W.J. Sanders III, AMD's chairman and chief executive.

In the fourth quarter, Sanders said AMD will sell out its production of its high-end "Athlon" processors and low-end "Duron" processors. He also said the company "will easily exceed" its earlier forecast of selling a total of 25 million PC processors this year, with the final tally projected to be approximately 28 million units. That compares with 18.8 million units last year.

Sanders said sales of AMD processors in the fourth quarter will be between 8 million and 9 million units, which would represent a roughly 20 percent share of a total market expected to be between 43 million and 45 million units.

AMD's Athlon and Duron chips represent the company's seventh generation of microprocessors. And their popularity over the past year has made the Sunnyvale, Calif.-based outfit a more serious competitor to Intel (INTC: Research, Estimates), its much larger, deep-pocketed rival.

Last month, Intel stunned investors and cast a pall over the entire technology sector when it warned that its third-quarter revenue growth would amount to as little as half what some analysts had been expecting.

Intel blamed the shortfall on weakening demand in Europe, which set off a chain reaction of selling that spilled over to most companies that have exposure to the PC market.

Sanders said Wednesday that AMD's business in Europe "looked just fine" in the third quarter, which he said would indicate that the company gained market share there. He noted that there was some sluggishness in the commercial PC segment. Sanders said Wednesday that AMD's business in Europe "looked just fine" in the third quarter, which he said would indicate that the company gained market share there. He noted that there was some sluggishness in the commercial PC segment.

AMD has a smaller presence in the corporate PC market than Intel.

As for concerns that the PC market is softening: "We think that much of the concern in the marketplace probably has a lot to do with Wall Street's misguided expectations that Intel could continue to grow in the face of a competitor with a superior solution," Sanders said.

Click here for a schedule of earnings releases

Earlier Wednesday, Intel chief executive Craig Barrett called the market turmoil in the tech sector an "overreaction ... that's feeding on itself," but other company executives acknowledged the world's largest semiconductor firm has had more than its share of missteps this year.

Among those, Intel has recalled its highest speed Pentium processors; canceled plans for its low-end Timna processor; been dogged by reports its new Pentium 4 computer chip will be delayed; and has scarce supplies of its much-touted high-end Pentium III chips.

Intel is expected to release its third-quarter earnings Oct. 17.

|

|

|

|

|

|

|