|

Energy a portfolio plus

|

|

October 12, 2000: 5:16 p.m. ET

Broad or focused, experts say some exposure to the sector is good

|

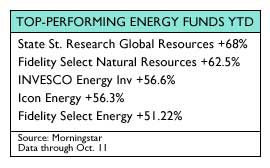

NEW YORK (CNNfn) - Surging oil prices amid rising violence in the Middle East on Thursday may spell further gains for energy funds, which have been rallying for most of the year. The average fund in the sector is up 22.6 percent, according to data from Morningstar, while key market indexes are toiling in the red.

But recent events aside, the stage has been set for a prolonged upswing in the sector, managers say, because of a fundamental imbalance between oil supply and demand.

The price of crude surged $2.36 to $35.36 a barrel on Thursday after five U.S. sailors were killed in a possible terrorist attack in a Yemen port and violence between Israelis and Palestinians escalated. The price of crude surged $2.36 to $35.36 a barrel on Thursday after five U.S. sailors were killed in a possible terrorist attack in a Yemen port and violence between Israelis and Palestinians escalated.

"The perception that there's trouble in the Middle East drives oil prices higher," said Dan Gillespie, manager of Rydex Energy Services, which is up 48 percent in the year to date.

But that one-day rally may just be fat padding over an already high price to protect against the possibility of disrupted oil supplies should the political climate in the region worsen further.

"The risk premium for crude oil just went up," said John Segner, manager of INVESCO Energy, one of the top-performing funds this year, with a gain of nearly 57 percent.

Excess is spare

But the insecurity fueling that jump is based on a longer-term issue. As it is, there is very little excess oil capacity worldwide.

"Fundamentals are tight to begin with," Segner said, noting that 15 years ago there was a 25 percent surplus whereas today it is only 4 percent. "Even a small [disruption in supply] can have a dramatic impact on the price," Segner said. Thursday's events aside, he added, "Prices probably shouldn't be this high."

They're likely to remain at somewhat elevated levels, however, until the United States builds excess capacity for both crude oil and North American natural gas to meet increased demand, he said, a process that he predicts is likely to take several years even under the best of circumstances.

That's why experts recommend having some exposure to businesses tied to the price of oil, such as oil exploration and drilling companies, or even those that offer seismic data for oil sites.

As the price of oil goes up and the search for more oil continues, their profits are likely to go up, said Morningstar oil fund analyst Michael Gaul. Moreover, they can be better diversification tools than some of the bigger oil companies such as Exxon, which tend to move more in line with the market than with the price of oil.

Indeed, Segner said, "You can't afford not to be there."

What should you do?

You can't afford to be overexposed, either.

Analysts and fund managers alike caution investors that the more focused the sector fund, the more volatile, and nowhere more so than in energy services.

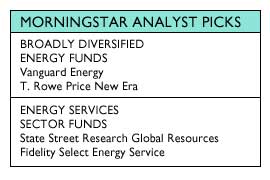

That's why Gaul recommends that the average investor get exposure to the sector through a broadly diversified energy fund that invests in both the bigger oil companies such as BP Amoco that draw on several sources of oil revenue, as well as the more narrowly focused energy services firms. That's why Gaul recommends that the average investor get exposure to the sector through a broadly diversified energy fund that invests in both the bigger oil companies such as BP Amoco that draw on several sources of oil revenue, as well as the more narrowly focused energy services firms.

He recommends that the energy weighting in your portfolio not exceed the 6 percent market weighting that energy has on major benchmark indexes such as the Wilshire 5000 and the S&P 500.

For those investors who can stomach more volatility and who are knowledgeable about the sector, energy services funds may be good bets, Gillespie said.

The fundamentals couldn't be better, he maintains. With greater economies of scale among the larger diversified oil companies, costs have gone down as oil prices have gone up, which will allow them to boost their capital spending. And that money is likely to go to the energy services firms, he said.

Even if the price of oil comes off its recent highs, which Gillespie expects it will, and hovers around $25 or $26 a barrel, "There's still plenty of room for profitability," he said. In his view it doesn't benefit OPEC members for the price of oil to stay above $30 a barrel long term because that means their customers will search for alternative energy sources.

Gaul agrees industry fundamentals are sound and earnings for the year are expected to be good going forward. But, he noted, oil-related stocks are currently priced "with high expectations," and "Whether [strong earnings] translates into higher stock prices is another matter."

|

|

|

|

|

|

|