|

Oil up on Mideast unrest

|

|

October 12, 2000: 3:21 p.m. ET

Panic buying spurs crude after U.S. ship attack, killing of Israeli soldiers

|

NEW YORK (CNNfn) - Crude oil prices jumped Thursday following outbursts of violence in the Middle East that stoked fears that supplies of oil from the region could be disrupted.

An apparent terrorist attack on a U.S. navy ship in Yemen killed four U.S. sailors, while Israel launched air strikes into Ramallah and Gaza on Thursday in retaliation for the killings of two Israeli soldiers captured by Palestinian police and beaten to death by a mob.

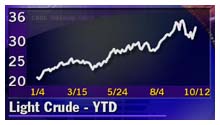

Light crude for December delivery jumped $2.76 to $36 on the New York Mercantile Exchange. Brent crude for December delivery rose $2.48 to $34.65 a barrel on London's International Petroleum Exchange. These were near the highest levels since the Gulf War, a decade ago.

Frantic buying had pushed prices up to $37 briefly Thursday.

"There's panic buying going on," a NYMEX trader from ABN-Amro said. "This market is going up, but I can't tell you where it will stop. We're, like, looking for war alerts now," the trader said, as news headlines flashed on all corners of the NYMEX trading floor in lower Manhattan.

Traders said concern about developments in the Middle East was growing after a small boat, which U.S. defense officials said appeared to be carrying explosives, rammed into the destroyer USS Cole in the Yemeni port of Aden. Besides killing the four sailors, the blast injured about 20 to 30 others.

"Historically whenever there are political issues that might raise uncertainty in terms of supply interruption, we see oil prices spiking," said Irene Haas, an oil analyst with Sanders Morris Harris. "But it is only temporary," she added. "Historically whenever there are political issues that might raise uncertainty in terms of supply interruption, we see oil prices spiking," said Irene Haas, an oil analyst with Sanders Morris Harris. "But it is only temporary," she added.

Haas said oil prices are very volatile, but the outlook for the end of the fourth quarter sees oil prices at around $38 a barrel. And in 2001 she forecasts an average of $26 a barrel.

U.S. crude prices rallied to near three-week peaks Wednesday after a weekly report from the American Petroleum Institute (API) showed U.S. oil stocks remain well below year-ago levels, renewing concerns of shortages this winter.

Oil traders awaited weekly inventory data from the Department of Energy that could back up the API figures. The release of the DOE data, expected later Thursday, is a day later than usual because of Monday's Columbus Day holiday.

Saudi keeps full volumes for customers

The East Coast, particularly the Northeast, is highly dependent on the fuel to heat homes and offices.

Prices had steadied earlier on word that Saudi Arabia kept November crude export allocations at full volume, unchanged from last month under its pledge to boost supplies to cool prices.

Since Saudi Arabia has the vast majority of OPEC's spare production capacity, its output moves are closely watched by traders struggling to track the kingdom's exact supply levels.

The Organization of the Petroleum Exporting Countries has been removing supply curbs imposed in 1998 and 1999 to rescue prices from a slump under $10 a barrel. This year's rally to 10-year highs has forced OPEC to raise production three times since April.

Although it has not had an impact on prices yet, the market is also keeping a close eye on a day-old indefinite strike by Venezuelan oil workers.

-- from staff and wire reports

|

|

|

|

|

|

OPEC

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|