|

U.S. prices, sales surge

|

|

October 13, 2000: 1:31 p.m. ET

Both producer prices and retail sales jump 0.9% in September, fueled by oil

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Wholesale prices in the United States posted their biggest jump in seven months in September while retail sales surged, government reports released Friday showed, reflecting higher costs for heating oil and gasoline and surprising spending fervor among Americans.

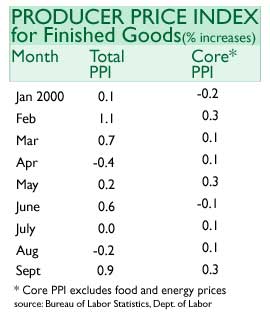

Prices at the wholesale level jumped 0.9 percent last month, the Labor Department said, above the 0.5 percent gain expected by economists polled by Briefing.com and August's 0.2 percent drop. Excluding more-volatile food and energy costs, producer prices rose 0.3 percent, above the 0.1 percent gain expected and the 0.1 percent gain registered the month before. Prices at the wholesale level jumped 0.9 percent last month, the Labor Department said, above the 0.5 percent gain expected by economists polled by Briefing.com and August's 0.2 percent drop. Excluding more-volatile food and energy costs, producer prices rose 0.3 percent, above the 0.1 percent gain expected and the 0.1 percent gain registered the month before.

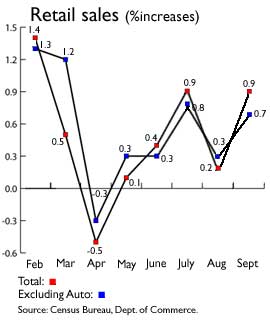

Retail sales, meanwhile, advanced 0.9 percent, the Commerce Department said, more than the 0.6 percent increase expected by economists and August's 0.2 percent gain. Excluding auto sales, which account for a large portion of the monthly tally, sales gained 0.7 percent.

Together, the reports spelled more negative news for financial markets, which already have taken a hit this week on concern about the skyrocketing price of oil and its potential for sparking inflation. Rising prices at the wholesale level typically force companies to pass on their higher costs to consumers in the form of higher prices, or inflation.

"It's not good news."

"It's not good news," said Hugh Johnson, chief investment officer with First Albany Corp. in Albany, N.Y. "Even though the focus is on the Middle East and oil prices, these numbers clearly are not going to stabilize the markets."

Indeed, stocks have plunged this week and short-term bonds have gained from investor concern that tensions in the Middle East will lead to even smaller global supplies of oil, sparking inflation. Despite the negative economic news, both the Dow Jones industrial average and Nasdaq composite index posted gains Thursday, while long-term bonds slipped.

The Federal Reserve has raised the overnight bank lending rate target six times between June 1999 and this past May, in an effort to slow the pace of economic growth and limited the threat of accelerating inflation. Economic growth in the quarter ended Sept. 30 probably ran at a 3.1 percent annual rate, below the previous quarter's 5.6 percent pace, according to forecasts. The Federal Reserve has raised the overnight bank lending rate target six times between June 1999 and this past May, in an effort to slow the pace of economic growth and limited the threat of accelerating inflation. Economic growth in the quarter ended Sept. 30 probably ran at a 3.1 percent annual rate, below the previous quarter's 5.6 percent pace, according to forecasts.

But that growth could be tempered even more if oil prices continue to climb and if consumers continue to shrug off the rising price of goods and services, particularly gasoline, said Peter Cardillo, director of research with Westfalia Investments.

Energy prices surge

"Energy prices are the reason for this," Cardillo said. "The crisis in the Middle East is obviously going to keep the price of energy at a strong level and that means this market is going to now be fearful of inflation exploding. We could be in for a further bumpy ride."

Charles Lieberman, a senior economist with First Institutional Securities, told CNNfn's Before Hours that the recent spike in oil prices will have an impact on overall inflation, but not as dire an effect as many investors are anticipating. (550KB WAV) (550 KB AIFF) Charles Lieberman, a senior economist with First Institutional Securities, told CNNfn's Before Hours that the recent spike in oil prices will have an impact on overall inflation, but not as dire an effect as many investors are anticipating. (550KB WAV) (550 KB AIFF)

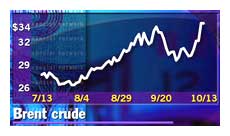

Because of that, he anticipates that the Fed will keep rates on hold through the remainder of this year and may even signal an intention to lower rates as the new year kicks off. Brent Crude for December delivery fell 74 cents to $33.85 a barrel. On Thursday, the contract surged $2.80 to close at $34.47, after hitting a 10-year high of $35.30. U.S. light crude fell 51 cents to $35.50 a barrel.

On the wholesale prices side, energy prices jumped 3.7 percent last month after falling 0.2 percent in August and 0.7 percent in July. The cost of gasoline rose 9.3 percent in September, the largest increase since a 15.6 percent rise in June.

Food prices rose 0.4 percent in September, led by a 27.4 percent increase in fresh fruits and melons and increases for vegetables and chickens. Passenger car prices rose 1.4 percent in September, the largest increase since October 1995.

Gas, food prices rise

Through September, the overall PPI rose at a 4.1 percent annual rate, compared with a 2.9 percent increase for all of last year. The core PPI rose at a 1.4 percent annual rate through September, compared with a 0.9 percent gain for all of 1999.

"Foreboding. That's the only word for today's report," said Oscar Gonzalez, an economist with John Hancock Financial Services in Boston. "We could be facing our worst case scenario: rising inflation in a slowing economy." "Foreboding. That's the only word for today's report," said Oscar Gonzalez, an economist with John Hancock Financial Services in Boston. "We could be facing our worst case scenario: rising inflation in a slowing economy."

As for retail sales, the rise was the biggest since a gain of 1.4 percent in February, fueled mostly by a 1.4 percent increase in purchases at auto dealers, the largest gain since a 1.5 percent rise in February.

Gasoline service station sales jumped 2.1 percent, the largest since a 2.9 percent increase posted in June. The price of gasoline at the pump averaged $1.59 a gallon last month, up from $1.51 a month earlier though below the record high of $1.71 a gallon hit in June.

Outside of service stations and auto dealers, sales also rose. Sales of furniture and home furnishings rose 0.8 percent after rising 0.6 percent in August. Sales also increased at grocery stores, clothing outlets, restaurants and drug stores, the Commerce Department report showed.

"Overall, this can be viewed as more evidence that the consumer is hanging in well despite the run-up in oil prices and growing equity market volatility," said Sherry Cooper, chief economist with BMO Nesbitt Burns.

|

|

|

|

|

|

|