|

Chips slide on PC worries

|

|

October 16, 2000: 2:40 p.m. ET

Cautious analysts warn of looming price pressure ahead on Intel's results

|

NEW YORK (CNNfn) - Shares of Intel and AMD, the top two suppliers of PC microprocessors, plunged Monday as investors braced for what some predict will be a brutal pricing environment for both companies in the coming months.

The selling spread to other segments of the semiconductor market as well, driving the Philadelphia Stock Exchange's semiconductor index down 24.24 to 734.08, a 3.2 percent decline.

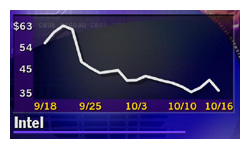

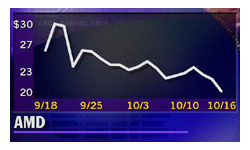

Intel (INTC: Research, Estimates) shares were off $4.38 at $36, a 10.8 percent decline. Meanwhile, AMD (AMD: Research, Estimates) shares were trading $1.88, or 8.6 percent, lower at $20.

Weighing heavily on both those stocks Monday were reports from analysts at two Wall Street brokerages warning of increased pressure on microprocessor pricing in a weakening PC market.

Intel, the world's largest supplier of PC processors, already has been under pressure. Its stock has lost roughly half its value since the Santa Clara, Calif.-based company warned last month that its third-quarter revenue will come in much lower than previously had been expected. Intel, the world's largest supplier of PC processors, already has been under pressure. Its stock has lost roughly half its value since the Santa Clara, Calif.-based company warned last month that its third-quarter revenue will come in much lower than previously had been expected.

On Monday, just a day before Intel is expected to post its latest results, Salomon Smith Barney analyst Jonathan Joseph said he thinks Intel's could be even weaker than the company already has warned.

"The much hoped for mid-October pickup in personal computer demand has failed to materialize, which suggests to us Intel's guidance on its Tuesday afternoon conference call will be more cautious than most investors anticipate," Joseph said in a research note Monday.

More importantly, Intel's aggressive moves to expand its manufacturing capacity amid weaker-than-expected demand for its products likely will undercut its profit margins in the fourth quarter and into 2001, Joseph said.

In a separate report, Joseph painted a similarly bleak picture of the broader PC-chip market, citing waning demand for microprocessors as well as dynamic random access memory, or DRAM, chips.

"The microprocessor market remains weak, with Intel accelerating by two weeks price cuts of low-end Pentium IIIs," Joseph said. "Meanwhile, AMD Athlon prices have fallen sharply in the past week."

He added that DRAM prices also have been declining, with average prices of 64-megabyte chips having fallen roughly 20 percent in recent weeks.

Meanwhile, Credit Suisse First Boston analyst Charlie Glavin also warned of increasing pressure in PC-chip pricing moving ahead. "Going into Intel's third-quarter earnings report, we are becoming more cautious about how Intel is going to address some lingering issues," Glavin said in a note to clients Monday.

Part of Glavin's concern is that AMD has become very aggressive in pricing its high-end Athlon processors operating at 1 gigahertz and higher. Over the past two months, AMD has been reducing prices on those chips by $10-$15 per week and currently is selling some customers the 1GHz version for $150 and the 1.1 GHz version for $160, he said. Part of Glavin's concern is that AMD has become very aggressive in pricing its high-end Athlon processors operating at 1 gigahertz and higher. Over the past two months, AMD has been reducing prices on those chips by $10-$15 per week and currently is selling some customers the 1GHz version for $150 and the 1.1 GHz version for $160, he said.

In so doing, Glavin said, AMD is likely trying to capture as much market share as possible on the high-end prior to Intel's launch later this year of the Pentium 4, which is expected to be introduce at speeds of 1.4 GHz or better.

Meanwhile, AMD Tuesday is expected to officially announce the availability of its 1.2 GHz Athlon processor, which Glavin said has been selling to some customers for as little as $180.

"It appears AMD has engaged in a price war, where it is essentially bidding against itself," Glavin said.

Shares of Micron Technology (MU: Research, Estimates), a leading supplier of DRAMs, were off $2.44 at $33.94, a 6.7 percent slide.

|

|

|

|

|

|

|