|

Big banks post 3Q results

|

|

October 17, 2000: 3:37 p.m. ET

Citigroup beat expectations while Bank One, Wells Fargo meet Street

|

NEW YORK (CNNfn) - More big-name U.S. banks posted their third-quarter earnings Tuesday, with No. 1 financial services company Citigroup leading the pack, citing strength in its consumer and investment banking operations.

Bank One Corp., Wells Fargo Inc. and Mellon Financial Corp. also all reported third-quarter earnings Tuesday that were in line with or ahead of Wall Street forecasts, while Dime Bankcorp Inc. unveiled a loss.

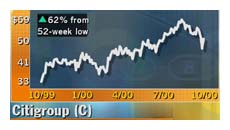

Citigroup, the biggest, said it earned $3.1 billion, or 67 cents a diluted share, up 27 percent from $2.4 billion, or 53 cents a share, before special charges, a year earlier. Wall Street forecasts were for 65 cents a share, according to earnings tracker First Call/Thomson Financial. Citigroup, the biggest, said it earned $3.1 billion, or 67 cents a diluted share, up 27 percent from $2.4 billion, or 53 cents a share, before special charges, a year earlier. Wall Street forecasts were for 65 cents a share, according to earnings tracker First Call/Thomson Financial.

The quarter included a $15 million restructuring charge and an $8 million charge for accelerated depreciation, but even together they didn't change the company's earnings per share. Revenue at the New York-based firm rose 15 percent to $16.8 billion from $14.6 billion.

Profit rose 40 percent to $1.6 billion in its corporate and investment banking unit, which includes Salomon Smith Barney, and 14 percent to $176 million for investment management and private banking. In addition, it had a 51 percent jump in investment income to $292 million.

Income rose 17 percent to $1.32 billion in the global consumer group, which includes its consumer banking, credit card and Travelers insurance operations. The banking portion of that unit saw profit rise 17 percent to $706 million, while insurance profit rose 22 percent to $371 million.

Shares of Citigroup (C: Research, Estimates), a component of the Dow Jones industrial average, slipped $2.19 to $48.63 in mid-afternoon trading Tuesday.

FleetBoston reports 22% earnings gain

FleetBoston Financial (FBF: Research, Estimates) posted a 22-percent increase in its third-quarter earnings, saying profits were lifted by higher levels of capital markets and revenue from investment services.

The Boston-based company reported its net income in the latest quarter rose to $841 million, or 90 cents per share, from $711 million, or 74 cents per share a year ago.

Excluding special items a gain for a divestiture and integration charges earnings were $782 million, or 84 cents a share. That was in line with predictions from analysts surveyed by First Call/Thomson Financial.

Bank One profit declines

Separately, Bank One Corp., the fourth-largest U.S. bank, said its third-quarter profit fell 37 percent as it continued to cut costs to revive earnings.

The Chicago-based bank said third-quarter net income fell to $581 million, or 50 cents a share, from $925 million, or 79 cents, a year earlier. The results matched the average earnings forecast of analysts polled by First Call. The Chicago-based bank said third-quarter net income fell to $581 million, or 50 cents a share, from $925 million, or 79 cents, a year earlier. The results matched the average earnings forecast of analysts polled by First Call.

Income at the company's First USA Inc. credit card unit, whose poor performance has hurt the company's bottom line, fell 39 percent to $177 million, while its retail bank had income of $251 million, down 6 percent from a year earlier. Commercial banking income fell 13 percent to $172 million.

Bank One also said it increased its credit loss reserve, a cushion against the possibility of losses on bad loans, by $171 million, a move that pushed its overall profit lower for the quarter. Still, the bank said it is most concerned about the possibility of bad loans in its commercial lending unit, where net income fell 13 percent to $172 million.

Bank One (ONE: Research, Estimates) shares fell $1.69 to $32.94.

Wells Fargo hits record

Wells Fargo & Co., meanwhile, the seventh-biggest U.S. bank, said third-quarter profit rose 11 percent to a record $1.07 billion on venture capital gains and fees from managing investments.

Income for the San Francisco-based company rose to 64 cents a share from 57 cents a share, or $962 million, a year earlier -- matching the average estimate of analysts polled by First Call. Net interest income rose 8 percent to $2.58 billion. Income for the San Francisco-based company rose to 64 cents a share from 57 cents a share, or $962 million, a year earlier -- matching the average estimate of analysts polled by First Call. Net interest income rose 8 percent to $2.58 billion.

The bank had net venture capital gains of $535 million, more than three times the $162 million of a year earlier. Trust and investment fees rose 18 percent to $375 million. Total non-interest income rose 21 percent to $2.19 billion, offset by non-interest expense, which rose 11 percent to $2.69 billion.

Shares of Well Fargo (WFC: Research, Estimates) fell $1.94 to $41.63,

Mellon's profit creeps higher

Banking and mutual fund firm Mellon Financial Corp. on Tuesday posted a 7 percent rise in third-quarter profit, lifted by money management fees.

Pittsburgh-based Mellon, which owns the $130 billion Dreyfus mutual fund family, reported net income of $252 million in the quarter, or 51 cents per diluted share. That compared with $236 million, or 46 cents per share, in the year-ago quarter.

Click here for CNNfn.com's earnings roundup

The results met analyst expectations of 51 cents per share, according to market research firm First Call/Thomson Financial.

Revenue from global investment services rose to $269 million from $238 million, while investment management revenue rose to $286 million from $245 million.

Mellon's (MEL: Research, Estimates) shares slipped 19 cents to $41.50.

Dime unveils a loss

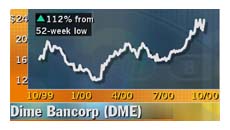

And Dime Bancorp Inc. reported a net loss for the third quarter Tuesday as it took charges for the costs of defending itself against a hostile takeover attempt by regional rival North Fork Bancorp Inc. (NFB: Research, Estimates) and launching cost-cutting plans.

Including the one-time charges, Dime, one of the largest thrift banks in the United States, reported a third-quarter loss of $16.5 million, or 16 cents per share, compared with a profit of $61.82 million, or 55 cents per share, in the same quarter a year ago. Including the one-time charges, Dime, one of the largest thrift banks in the United States, reported a third-quarter loss of $16.5 million, or 16 cents per share, compared with a profit of $61.82 million, or 55 cents per share, in the same quarter a year ago.

Excluding the charges, operating earnings rose about 12 percent to $69.4 million in the quarter, or 59 cents per share, from $61.8 million, or 55 cents per share, in the year-ago quarter.

Those results fell a penny short of analysts' consensus expectations of 60 cents per share, according to a survey by market research firm First Call/Thomson Financial.

Dime took a pretax charge of $131 million in the quarter, covering the costs of fending off North Fork's hostile takeover bid, plus expenses for various cost-cutting measures and the sale of about $2 billion of securities in the quarter.

Shares of Dime (DME: Research, Estimates) fell 88 cents to $22.75.

--compiled from staff and wire reports

|

|

|

|

|

|

|