|

Europe closes lower

|

|

October 17, 2000: 1:02 p.m. ET

Chip makers lead indexes down ahead of Intel results; tech, auto shares fall

|

LONDON (CNNfn) - Europe's major bourses closed mostly lower Tuesday as technology stocks tumbled amid concerns that U.S. chip maker Intel will report lower-than-expected earnings later in the day.

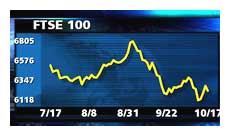

London's FTSE 100 fell 1.3 percent to close at 6,203.2 as telecom, software and other technology firms tumbled. London's FTSE 100 fell 1.3 percent to close at 6,203.2 as telecom, software and other technology firms tumbled.

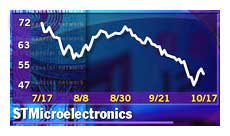

In Paris, the CAC 40 blue-chip index dipped 0.3 percent to end at 6,067.15, led by chip maker STMicroelectronics (PSTM).

Frankfurt's electronically traded Xetra Dax fell 1.4 percent to 6,531.74, led by chip maker Infineon Technologies (FIFX).

In Amsterdam, the AEX index slid 0.7 percent, depressed by a decline for consumer electronics and chip producer Philips Electronics. Milan's MIB30 slipped 0.4 percent. The SMI in Zurich bucked the regional trend, rising 0.3 percent.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

The pan-European FTSE Eurotop 300, a broader index of the region's largest stocks, was down 0.9 percent at 1,570.31, with its computer sub-index down 4.2 percent.

In the currency market, the euro traded at 85.10 U.S. cents, up from 84.94 cents in New York trading late Monday.

In the U.S., the Nasdaq composite index was down 2 percent, while the Dow Jones industrial average was trading 1.3 percent lower.

Chipmakers slide amid Intel concerns

Leading European chipmakers weakened amid nervousness about Intel's (INTC: Research, Estimates) earnings report, expected after the U.S. market close.

Germany's Infineon Technologies slipped 6 percent and French-Italian rival STMicroelectronics (STM), which posts its earnings Wednesday, fell 5.8 percent. Germany's Infineon Technologies slipped 6 percent and French-Italian rival STMicroelectronics (STM), which posts its earnings Wednesday, fell 5.8 percent.

Investment bank Salomon Smith Barney Monday lowered its quarterly earnings forecasts for Intel to 37 cents per share, sending the U.S. company's shares tumbling 11.6 percent by the close.

Philips Electronics fell 5.7 percent, caught up in the semiconductor sector's weakness even after it reported that underlying after-tax profit more than doubled to  771 million ($651 million) in the third quarter. Its German rival Siemens (FSIE) dropped 4.7 percent. 771 million ($651 million) in the third quarter. Its German rival Siemens (FSIE) dropped 4.7 percent.

Chip designer ARM Holdings (ARM) bucked the downward trend, gaining 4 percent.

Some computer software stocks fell for a second session in London. CMG (CMG) fell 15.3 percent. The Anglo-Dutch information technology services and software firm denied rumors it had talked down profit expectations and said it was happy with consensus forecasts.

Fellow software firm Misys (MSY) declined 7 percent while Europe's largest software firm, SAP [FSE:FSAP3], lost 3.2 percent in Frankfurt. Information technology service provider Logica dropped 4.9 percent while its French counterpart, Cap Gemini (PCAP), shed 3 percent.

Train operator Railtrack (RTK) slid 8.2 percent following the crash of a high speed train between London and Leeds that killed four people.

Hotel and catering company Granada Compass Group (GCP) fell 1.2 percent after it said o Monday it had put its Forte hotels division up for auction, as favored French bidder Accor (PAC) pulled out of the running. Accor gained 2.5 percent.

BT in Italian tussle

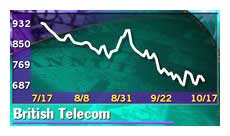

British Telecommunications (BT-A) fell 5.3 percent. The Financial Times said a disagreement between BT, which owns a 21 percent stake in Italian mobile phone operator Blu, and its fellow shareholders might lead to the Italian partners pulling out of Blu, as Italy's auction of third-generation mobile-phone licenses looms.

Mobile-phone operator Vodafone Group (VOD), which also is bidding for a 3G license in Italy, slipped 4.1 percent. Elsewhere in the U.K. phone sector, COLT Telecom (CLT) fell 4.7 percent and Cable & Wireless (CW-) lost 3.4 percent. Mobile-phone operator Vodafone Group (VOD), which also is bidding for a 3G license in Italy, slipped 4.1 percent. Elsewhere in the U.K. phone sector, COLT Telecom (CLT) fell 4.7 percent and Cable & Wireless (CW-) lost 3.4 percent.

In Paris, Bouygues (PEN) topped the leader board with a 7.5 percent gain.

In media shares, France's Lagardère (PMMB) dropped 2.3 percent while pay-TV firm Canal Plus (PAN) slipped 2 percent. British Sky Broadcasting (BSY) lost 3.6 percent. French television broadcaster TF1 (TFI) rose 3.3 percent.

German carmaker BMW (FBMW) fell 4.3 percent while Volkswagen dropped 0.7 percent. French rival Peugeot (PUG) lost 2.2 percent.

German engineer and truck maker MAN (FMAN) rose 4.5 percent after saying sales in the three months to Sept. 30 rose 32 percent to  3.2 billion. 3.2 billion.

Among banking shares, Crédit Lyonnais (PCL) lost 1.8 percent while BNP Paribas (PBNP) rose 1.9 percent in Paris and Dresdner Bank (FDRB) gained 1.1 percent in Frankfurt.

Defensive stocks cushioned London's gains, with Imperial Tobacco (IMT) up 4 percent and British American Tobacco (BATS) gaining 3.9 percent.

In Zurich, pharmaceutical company Roche Holding rose 2 percent. The company said sales in the nine months to September 2000 rose 10 percent to 20.3 billion Swiss francs ($11.4 billion), in line with analysts' expectations.

Ciba Specialty Chemicals rose 1.2 percent after reporting a rise in earnings in the first nine months, adding that it expects double-digit profit growth in 2000.

Investment bank Credit Suisse climbed 2.5 percent on its announcement it had entered exclusive negotiations to buy Britain's JO Hambro Investment Management Ltd., a provider of asset management services for wealthy individuals.

-- from staff and wire reports

|

|

|

|

|

|

|