|

Intel beats lowered targets

|

|

October 17, 2000: 7:30 p.m. ET

Chip giant beats earnings by 3 cents; revenue up 5 percent from 2Q

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Intel Corp. on Tuesday turned in a third-quarter profit of 41 cents per share, exceeding analysts' recently reduced forecasts following a warning from the semiconductor giant late last month.

However, executives provided a revenue growth forecast for the fourth quarter that was well below historic levels for the company.

Excluding one-time items, the world's largest supplier of PC microprocessors said it earned $2.9 billion, or 41 cents per share. That's up from an operating profit of 28 cents per share during the same period last year and 3 cents better than the 38 cents per share analysts polled by First Call had expected Intel to earn during the most recent quarter.

Intel's reported earnings included $966 million from investments and other interest income but excluded acquisition-related costs.

Including one-time items, Intel's third-quarter net income was $2.5 billion, or 36 cents per share. That's up 72 percent from the third quarter of 1999 and down 20 percent sequentially.

Revenue in the most recent quarter was $8.7 billion, up 19 percent from last year's third quarter and 5 percent sequentially. Intel had told analysts its sequential revenue growth would be between 3 and 5 percent when it lowered its forecast last month.

For the fourth quarter, Intel is on track to post revenue growth of 4-to-8 percent from the third quarter, Andy Bryant, Intel's chief financial officer, said in a teleconference Tuesday evening. For the fourth quarter, Intel is on track to post revenue growth of 4-to-8 percent from the third quarter, Andy Bryant, Intel's chief financial officer, said in a teleconference Tuesday evening.

That is well below what it has historically posted during the seasonally strong period.

Dan Scovel, semiconductor analyst at Needham & Co., said anything below 10 percent sequential revenue growth in the fourth quarter is "a very weak number" for Intel. The fourth quarter is typically one of the PC industry's strongest, as sales increase during the holiday season.

"Four-to-8 percent is slower than you would normally expect to get out of the fourth quarter," Bryant said. "We're being a little cautious and we're going to watch and see what develops."

Intel said its third-quarter gross profit margin was 63 percent. When the company issued its revised third-quarter guidance, Intel said it expected the gross margin to be about 62 percent, plus or minus 1 percent.

Gross margins for the fourth quarter should be 63 percent, plus or minus 1 percent, Bryant said.

Intel executives said the company is especially pleased with growth in sales of chips for network servers as well as sales of flash memory chips, which are used widely in portable communications devices and other consumer electronics.

But sales of microprocessors, which represent roughly two-thirds of Intel's total business, were about equal to processor sales during the second quarter, Bryant said.

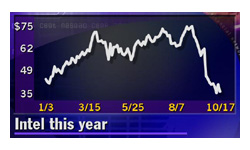

Intel (INTC: Research, Estimates) shares rose 50 cents to $36.19 on Nasdaq ahead of the earnings news, which was released after the market closed. They rose another 38 cents to $36.57 in after-hours trade.

Click here to see which stocks are moving after hours

When the company pre-announced earnings on Sept. 21, it blamed weak demand in Europe for the revenue shortfall.

During the quarter, Intel said sales in Europe had risen 22 percent, down slightly from a 26 percent increase during last year's third quarter and flat with the 22 percent increase in European revenue during the second quarter of this year.

Bryant said the problem was not as much in weakness in Europe, but more in Intel's previous expectations for sales in Europe during the quarter.

"The problem was as we entered the quarter, we forecasted a Q4 type of growth rate," he said. "We forecast a phenomenal Q3, and it was pretty much a normal one."

"Don't think of Europe as having not been a good quarter," Bryant added. "Think of it as being a little down and us having made a very aggressive forecast."

Intel's revenue warning last month was followed shortly after by a similar warning from Dell Computer (DELL: Research, Estimates), which also cited weaker-than-expected sales in Europe as the main culprit. That set off a chain reaction of selling which weighed on a wide range of PC-related stocks.

The value of Intel's stock has been cut by more than half since the company warned about the third quarter. The value of Intel's stock has been cut by more than half since the company warned about the third quarter.

During the quarter, Intel also suffered a series of embarrassing technical missteps. Among them, Intel recalled its highest speed Pentium processors and canceled plans for its low-end Timna processor. There have also been reports that its next generation of microprocessor, the Pentium 4, also has been delayed. Intel says it has never pegged a specific date for that product, which it said is on track to be released in the fourth quarter.

Adding to the pressure this week were cautious analysts' comments, some of which suggested that Intel would not only fall shy of its already reduced revenue growth forecast, but that the company also would provide a similarly bleak outlook for the fourth quarter.

Analysts also have been growing increasingly cautious about PC microprocessor pricing. With the competitive threat from rival Advanced Micro Devices (AMD: Research, Estimates) on the rise and the PC market generally weakening, they say profits at both companies could be decimated as they continue to battle for market share.

In an interview on CNNfn's Moneyline News Hour Tuesday, Intel's Bryant would not specifically address the pricing question, but he did say the company expects to take back some of the market share AMD has been snatching from it. [139K WAV or 139K AIFF]

For its part, AMD released its latest financial results last week. At 64 cents per share, the company topped analysts' profit expectations by 2 cents per share and executives even raised their processor sales target for the year.

AMD also said it did not see any weakness in Europe during the third quarter. However, the company does not have as much exposure to the corporate PC market there.

|

|

|

|

|

|

|