|

STMicro: chip profit triples

|

|

October 18, 2000: 7:27 a.m. ET

Bonanza at Franco-Italian processor co as phone chips, set-top boxes boom

|

LONDON (CNNfn) - Chipmaker STMicroelectronics NV said Wednesday its third-quarter profit tripled, beating expectations, as it shipped more chips to meet ballooning demand for processors used in digital TV set-top boxes and mobile phones.

The company said net income rose to $415.3 million, or 45 cents a share, from $135.3 million, or 15 cents a share, a year ago, as revenue jumped 60.3 percent to $2.04 billion.

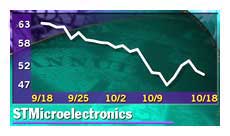

Net profit surpassed analysts' estimates of between $352 million and $356 million, according to Reuters.  Still, the company's stock fell Still, the company's stock fell  1.25, or 2.5 percent, to 1.25, or 2.5 percent, to  49.10 ($41.91) in midday trade in Paris, on news that STMicroelectronics is looking at ways of raising between $1 billion and $1.5 billion in financial markets to fund expansion, which will cost $3 billion in investment spending this year. The stock also fell in reaction to a 10 percent slide overnight in the Philadelphia Stock Exchange semiconductor index 49.10 ($41.91) in midday trade in Paris, on news that STMicroelectronics is looking at ways of raising between $1 billion and $1.5 billion in financial markets to fund expansion, which will cost $3 billion in investment spending this year. The stock also fell in reaction to a 10 percent slide overnight in the Philadelphia Stock Exchange semiconductor index

"The results are even better than we hoped." Said Laurent Daure, an analyst at BNP-Paribas. "It's the capital increase and the impact of the U.S. semiconductor index hitting the stock."

The Netherlands-registered company derives half of its revenue from makers of digital consumer electronic goods and mobile phones, both booming markets. STMicroelectronics also makes chips to control the performance of engines and transmission controls for the automotive industry.

"STM's very moderate exposure to the PC market is definitely working in its favor," said an analyst, noting that the 12 percent of total sales that it generates from makers of desktop computers was through the sale of chips to control hard disk drives and printers, and not microprocessors to power personal computers.

Chief Executive Pasquale Pistorio said that while analysts' are forecasting market growth of between 25 percent and 30 percent in 2001, "we believe ST is positioned to grow faster than the overall semiconductor market due to our strong product portfolio."

"ST's order rates and backlog remain strong, indicating the fourth quarter will be another period of record financial performance," Pistorio added.

--from staff and wire reports

|

|

|

|

|

|

STMicroelectronics

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|