|

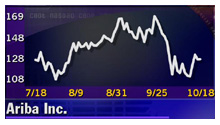

Ariba's 4Q breaks even

|

|

October 18, 2000: 9:26 p.m. ET

B2B software maker beats estimates by 5 cents, but loses value after-hours

|

NEW YORK (CNNfn) - Business-to-business e-commerce software maker Ariba Inc. Wednesday said improved revenues helped it beat Wall Street's fourth-quarter expectations.

The Mountain View, Calif. company had a fourth-quarter net loss of $1.1 million, or zero cents per share, before extraordinary charges, compared with a net loss of $4.6 million, or 3 cents a share in the year-ago period.

A consensus of analysts predicted a fourth-quarter loss of 5 cents per share, according to First Call/Thomson Financial. A consensus of analysts predicted a fourth-quarter loss of 5 cents per share, according to First Call/Thomson Financial.

The company said fourth-quarter revenues hit record levels, growing 687 percent to $134.9 million from $17.1 million in the year-ago quarter as the company added 114 customers. Those customers included Bear Stearns & Co. Inc., Target Corp. and American International Group Inc.

Ariba (ARBA: Research, Estimates) ended the regular trading day up 6 cents to close at $127.06, prior to the announcement. However in after-hours trade, following the announcement, the stock slipped $10 to $117.06.

"During the year we increased our customer base 500 percent and deployed more B2B customers than any competitor," Keith Krach, Ariba's chief executive officer, said in a statement.

When reached for comment, Krach told CNNfn.com that he was baffled as to the investor sell-offs. "We achieved break even, we are in good shape and are focused on the long term," he said.

Stephen H. Sigmond, managing director and analyst at Dain Rauscher Wessels, said the sell-offs may have stemmed from "some speculators jumping in, and worrying about long-term revenue," and the fact that, in spite of the consensus estimate, some analysts may have been expecting slightly better earnings.

He stressed, however that "we were really blown away by the results. We thought it showed great potential."

Ariba provides Internet platforms and network services that enable companies to do business with each other.

--from staff and wire reports

|

|

|

|

|

|

Ariba

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|