|

Microsoft beats estimate

|

|

October 18, 2000: 8:23 p.m. ET

Software giant's earnings are bolstered by $1.13B investment gain

|

NEW YORK (CNNfn) - Software giant Microsoft Corp. reported Wednesday fiscal first-quarter earnings and revenue that exceeded analysts' estimates, aided by more than $1 billion in investment income.

Redmond, Wash.-based Microsoft (MSFT: Research, Estimates) reported that its first-quarter net income, before an accounting change, rose to 18 percent to $2.58 billion, or 46 cents per share, from $2.19 billion, or 40 cents per share, in the same quarter last year. That was 12 percent above the mean analyst estimate of 41 cents, according to earnings tracker First Call.

Almost all of that gain came from Microsoft's investment portfolio. During the quarter, the company collected $1.13 billion from interest on its cash balances and gains on the sale of securities. That's up from $550 million in the same period last year. The software giant ended the quarter with $24.7 billion in cash and short-term investments.

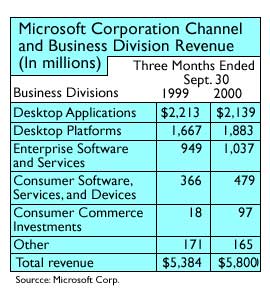

Revenue rose 8 percent to $5.8 billion from $5.38 billion, aided by sales of the company's Windows 2000 operating system and a 31 percent gain in consumer software, services, and devices sales. The quarter's revenue total was $100 million above the estimate made by Merrill Lynch analyst Chris Shilakes.

Microsoft's operating income was $2.8 billion, which was flat with the same period last year. Operating income as a percentage of revenue declined to 47.9 percent from 51.8 percent. Microsoft's operating income was $2.8 billion, which was flat with the same period last year. Operating income as a percentage of revenue declined to 47.9 percent from 51.8 percent.

"Results were solid across all businesses, led by accelerating deployments of Windows 2000 Professional in the business sector and Windows Me in the consumer arena," said Microsoft Chief Financial Officer John Connors in a statement. "While we remain guarded about worldwide economic conditions, we are extremely enthusiastic about our Windows 2000 generation of server products."

Looking forward

Looking forward, Connors expects Microsoft's revenue to increase in the low teens in the second fiscal quarter versus the same period in 1999. Operating income and earnings per share are likely to increase at the same rate as revenue in the second quarter, he said.

Microsoft kept its guidance for the second quarter's earnings per share at 49 cents. Earnings per share for all of fiscal 2001 is likely to be "a few cents" higher than the current consensus estimate of $1.88, the Connors said.

And that could take some of the pressure off Microsoft's stock, according to Goldman Sachs analyst Rick Sherlund. And that could take some of the pressure off Microsoft's stock, according to Goldman Sachs analyst Rick Sherlund.

In an interview on CNNfn's Moneyline News Hour Wednesday, Sherlund said there had been some concerns on Wall Street that Microsoft would lower its financial guidance. The fact that the company did not could act as a catalyst for the stock, he said. [191K WAV or 191K AIFF]

Microsoft shares rose $1.31 to $51.75 in regular trade ahead of the earnings news, which was released after the markets closed. They rose another $4.19, or 8.1 percent, to $55.94 in extended hours trading.

Click here to see which stocks are moving after hours

Microsoft's third-quarter revenue growth was constrained by weak business PC sales in Europe and consumer PC growth that slowed to the single digits in the quarter. In addition, the PC manufacturing business is consolidating around a few large, international companies, which reduces the average revenue Microsoft receives for each copy of the Windows operating system, since large buyers can negotiate lower prices for Windows.

Sales of desktop applications, which include the Microsoft Office suite, declined 3 percent to $2.14 billion. However, Office revenue in the third quarter of 1999 benefited from Microsoft's issuance of product coupons. Revenue from desktop platforms increased 13 percent to $1.88 billion, largely because of greater-than-expected sales of Windows 2000 and Windows Me operating systems.

Enterprise software and services revenue -- which includes Windows 2000 Server, SQL Server, Exchange Server, and Developer Tools -- rose 9 percent to $1.04 billion. Consumer software, services, and devices revenue -- which includes MSN, WebTV, Learning and Productivity Software, Embedded Software, Mobile and Wireless, and Games -- jumped 31 percent to $479 million.

|

|

|

|

|

|

|