|

Sun beats the Street

|

|

October 18, 2000: 7:02 p.m. ET

Network server giant exceeds forecast, sees clear skies ahead

|

NEW YORK (CNNfn) - Sun Microsystems reported a fiscal first-quarter profit Wednesday that beat Wall Street's expectations on sales that rose 60 percent from the year-earlier period.

And executives at the Palo Alto, Calif.-based company said they expect revenue and earnings per share in the fiscal second quarter to be slightly more than previously forecast.

But the better-than-expected earnings and second-quarter guidance were not the only surprise out of the Palo Alto, Calif.-based company. The earnings release was inadvertently posted on Sun's Web site earlier in the day and then quickly removed.

After the results, which had been set for release after the market closed, were reported by several news services, Sun distributed the release through the regular channels. In a teleconference later in the afternoon, Sun executives apologized for any inconvenience the early release might have caused but did not elaborate on how or why it happened.

Sun, the world's leading supplier of network servers, said it earned $510 million, or 30 cents per share, during the quarter. That's up 85 percent from a year ago and 4 cents better than the 26 cents per share analysts polled by First Call had expected.

Revenue rose 60 percent to $5 billion.

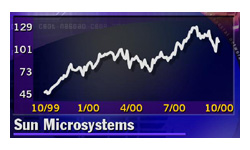

Shares of Sun (SUNW: Research, Estimates) rallied sharply earlier Wednesday after the earnings were mistakenly posted on the Web site, but then were halted for pending news. The stock ended the session down $1.06 at $110.31. Shares of Sun (SUNW: Research, Estimates) rallied sharply earlier Wednesday after the earnings were mistakenly posted on the Web site, but then were halted for pending news. The stock ended the session down $1.06 at $110.31.

The company's gross margin, which is the portion of revenue left after expenses, was 48 percent in the most recent quarter. That's down from 52 percent during the same period last year.

Sun is the world's leading supplier of Web servers, the powerful computers that make up the backbone of the Internet. Over the past year, the company has seen its stock price more than double as it has aggressively gone after dot.com companies and Internet service providers expanding their network infrastructures.

However, Sun has been facing increasingly aggressive competition from Hewlett-Packard (HWP: Research, Estimates) and IBM (IBM: Research, Estimates), its chief rivals in the market for Web servers.

For its part, IBM, which has been quite candid in expressing its intention to unseat Sun as the Web server king, rolled out its latest weapon in that fight, the eServer pSeries 680. Big Blue expects to start shipping those systems in less than a month.

HP introduced its latest Web server, dubbed "SuperDome," last month, and the company expects to begin shipping them in volume in late December.

Sun last month showcased its next generation of Web servers, which are powered by its long-awaited UltraSPARC III processors. While the company has begun shipping its low-end UltraSparc III-based servers, it does not expect to begin selling the mid-range and high-end products for about another nine months.

In a teleconference with analysts Wednesday afternoon, Michael Lehman, Sun's chief financial officer, blamed higher component costs for the reduction in gross margins during the quarter, emphasizing that the company had not become more aggressive in pricing its products.

"The vast majority of the decline is due to increased costs of memory components," Lehman said. "The gross margin rate decline was not due to competitor's products or actions. This is a cost matter, not a competitive pricing issue. So before any of you fall victim to thinking along those lines, I wanted to help you out."

Looking ahead, Lehman said Sun is slightly raising its fiscal second-quarter revenue growth rate forecast to be in the high-40 percent range, with earnings per share rising either at that level or slightly below it.

For all of fiscal 2001, Lehman said Sun's revenue growth should be in the mid-30-percent range, which is slightly up from the company's most recent guidance. Earnings per share for fiscal 2001 are expected to grow at that level or slightly below it.

When IBM posted its latest results on Tuesday, the company reported weakness in sales of its high-end servers, which executives attributed to a product transition. Meanwhile, they said demand for mid-price range servers was strong. IBM's overall revenue growth was 3 percent.

Ed Zander, Sun's president and chief operating officer, said the 60 percent revenue growth proves that the company has "nothing less than stunning market share," adding that IBM's recently reported results lend support to that argument.

As for Sun's prospects moving ahead, Scott McNealy, its chief executive, said the company is poised to widen the gap between it and its competitors in the marketplace in 2001.

"I'm busting at the seams," he said. "It's just open-field running for us now."

|

|

|

|

|

|

Sun investor relations

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|