|

Merck beats forecast

|

|

October 20, 2000: 10:27 a.m. ET

No. 2 U.S. drug maker's 3Q earnings rise 19% on 29% sales jump

|

NEW YORK (CNNfn) - Merck & Co., the second largest U.S. drug maker, posted a 19 percent jump in third-quarter profit Friday, beating analysts' expectations, as sales of new arthritis painkiller Vioxx and other medicines soared.

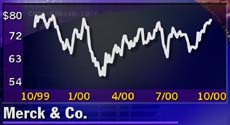

Merck's results pleased Wall Street, pushing up the Dow Jones industrial average component's shares $1.94, or 2.5 percent, to $79.75 in early trading. The results follow strong profit reports Thursday from several other big drug makers, including Bristol-Myers Squibb Co. (BMY: Research, Estimates), Elli Lilly and Co. (LLY: Research, Estimates) and American Home Products Corp. (AHP: Research, Estimates) amid healthy growth in pharmaceutical sales, particularly in the key U.S. market.

Whitehouse Station, N.J.-based Merck (MRK: Research, Estimates) earned $1.84 billion, or 78 cents a share, up from $1.54 billion, or 64 cents a share, a year earlier.

The results beat the 73-cent per share First Call consensus estimate of analysts by five cents per share. The better-than-expected earnings growth helps Merck going forward as it struggles with looming patent expirations and a dwindling pipeline, said Chase H&Q pharmaceutical analyst Corey Davis.

Merck had "a very, very impressive quarter," Davis told CNNfn's Before Hours. "All of their drugs seem to be doing exceptionally well." (469WAV) (469AIF)

Sales soared 29 percent to $10.6 billion from $8.2 billion in the 1999 third quarter. Sales of Vioxx, a treatment for arthritis pain, totaled $615 million.

The drug was introduced in June 1999 and recorded only minimal sales in last year's third quarter.

Merck is locked in a battle for market share with Pharmacia Corp. (PHA: Research, Estimates) and No. 1 U.S. drug maker Pfizer Inc. (PFE: Research, Estimates) for sales of so-called COX-2 inhibitor painkillers. Pharmacia and Pfizer jointly market Celebrex, which was launched several months before Vioxx. Both drugs are considered easier on the stomach lining than other commonly used painkillers.

Merck said sales of its best-selling drug, cholesterol-lowering treatment Zocor, rose 18 percent to $1.36 billion. Sales of asthma drug Singulair jumped 86 percent to $615 million, while sales of osteoporosis treatment Fosamax increased 27 percent to $960 million. Merck said sales of its best-selling drug, cholesterol-lowering treatment Zocor, rose 18 percent to $1.36 billion. Sales of asthma drug Singulair jumped 86 percent to $615 million, while sales of osteoporosis treatment Fosamax increased 27 percent to $960 million.

But Merck also has some big challenges going forward. The company, which stood on the sidelines during this past year's consolidation wave in the drug industry, has said it has no interest in a mega-merger. But some analysts question whether the company can remain an industry powerhouse without linking up with a rival.

Merck recently lost patent exclusivity on hypertension drug Vasotec and could also lose patent protection on Pepcid ulcer medication later this year. Sales of Vasotec slipped 5 percent to $460 million in the third quarter amid competitive pressures from cheaper generic rivals. Several other products, including anti-cholesterol pill Mevacor and hypertension drug Prinivil are expected to lose patent protection next year.

Merck also shares in the profit from AstraZeneca PLC's (AZN: Research, Estimates) ulcer drug Prilosec (known as Losec outside the United States). Prilosec, the world's best-selling drug with roughly $6 billion in sales last year, could lose exclusivity on several key patents next year.

The company said Friday it expects soon to receive U.S. Food and Drug Administration approval for once-weekly formulation of Fosamax, which could boost sales of that drug. The company is also studying other potential uses for Vioxx, including as a treatment for chronic pain, rheumatoid arthritis and Alzheimer's disease.

For the first nine months of the year, Merck's net income rose 17 percent to $5.06 billion, or $2.15 per share, from $4.32 billion, or $1.79 per share, in the 1999 period. Sales rose 22 percent to $28.9 billion.

The company also said it is "comfortable" with fourth-quarter earnings expectations, ranging from 73 cents to 76 cents per share.

|

|

|

|

|

|

Merck

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|