NEW YORK (CNNfn) - The Nasdaq composite index tumbled nearly 6 percent Wednesday as investors unloaded fiber-optic and computer networking stocks after Nortel Networks posted disappointing sales.

Nortel, which trades on the New York Stock Exchange stock, lost more than 25 percent of its market value following a third-quarter revenue shortfall. The selling spread to JDS Uniphase, Cisco Systems and other Nasdaq movers that could suffer from Nortel's apparent growth problems.

For a market worried that technology stocks still cost too much relative to their growth prospects, falling stock prices are nothing new. But fiber optics firms, unlike Internet and chip shares, mostly escaped the fall's sell-off. That changed Wednesday.

"The whole networking equipment area was the last bastion of high P/Es," said John Forelli, senior vice president at Independence Investment Advisors. "A lot of these stocks were still at nosebleed valuations." "The whole networking equipment area was the last bastion of high P/Es," said John Forelli, senior vice president at Independence Investment Advisors. "A lot of these stocks were still at nosebleed valuations."

Still, bright spots flickered amid the sell-off. Internet stocks gained after Amazon.com posted a surprisingly small quarterly loss. And drug and financial stocks rose, limiting the losses on the Dow Jones industrial average.

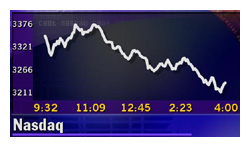

The Nasdaq slid 190.22 points, or 5.6 percent, to 3,229.57. The Nasdaq's third straight loss was its eighth-worst point decline on record.

The Dow Jones industrial average lost 66.59 to 10,326.48, breaking a four-session winning streak. The S&P 500 lost 33.23, or 2.4 percent, to 1,364.90.

More stocks fell than rose. Declining issues on the New York Stock Exchange topped advancing ones 1,901 to 961, on trading volume of 1.2 billion shares. Nasdaq losers beat winners 2,730 to 1,253, as more than 2 billion shares changed hands. More stocks fell than rose. Declining issues on the New York Stock Exchange topped advancing ones 1,901 to 961, on trading volume of 1.2 billion shares. Nasdaq losers beat winners 2,730 to 1,253, as more than 2 billion shares changed hands.

In other markets, the dollar rose against the yen and euro, which fell to a record low. Treasury securities declined.

Nortel shakes things up

Even though it topped profit forecasts, Nortel Networks (NT: Research, Estimates) tumbled $18.31, or 29 percent, to $45 after posting sales of $7.31 billion in the third quarter, below expectations of $7.5 billion.

Nortel, a Canadian company involved in fiber optics, computer networking and telecommunications accessories, earned 18 cents per diluted share, up from 11 cents per share in the year-earlier quarter. Nortel, a Canadian company involved in fiber optics, computer networking and telecommunications accessories, earned 18 cents per diluted share, up from 11 cents per share in the year-earlier quarter.

But that wasn't enough for a market bent on punishing financial imperfections. Still, at least one analyst called Nortel's pummeling an overreaction

"I think it's dramatically overdone," Alex Henderson, who covers the company for Salomon Smith Barney, told CNNfn's Market Call. "The only area that they missed was in the optical systems business."

The Toronto Stock Exchange's main index, the TSE 300, which is heavily influenced by Nortel, fell 8.13 percent.

And JDS Uniphase (JDSU: Research, Estimates), which supplies Nortel with fiber-optics equipment, fell $24.06 to $71, while Nortel competitor Cisco (CSCO: Research, Estimates) lost $4.25 to $50.63.

Applied Micro Circuits (AMCC: Research, Estimates), which sells integrated circuits to Nortel, tumbled $50.31 to $148. PMC-Sierra (PMCS: Research, Estimates), another Nortel supplier, lost $37.75 to $161.13.

"This was one of the last areas of technology that still had the great, glory days of April going for it," Ken Tower, chief technical analyst of UST Securities, told CNN's Street Sweep. "The market is just not willing to put up with those high P/Es and is shooting them down one by one."

Tower sees more losses ahead for a market that must build more negative sentiment before it can actually recover.

"Paradoxically you need people to be more discouraged in order for there to be a market bottom," Tower said.

Still, the market showed pockets of strength. Amazon.com (AMZN: Research, Estimates) jumped $2.31 to $31.88. The Internet retailer posted a narrower-than-expected loss of 25 cents a share, excluding special items -- better than the 33 cents a share loss Wall Street expected.

CMGI (CMGI: Research, Estimates), the Internet investment firm, rose 44 cents to $16.69.

More news from CNNfn.com for investors:

· Franklin snags Fiduciary

· The politics of business

· Mets, Yankees and money

And while most technology stocks fell Wednesday, investors sought safety in financial and drug shares, among the year's best performers. J.P. Morgan (JPM: Research, Estimates) jumped $1.38 to $146.50 and American Express (AXP: Research, Estimates) gained 25 cents to $57.38.

Among Dow drug issues, Merck (MRK: Research, Estimates) rose $1.88 to $85.31 while Johnson & Johnson (JNJ: Research, Estimates) advanced $2.25 to $93.94.

Linda Jay, NYSE floor trader for RPM Specialists, told CNNfn's Market Call that this rotation into defensive stocks with stable earnings could continue. (395K WAV) (395K AIFF).

Two Dow components, meanwhile, braced Wall Street for earnings disappointments.

DuPont (DD: Research, Estimates), the chemical maker, said it will earn $2.85 a share this year, 3 cents below forecasts. Its shares fell 50 cents to $42.63. In its earnings report, DuPont earned 51 cents a share before one-time items, in line with expectations.

And AT&T (T: Research, Estimates) shed $3.50 to $23.38 after warning that fourth-quarter profit from operations will miss analysts' forecasts due to continued pricing pressure on its long-distance business.

In a blitz of news, AT&T announced plans to divide into four units. And the long-distance provider also posted earnings excluding special items of $1.4 billion, or 38 cents a share. That's 2 cents above the consensus of analysts surveyed by First Call, but down 24 percent from the $1.6 billion, or 50 cents a share, reported a year earlier.

In economic data, sales of existing homes for September fell in line with economists' expectations, slipping 2.7 percent to a seasonally adjusted annual rate of 5.1 million units, according to the National Association of Realtors.

While home sales are weakening under higher interest rates, the overall level remains high.

Ahead, Friday brings the first reading from the government on the nation's gross domestic product for the third quarter. Any surprise slowdown in growth could cheer stock investors looking for signs that interest rates will fall.

"What this market is going to need is for the Fed's next (interest rate) move to be down rather than up," Independence Investment Advisors' Forelli said.

|