|

Amgen beats estimate

|

|

October 26, 2000: 5:13 p.m. ET

Biotech firm warns of disappointing sales growth for two of its top drugs

|

NEW YORK (CNNfn) - Biotechnology bellwether Amgen Inc. posted a 16 percent increase in third-quarter earnings Thursday, slightly beating Wall Street's forecasts, but warned that sales growth for its two biggest-selling products likely will fall short of full-year estimates.

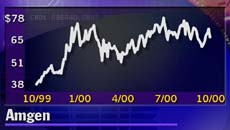

The report, released after the market close, sent Amgen shares sliding in after-hours trading. The stock fell $6.50 to $62, after finishing the regular day down 13 cents at $68.50 on the Nasdaq exchange.

Amgen (AMGN: Research, Estimates), maker of anemia drug Epogen and cancer treatment Neupogen, earned 29 cents per diluted share, excluding one-time items, from 25 cents per share in the year-earlier quarter. Analysts polled by First Call Corp. had anticipated profit of 28 cents per share.

Including one-time gains, the company earned $359 million, or 33 cents per diluted share, from $300 million, or 28 cents per share, in the 1999 third quarter.

Revenues rose 12 percent to $949.5 million. Analysts had called for revenues of $963.5 million, according to the consensus projection of analysts polled by First Call.

Sales of Epogen, the Thousand Oaks, Calif.-based company's top-selling drug, increased 11 percent to $449 million. But the company said Epogen sales growth for the full year likely will rise "in the low double digits, down from previous guidance of growth in the low teens." Amgen cited moderating demand for the drug, which is used to fight anemia in dialysis patients. Sales of Epogen, the Thousand Oaks, Calif.-based company's top-selling drug, increased 11 percent to $449 million. But the company said Epogen sales growth for the full year likely will rise "in the low double digits, down from previous guidance of growth in the low teens." Amgen cited moderating demand for the drug, which is used to fight anemia in dialysis patients.

The company also revised sales estimates for Neupogen, saying sales likely will fall slightly below year-earlier figures because of slower demand and negative currency effects caused by the weak euro. Amgen previously said 2000 sales would be flat over the prior-year results. For the third quarter, Neupogen sales rose 13 percent to $353 million.

The company said it now expects earnings per share for the full year to come in at the low end of its targeted range of $1.06 to $1.08.

One analyst said the slowing sales for the two drugs is not a huge problem, saying the company is only projecting modestly lower sales growth for the year for Epogen and Neupogen.

"I think this is just an initial reaction," Matt Geller, a biotech analyst at CIBC World Markets, said of the after-hours sell-off of the stock.

|

|

|

|

|

|

Amgen

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|