NEW YORK (CNNfn) - It's 3 a.m. and you're lying in bed staring at the ceiling again obsessing over the few dollars you've managed to save for retirement. Will it be enough? If your palms sweat at the thought of retirement, you're not alone. Apparently, most investors panic when it comes to saving enough for the big day.

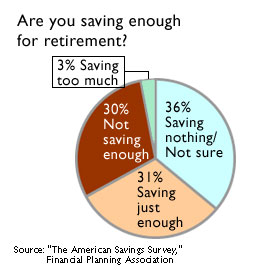

More than half of the investors surveyed by the Financial Planning Association, which represents financial planners nationwide, say they are troubled about their retirement savings. The study shows that Americans aren't saving enough for their golden years and on top of that, investors say a handful of reasons are holding them back from putting enough pennies in the piggy bank slot.

"You need accurate projections for retirement," said Roy Diliberto, a certified financial planner (CFP) and president of the FPA. "More importantly, people need help to figure out what they want out of life. 'What kind of retirement do I want? It's more than just dollars."

The tale of the tape

Whether it's mounting utility, phone and cable bills, an extravagant lifestyle, lack of discipline of regular saving or not having enough information, investors say these obstacles are holding them back from saving adequately for their future.

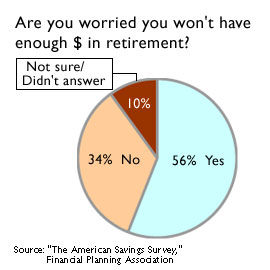

According to the FPA's "American Savings Survey," which was conducted in June, 56 percent of the 1,000 investors questioned said they are indeed worried about their retirement savings. About one-third said they had no reservations about their retirement savings and 10 percent said they just weren't sure. According to the FPA's "American Savings Survey," which was conducted in June, 56 percent of the 1,000 investors questioned said they are indeed worried about their retirement savings. About one-third said they had no reservations about their retirement savings and 10 percent said they just weren't sure.

"Many people are not planning. Maybe they are saving some money, but how do they define what is enough," Diliberto said. "Most people would like to save more, so why aren't they saving more?"

Click here for practical tradeoffs to help you save

Forty-six percent of the investors questioned in the survey said mounting everyday expenses overshadow their long-term savings. In addition, 37 percent of the respondents said living an extravagant lifestyle was a barrier preventing them from saving for retirement.

That attitude, says CFP Barbara Saunders, is a bad excuse. That attitude, says CFP Barbara Saunders, is a bad excuse.

"The biggest thing is consumption today and some investors want that that 45-inch TV with surround sound, a home theatre, and want to drive a Lexus instead of a Camry," she said. "They want to own their own condo, and they're into saying, 'I'm a young professional and I'm into the here and now.'"

Did you miss CNNfn.com's Special Retirement report? Click here...

Unfortunately, a lavish lifestyle today that includes minimal or no saving doesn't bode well for retirement, planners say. Thirty percent of Americans have not put any money aside specifically for retirement, according to The American Savings Education Council (ASEC).

"People spend first and save later and no one is successful doing it that way," Diliberto said.

So what's the plan, Stan?

The painful reality is that many Americans are wringing your hands over how to make their retirement savings grow successfully for the big day. Also, the big day of retirement can stretch for decades with the way more and more people are living longer lives. Retirees are living into their 90s and even 100s, so for many, they'll need to have a nest egg ready to work for at least a few decades.

Diliberto says taking at least a few simple steps will get you started to putting together a decent retirement plan.

Find out how long you're going to live! Click here

| |

|

|

| |

|

|

| |

People spend first and save later and no one is successful doing it that way

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Roy Diliberto

president of FPA |

|

The first thing to do is figure out a ballpark estimate of how much you'll need during retirement and where your income will come from. For many, that means an employer-sponsored plan, an IRA, a company pension, Social Security benefits, and any additional savings.

You'll have to envision how you plan to spend your days in the golden years. Will it be traveling around the globe or working part-time in the same town you grew up in? The answers to these questions will help determine how much money you'll need.

Pick up a new habit

Not all habits, like smoking or nail biting, have to be bad ones. Getting into the habit of regular saving is well worth your time and effort, planners say.

Create automatic savings deductions of $25 or $50 per pay period from your bank checking account or directly from your paycheck, if possible, into a mutual fund.

Also, contributing to your company's 401(k) plan is a great way to do regular deductions. The contributions are taken automatically from your paycheck so you don't need to write a check or keep on top of it. You'll receive a quarterly statement on your plan's progress.

Many companies offer online account information, so you can view your holdings as often as you like. And contact your company's human resources department to check if your company offers a match and how much you need to contribute to receive the full benefit.

The bottom line is to make a plan today, at an early age, and stick to it.

"The dollar you put away at age 25 is more important than the dollar you put away at 50," Diliberto said.

|