|

Dell makes 3Q mark

|

|

November 9, 2000: 7:30 p.m. ET

PC supplier meets estimates but sees growth slowing in coming fiscal year

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Personal computer maker Dell Computer Corp. on Thursday reported a third-quarter profit that met Wall Street's expectations, and said it is on track to post roughly 27 percent sales growth for its current fiscal year.

However, Dell executives said they expect the company's revenue growth in the coming year to be much lower than it has been historically.

In a teleconference after the third-quarter earnings release, James Schneider, Dell's chief financial officer, told analysts that the company has "set a target to grow revenue at about 20 percent for fiscal 2002, with slightly faster growth in earnings per share." Dell is currently in the last quarter of its fiscal year 2001.

That's much lower than the 40-to-50 percent growth rate Dell has posted in recent years, and it marks the second fiscal year in a row during which the company said it expects a 10 percent decline in revenue growth.

Earlier this year, Dell executives had been targeting a 30 percent growth rate for the current year, but they took that down a few notches to 27 percent in October.

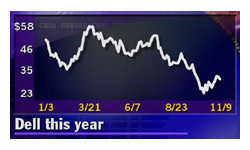

Shares of Dell (DELL: Research, Estimates), which closed at $28.38 in regular trade, had held relatively steady in after-hours trade, but then fell another $1.94 to $26.44 shortly after the company provided the outlook for fiscal 2002.

Michael Dell, the company's founder and chairman, said he thinks 20 percent is still substantial, considering the company's size. If Dell meets its fiscal 2001 revenue targets, it will have posted $32 billion in sales.

"Some people will be dismayed by the revenue forecast, but some people will think they're low-balling it," said Andrew Neff, technology analyst at Bear Stearns.

Excluding acquisition related charges, Dell said it earned $674 million, or 25 cents per share, during the three-month period ended Oct. 27, meeting the consensus estimate of analysts surveyed by earnings tracker First Call.

The company logged third-quarter revenue of $8.3 billion, which is 22 percent more than its third-quarter revenue last year and slightly above Wall Street's expectations, according to the First Call survey.

Dell executives emphasized the growth in revenue from enterprise servers and storage products, notebooks computers and services, more profitable areas which they said will be their major thrust in the coming fiscal year. Dell executives emphasized the growth in revenue from enterprise servers and storage products, notebooks computers and services, more profitable areas which they said will be their major thrust in the coming fiscal year.

"We believe that this richer product mix is where the profit growth is for Dell," Schneider said.

During the third quarter, Dell said 19 percent of its total revenue from computer systems came from enterprise products, while 29 percent came from notebooks. The remaining 52 percent of systems revenue was derived from desktop computers.

Total unit shipments rose 21 percent during the quarter, Dell said.

Lower costs make for aggressive pricing

Dell's gross margin, or its net sales minus the cost of goods sold, came in at 21.3 percent, which is flat with its gross margin during the second quarter. Some analysts had been concerned about Dell's third-quarter gross margins, which they thought might be hurt because of the company's aggressive pricing.

Indeed, the company did take a more aggressive position on pricing during the quarter, which it was able to do because of lower component costs, according to Schneider. During the quarter, the average selling price of Dell systems came down 4 percent.

"Despite this decline in prices, we maintained flat gross margins," Schneider said. "Despite this decline in prices, we maintained flat gross margins," Schneider said.

During the fiscal fourth quarter, which is typically stronger as consumer demand picks up during the holiday season, Schneider said Dell intends to continue its aggressive stance on pricing as it fights to capture more market share. Though it still runs second to its cross-state rival Compaq (CPQ: Research, Estimates) in worldwide sales, Dell has been steadily creeping up, and already has surpassed Compaq in the U.S.

As a result, Schneider said Dell's gross margin in the fourth quarter is likely to be lower. He expects total revenue in the fourth quarter to be $8.75 billion.

"That's a reason to be a little cautious," said Bear Stearns' Neff. "There's the potential for a price war to start. There could be a lot of pressure on the margins."

Schneider also warned that any further weakening of the euro, which Dell has already accounted for in its forecasts, could have an impact on the company's future results.

As have many PC makers, Dell has been stung by weakness in Europe, especially in the corporate market there, where its business is concentrated. During the third quarter, Dell said its sales in Europe rose a tepid 7 percent.

In the Americas, Dell revenue was up 24 percent, led by a 34 percent increase in sales to small businesses and consumers. At the same time, Dell reported more robust corporate demand in the Asia-Pacific region and in Japan, where the company said strong sales to large corporate customers helped drive a 39 percent quarterly revenue improvement.

|

|

|

|

|

|

|