|

Web ad stocks tumble

|

|

November 9, 2000: 12:37 p.m. ET

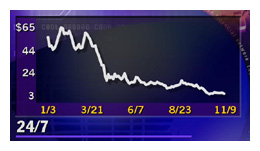

Shares of 24/7 Media, Engage tumble on slow growth, dismal earnings

|

NEW YORK (CNNfn) - Shares of 24/7 Media Inc. and Engage Inc. tumbled in Thursday trading after the online advertising companies warned of slower near-term growth, prompting analysts to issue caution on stocks in the sector.

24/7 Media (TFSM: Research, Estimates) shares plunged $1.38, or 30 percent, to $3.25, hitting a fresh 52-week low and down sharply from their year high of $65.25. Engage (ENGA: Research, Estimates) shares tumbled $1.28 to $2.19, a drop of 37 percent and also hit a new 52-week low.

"The e-marketing meltdown continues," said Credit Suisse First Boston analyst Rich Petersen in a research note.

New York-based 24/7 Media said it will cut 200 jobs and expected tempered growth until mid-2001. It posted a wider-than-expected pro forma loss, excluding items, of $22.5 million or 59 cents a share. New York-based 24/7 Media said it will cut 200 jobs and expected tempered growth until mid-2001. It posted a wider-than-expected pro forma loss, excluding items, of $22.5 million or 59 cents a share.

Petersen cut his rating on 24/7 Media to "hold" from "buy," citing concerns about margin trends and cash reserves. He also said his ratings for Engage were under review.

J.P. Morgan also cut its rating on 24/7 Media to "market perform" from "buy" while Merrill Lynch cut its rating to "neutral" from "accumulate."

Merrill Lynch analyst Henry Blodget rated 24/7's quarter a "D" after the company missed his revenue estimates by $15 million. He downgraded the firm to "neutral" from "accumulate," lowered his 2000 and 2001 earnings-per-share and revenue estimates and estimated that 24/7 burned through "at least $40 million." Merrill Lynch analyst Henry Blodget rated 24/7's quarter a "D" after the company missed his revenue estimates by $15 million. He downgraded the firm to "neutral" from "accumulate," lowered his 2000 and 2001 earnings-per-share and revenue estimates and estimated that 24/7 burned through "at least $40 million."

"24/7 has board seats on both China.com and Network Commerce and thus is unable to sell shares during certain insider-trading windows. Put succinctly, without the sale of these securities or raising additional funds, the company will run out of cash in the next few months," Blodget warned.

Blodget noted that the company will terminate the 200 positions beginning in its fourth quarter, but said that across the board, costs were much higher than he had anticipated, that gross margins "suffered terribly," and that network ads declined 16 percent sequentially.

Engage (ENGA: Research, Estimates), majority-owned by Internet incubator CMGI Inc., warned again about its fiscal first-quarter revenues due to market-related and internal factors. Shares of CMGI (CMGI: Research, Estimates) plummeted $4.12, or 19 percent, to $17.69.

The Andover, Mass.-based company also said Chief Executive Officer Paul Schaut planned to resign and will be replaced by Anthony Nuzzo.

Online advertisers still in the eye of the storm

Online ad companies have faced a difficult quarter and analysts said they do not expect the cloud over their sector to lift until mid-2001. A weakening ad environment has also been cited by analysts as a reason for more cautious outlooks for traditional media companies such as Walt Disney Co. (DIS: Research, Estimates).

While the shortfalls were expected, Petersen said their magnitude provided fresh evidence that online-ad selling favors big companies over the smaller firms.

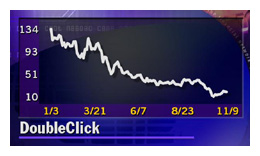

"In combination with 24/7's third-quarter earnings shortfall and DoubleClick Inc.'s soft third quarter reported last month, Engage's announcement rounds out the expected bad news for the third quarter among the Internet-ad networks," Petersen said. "In combination with 24/7's third-quarter earnings shortfall and DoubleClick Inc.'s soft third quarter reported last month, Engage's announcement rounds out the expected bad news for the third quarter among the Internet-ad networks," Petersen said.

Shares of DoubleClick (DCLK: Research, Estimates), the leading online-ad network, were off $3.62, or 19.3 percent, to $15.12, in sympathy with its smaller rivals. Its shares have fallen nearly 90 percent since January.

ING Baring's David Doft said there is little catalyst for Engage and 24/7 shares to rise in the near term.

"While we still acknowledge the long-term opportunity for Internet advertising, investors are best served on the sidelines in the near term," Doft said in a research note.

--from staff and wire reports

|

|

|

|

|

|

24/7 Media

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|