|

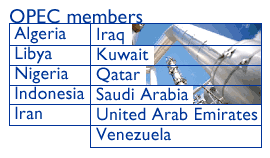

OPEC keeps output quotas

|

|

November 12, 2000: 11:09 a.m. ET

Cartel to consider oil output cut in January; formal Vienna meeting Monday

|

LONDON (CNNfn) - OPEC decided Sunday against pumping more oil and agreed to meet in January, as was widely expected, amid concerns four production hikes this year may lead to oil prices plunging through the floor after winter demand for fuel in the Northern hemisphere dries up.

The Organization of Petroleum Exporting Countries agreed at a meeting in the Austrian capital of Vienna to scrap its automatic output mechanism but plans to keep target prices between $22 and $28 a barrel.

The oil cartel, which pumps about 40 percent of the world's oil, plans to meet Jan. 17 to review output levels. A formal meeting scheduled for Sunday has been delayed until Monday 9 a.m. Vienna time as a mark of respect following the Austrian ski train tragedy on Saturday.

"There is no need to do anything now," Saudi Oil Minister Ali al-Naimi said. "We are just monitoring the situation and will make decisions when necessary." "There is no need to do anything now," Saudi Oil Minister Ali al-Naimi said. "We are just monitoring the situation and will make decisions when necessary."

OPEC President Ali Rodriguez was also voted in as the new secretary-general of the cartel from Jan. 1, replacing Nigeria's Rilwanu Lukman. Algerian Oil Minister Chekib Khalil will become OPEC's president.

International political pressure has forced the oil cartel this year to boost oil production by more than 3.7 million barrels a day, in a vain attempt to deflate oil prices that have risen to 10-year highs. Asia-Pacific Economic Cooperation nations, meeting in Brunei on Sunday, called on OPEC to make available additional supply.

Commodity analysts had expected the cartel to suspend the price mechanism that has failed to slash oil prices and agree to meet in January to discuss a possible cut in output.

OPEC may consider "suspending" the price mechanism, Lawrence Eagles, a commodity analyst at brokerage GNI Ltd., told CNNfn.com before the meeting. "It doesn't work."

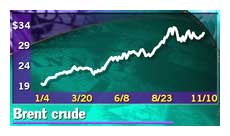

Oil prices have stubbornly stayed above $30 barrels, despite the cartel's agreement to pump an extra 500,000 barrels on Oct. 30. Under the current price mechanism the cartel should increase output in 20 business days, although analysts don't expect a hike.

Under its price mechanism adopted in March, if the average price of OPEC's benchmark basket of different oil blends remained above $28 for 20 business days an increase would automatically follow. OPEC can also reduce output by 500,000 barrels a day if oil prices stay below $22 a barrel for 20 days.

"The current formula is aggravating instability" in the oil markets, Mehdi Varzi, an oil analyst at Dresdner Kleinwort Benson, told CNNfn. "The $6 price difference should be narrowed otherwise the futures market will continue to be volatile." "The current formula is aggravating instability" in the oil markets, Mehdi Varzi, an oil analyst at Dresdner Kleinwort Benson, told CNNfn. "The $6 price difference should be narrowed otherwise the futures market will continue to be volatile."

The International Energy Agency (IEA) expects world demand for oil to fall to 77.5 million barrels a day in the first quarter of next year, from a current 78.4 million barrels. The Paris-based institute also foresees a further drop in demand to 75.6 million barrels a day in the second quarter.

OPEC's regular twice-yearly meetings are in March and September. The cartel held an extraordinary meeting in July because it was worried about the rise in oil prices, after which Saudi Arabia unilaterally raised production by 500,000 barrels, but backtracked to maintain unity with its neighbors.

The cartel is concerned a fall in demand and will see prices plummet. It was badly caught out by the Asian financial crisis in December 1998, when oil hit a low of $9.95 a barrel on Dec. 11, 1998. A year earlier OPEC had raised output to meet demand from booming economies in the region.

OPEC in early 1999 agreed to restrict production, resulting in a tripling in the price of crude over the following year.

Oil consumers' concerns in recent weeks has have centred on declines in U.S. oil inventories to 24-year lows, just as more heating oil was required to meet rising winter demand in the northern hemisphere.

The IEA in its monthly oil market report said there was still "serious concern" about the level of heating oil and diesel inventories, or distillates, among Organization for Economic Cooperation and Development countries.

Saudi Oil Minister Al-Naimi said the full impact of this year's production increases had yet to be felt in the oil markets.

"It takes time to assess what has been done. I believe oil is in the market," he said. "It took us 18 months to recover from the price collapse. We've had less than a year of the output increases."

--from staff and wire reports

|

|

|

|

|

|

OPEC

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|