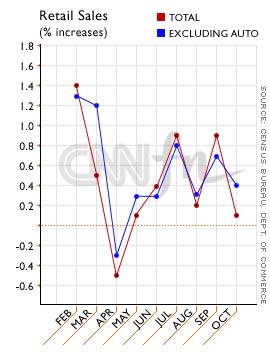

NEW YORK (CNNfn) - U.S. retail sales posted their smallest advance in two months in October, the government reported Tuesday, fueling expectations that the economy may be slowing to a more sustainable pace that could spur the Federal Reserve to consider cutting interest rates soon.

Retail sales advanced 0.1 percent, the Commerce Department said, a shade above the unchanged reading expected by economists polled by Briefing.com but well below September's 0.9 percent gain. Excluding autos, which account for about one-quarter of the monthly tally, sales gained 0.4 percent, just above the 0.3 percent increase expected. Retail sales advanced 0.1 percent, the Commerce Department said, a shade above the unchanged reading expected by economists polled by Briefing.com but well below September's 0.9 percent gain. Excluding autos, which account for about one-quarter of the monthly tally, sales gained 0.4 percent, just above the 0.3 percent increase expected.

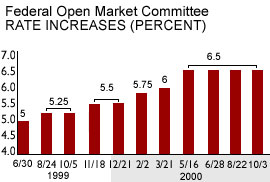

October's gain was the most tepid since August and provided more evidence for investors that falling stock prices, rising oil prices and the Fed series of six rate increases since June 1999 have begun convincing consumers to keep their wallets in their back pockets.

"What we are seeing is a fairly significant slowdown, and part of that is consumers responding to events in the market," Robert Barberra, chief economist with Hoenig Group, told CNNfn's Before Hours. "I think by the first quarter, the spring of next year, [the Fed] will be easing interest rates."

More signs of slowing?

Stocks surged at the opening bell as analysts and investors concluded that the U.S. economy in general and U.S. consumers in particular are beginning to respond to the Fed's series of rate increases. Consumer spending accounts for more than two-thirds of total economic output. General bargain hunting for tech stocks and positive comments from influential Goldman Sachs' strategist Abby Joseph Cohen also lifted equities.

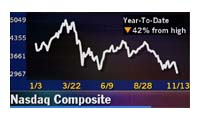

The big question for most economy watchers is whether the impact of a 42-percent drop in the Nasdaq composite index from its all-time high, oil prices almost three times higher than a year ago, uncertainty about earnings prospects among U.S. companies and uncertainty about who the next U.S. president will be has offset the one stable element in the economy -- strong job creation. The big question for most economy watchers is whether the impact of a 42-percent drop in the Nasdaq composite index from its all-time high, oil prices almost three times higher than a year ago, uncertainty about earnings prospects among U.S. companies and uncertainty about who the next U.S. president will be has offset the one stable element in the economy -- strong job creation.

The unemployment rate stood at 3.9 percent in October, matching a 30-year low set in April and repeated in September. The economy created 137,000 jobs in October after gaining 195,000 the month before. And average hourly earnings rose 6 cents last month, the largest gain in six months.

That has kept consumers feeling fairly confident about buying, even as their investment portfolios have shrunk and higher interest rates have made it more expensive for them to borrow. All the same, many analysts expect the U.S. job market to slow as the U.S. economy downshifts from its torrid 4-percent-plus annual pace last year, further damping consumers' penchant to spend.

Following the Nasdaq

"Retail sales have slowed over the last six months in response to the slower pace of job creation, higher rates, and increased volatility in the stock market," said Steven Wood, an economist with Banc of America Securities in San Francisco. "Indeed, in the past two years there has been tight relationship between the Nasdaq and retail spending, suggesting further spending weakness in coming months."

New-car dealer sales declined 1 percent in October after posting a 1.6 percent jump in September. It was the steepest falloff in auto sales since a matching 1 percent decline in April, and fit with earlier reports from automakers that their annual sales pace was the slowest of the year. New-car dealer sales declined 1 percent in October after posting a 1.6 percent jump in September. It was the steepest falloff in auto sales since a matching 1 percent decline in April, and fit with earlier reports from automakers that their annual sales pace was the slowest of the year.

Sales at clothing and accessory stores rose 1 percent after rising 1.4 percent in September. October is generally a discount month for department stores as they make room on their shelves and racks for holiday merchandise. Gasoline service station sales rose 0.9 percent last month after rising 2.3 percent in September. Sales at restaurants and bars fell 0.1 percent in October after rising 1.2 percent in September.

The report comes a day before Fed policy makers meet to consider interest-rate strategy. Expectations are that rates will remain on hold at the conclusion of Wednesday's session as the U.S. central bank weighs whether the economy is slowing enough to keep inflation under wraps. The fed funds rate, the target interest rate the Fed sets for commercial banks to lend to each other overnight, currently stands at 6.50 percent.

Still drawing in customers

Speaking in Mexico City, Fed Chairman Alan Greenspan made no direct reference to the current state of the economy, but did point out that slowing growth could trigger a cry for a return to more protectionist trade policies, discouraging overseas companies from selling their goods in the United States and allowing U.S. producers to charge more for their products.

| |

|

|

| |

|

|

| |

Any notable shortfall in economic performance from the exemplary standard of recent years runs the risk of reviving mistrust of market-oriented systems, even among conventional policymakers.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Alan Greenspan, Chairman of the Federal Reserve |

|

"Any notable shortfall in economic performance from the exemplary standard of recent years runs the risk of reviving mistrust of market-oriented systems, even among conventional policy makers," Greenspan said.

So far, many retailers are still managing to lure customers into their stores. U.S. chain store sales jumped 0.8 percent in the week ended Nov. 11, compared with a 0.2 percent fall in the prior week, reversing three weeks of declines, the Bank of Tokyo-Mitsubishi (BTM) and UBS Warburg said Tuesday in their Weekly Chain Stores Sales Snapshot.

Those figures came alongside third-quarter earnings reports from three of Wall Street's biggest retailers. Wal-Mart Stores Inc. (WMT: Research, Estimates) and Home Depot Inc. (HD: Research, Estimates) both reported higher fiscal third-quarter profit Tuesday, while J.C. Penney (JCP: Research, Estimates) unveiled a narrower-than-expected third-quarter loss.

All the same, most analysts don't expect this year's holiday shopping season will prove as robust as last year's. On a year-over-year basis, holiday sales gained 9.1 percent last year, up from 8.9 percent in 1998 and 6.1 percent in 1997, according to Commerce Department figures. The biggest increase in holiday sales was a 9.3 percent jump back in 1992.

|