|

Inflation rate slows

|

|

November 16, 2000: 1:12 p.m. ET

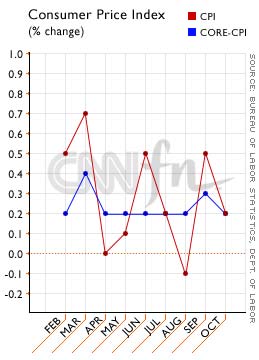

October Consumer Price Index rises 0.2%; core-CPI also up 0.2%

|

NEW YORK (CNNfn) - The pace of inflation slowed in October, according to a government report released Thursday, a day after the Federal Reserve said it continues to see risks of a pick up in consumer prices.

The Labor Department's closely watched Consumer Price Index showed that retail prices increased 0.2 percent in October. That was in line with the consensus forecast of economists surveyed by Briefing.com and below the 0.5 percent increase registered in September.

The so-called "core-CPI," which excludes often-volatile food and energy prices, also increased 0.2 percent in October, matching economists' forecasts. The core figure posted a 0.3 percent rise in September. The so-called "core-CPI," which excludes often-volatile food and energy prices, also increased 0.2 percent in October, matching economists' forecasts. The core figure posted a 0.3 percent rise in September.

While Thursday's report provided more evidence for that inflation continues to remain under wraps, analysts and investors weren't convinced that inflation will stay subdued in the months ahead, particularly with energy prices soaring and with workers' wages on the rise.

"Even though the numbers are soothing, the Fed still is on high alert for a future flare-up in prices," said Oscar Gonzalez, an economist with John Hancock Financial Services in Boston. "The inflation risks posed by a still very tight labor market and the possibility of additional spillover effects from higher energy prices can't be discounted.

Fed expected to stay the course

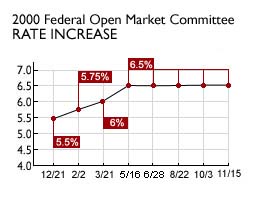

The Federal Reserve left interest rates unchanged for its fourth straight meeting Wednesday, but its continued concern about inflationary pressures stopped it from taking any steps towards a future interest rate cut.

"The utilization of the pool of available workers remains at an unusually high level, and the increase in energy prices, though having limited effect on core measures of prices to date, still harbors the possibility of raising inflation expectations," the Fed's statement said Thursday, as it said it maintained its "bias" towards rate hikes in the future.

That statement, combined with Thursday's CPI report, dashed what had been a growing hope in some quarters that the Fed might soon signal a scale back in their concern about accelerating inflation as the first step towards scaling back the six rate increases imposed between June 1999 and this past May.

The core rate has stayed remarkably steady for the last year, coming in with a 0.2 percent increase in six of the last seven months, and 11 of the last 14. That suggests that while an acceleration of inflation is not imminent, there's not much sign of a lessening of prices as the economy slows.

"The tightening bias will remain in place for the foreseeable future," said Rob Palombi, economist with Standard & Poors MMS. "If you look at core components of CPI, they seem fairly well behaved, but there's nothing in this report will change Fed's mind."

Transportation costs drop, housing up

Thursday's report showed that food prices increased only 0.1 percent in the period while energy prices, which jumped 3.8 percent in September, rose only 0.2 percent.

The biggest jump in prices came in the education and communication category, in which prices increased 0.6 percent, and housing, in which prices rose 0.5 percent.

Price decreases came in transportation, down 0.4 percent, and the catch-all "other goods and services" category, which declined 0.6 percent. Lower prices for gasoline, airline fares and new vehicles helped bring the transportation costs lower.

Overall the CPI rose 3.4 percent for the 12-month period ending in October, while the core-CPI increased 2.5 percent for the same period.

In a separate report Thursday, initial jobless claims filed last week fell to 326,000 from 346,000 the previous week, but that still topped analysts' forecasts of 315,000 new claims for.

The two reports are "consistent with the view the economy is slowing and inflation remains very subdued," Hugh Johnson, chief investment officer at First Albany Corp., told Reuters.

Economists said it is probably too soon to expect the Fed to take the first steps towards lower interest rates.

"I think the Fed is erring on the side of caution, as a central bank should," Kathleen Camilli, chief economist with Tucker Anthony, told CNNfn's Before Hours program Thursday. "That's why they left the direction in place. It could be this time they're holding tight too long. We'll know that only in hindsight, as unfortunate as that is." (491KB WAV) (491KB AIFF) "I think the Fed is erring on the side of caution, as a central bank should," Kathleen Camilli, chief economist with Tucker Anthony, told CNNfn's Before Hours program Thursday. "That's why they left the direction in place. It could be this time they're holding tight too long. We'll know that only in hindsight, as unfortunate as that is." (491KB WAV) (491KB AIFF)

With the report coming so close on the heels of Wednesday's Fed meeting, and with increases hitting expectations, there was relatively little market reaction to the numbers Thursday.

"It is good news since we did not get any surprises on the upside, but by the same token, the Fed already made its decision, not changing its bias or interest rates," Peter Cardillo, director of research for Westfalia Investments, told Reuters.

Little impact on markets

U.S. stock markets opened mixed Thursday, then moved into negative territory. But analysts cited continued uncertainty over the U.S. Presidential election, not the economic reports, for investors and traders' selling Thursday.

"With the Fed action taking some of the prospects for a rally away from the market, we're just sitting here quietly waiting to see what happens in Florida with the absentee ballot count," said Craig Ellis, portfolio manager at Safari Capital Management.

|

|

|

|

|

|

|