|

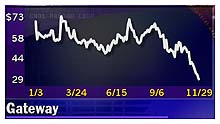

Gateway warns, stock falls

|

|

November 29, 2000: 6:39 p.m. ET

PC maker sees profits sharply below analysts' estimates; stock tumbles 34%

|

NEW YORK (CNNfn) - Gateway Inc. shares tumbled in after-hours trade on Wednesday after it warned that its fourth-quarter earnings would be nearly half of Wall Street estimates, hurt by weak holiday sales for its personal computers.

The San Diego-based company said it now expects to report profits of 37 cents per share for the quarter ending Dec. 31, well below the 62 cents analysts forecast, according to research firm First Call.

The news sparked a selloff in after-hours trading, where the stock changed hands at $19.50 a share on Instinet, off about 34 percent from its level at the close of the regular session on the New York Stock Exchange. The warning was issued after the markets closed for the regular session, where Gateway shares ended off $1.50 at $29.50.

Gateway also said its fourth-quarter revenue would total $2.55 billion, about equal to what it recorded during the same period last year. Analysts projected Gateway's revenues at $3.1 billion. Gateway also said its fourth-quarter revenue would total $2.55 billion, about equal to what it recorded during the same period last year. Analysts projected Gateway's revenues at $3.1 billion.

"We expect consumer sales to continue ramping up this quarter, but it is now obvious to us following the Thanksgiving weekend that they will not grow sufficiently to allow us to meet previous consensus for EPS and guidance for revenue," said John Todd, Gateway chief financial officer, in a statement.

On a conference call with analysts, the company said that during the Thanksgiving weekend, traditionally one of the biggest sales periods of the year, PC revenues were down 30 percent from the year-ago period.

Earlier Wednesday, shares of Gateway slumped after a Wall Street analyst reduced his outlook for the company's sales in the fourth quarter.

Merrill Lynch analyst Steven Fortuna reduced his sales estimate for the fourth quarter to bring it in line with the consensus view for 24 percent sales growth, or $3.04 billion, from his previous estimate for 28 percent growth, or $3.14 billion.

"While November (pre-Thanksgiving) did see a sequential increase in weekly (telephone sales) call volumes, we believe it was slightly below expectations," Fortuna wrote in a note to clients.

"Price war" on Horizon, CFO says

Gateway CFO Todd said he anticpates a price war in the personal computer industry, given high inventory levels.

"Clearly we think in Q1 there will be an aggressive sort of price war," he said. "People are going to have to be aggressive to get the inventory out."

In its earnings warning, Gateway noted that the slowdown in the nation's economic growth has had an effect on its results. In its earnings warning, Gateway noted that the slowdown in the nation's economic growth has had an effect on its results.

"The economic slowdown, coupled with on-going shifts in PC seasonality, clearly had a significant impact on our sales over the holiday weekend," Gateway's Todd said. "We expect these issues will continue to have an effect on overall demand over the next twelve to eighteen months."

He also detailed guidance for 2001 sales and earnings per share.

Gateway said it remained confident about its strategy and that it would "continue to distance" itself from traditional competitors next year. Still, it warned that its 2001 profits would be about $1.89 a share, down from previous consensus estimates of $2.28 a share.

Todd said he expects $2.6 billion in first-quarter sales, and earnings of 45 cents per share. For the second quarter, he said he sees sales of $2.4 billion, and EPS of 43 cents. He said he sees third-quarter sales of $2.9 billion and EPS of 53 cents, and fourth-quarter sales of $2.9 billion and EPS of 48 cents.

Computer makers' stocks hit hard

Technology stocks have been hit hard in recent months, including computer makers. The Philadelphia Stock Exchange computer maker index has dropped off sharply since this summer. It was trading at 139.17 on Wednesday, well off its year-high of 244 hit on Sept. 1.

Since then, No. 2 personal computer maker Dell Computer Corp (DELL: Research, Estimates) and Apple Computer Inc. (AAPL: Research, Estimates) both scaled back their second-half growth targets.

Those disappointments added to a gloomy picture painted by slower growth in unit shipments in the second quarter. Unit shipments in that period slowed to half of what they were in the second quarter the year before, according to research firm International Data Corp.

However, 1999 was considered a stronger-than-usual year, as companies upgraded systems to gear up for the Year 2000 date changeover -- making it difficult to compare.

Gateway also said it would take a one-time charge of about $200 million, or 39 cents a share, related primarily to the write-down of the company's investments in technology-based companies.

-- from staff and wire reports.

|

|

|

|

|

|

Gateway

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|